In the waning days of 2016 we approach a new year, a new President and a Republican Party that holds a majority in both Houses of Congress with an ambitious new policy agenda. The S&P 500’s strong 6.2% advance since the election seems to express investors’ hopes and expectations of some favorable changes forthcoming; possibly changes that can spur our economy out of the slow growth trajectory it has been in since the Great Recession (December ’07 – June ’09). To know whether this optimism is justified, we need to assess the changes the new administration may be able to accomplish, when the changes might occur and what will be the economic and investment implications.

President-elect Trump’s ‘Make America Great Again’ campaign made several promises, many of which have the potential to meaningfully affect the economy and financial markets in the immediate months or years ahead if they are achieved. Here is a partial list of those promises:

- Cancel immediately all illegal and overreaching executive orders and remove all onerous regulations and barriers to business,

- Reduce and simplify personal taxes across the board, especially for working middle-income Americans,

- Lower the business tax rate from 35 percent to 15 percent,

- Work with Congress to fully repeal the defense sequester and submit a new budget to rebuild our depleted military,

- Rebuild and update infrastructure,

- Repeal and replace Obamacare with Health Savings Accounts (HSAs),

- Appoint justices to the United States Supreme Court who will uphold our laws and our Constitution,

- Negotiate fair trade deals that create American jobs, increase American wages, and reduce America’s trade deficit,

- Control the borders and prioritize the jobs, wages and security of the American people,

- Clean up corruption in Washington by enacting new reforms to reduce special interests and lobbyists’ influence on the White House and Congress.

Trump’s priorities for achieving many of these objectives are written in his ‘Contract with the American Voter’ and posted on his website, https://www.donaldjtrump.com. It is a very bold and comprehensive agenda, but how much of it will his administration be able to accomplish? Let’s take a closer look at some of his promises and how they might affect your investments if passed.

For starters, Donald Trump is in the fortunate position of having his Republican Party in control of both the House and the Senate. The degree to which a President’s political party has control over both houses of Congress often determines his or her political muscle to get things done, such as the ability to have Cabinet members and judges approved, pass legislation and ratify treaties. Since 1945, the balance of power has only been this lopsided about 39% of the time. That puts Trump in a much better position, at least until the mid-term elections in two years, to get more of his ambitious plans accomplished.

He will be able to immediately overturn onerous regulations or roadblocks to business that were created in previous administrations by executive order or memorandum. With the stroke of his pen, many of these executive orders will be history in the early day(s) of his administration.

Most of the other items on his wish list will go through a legislative process fraught with potentially grueling negotiations and concessions before they can ultimately muster enough votes to pass Congress. It’s likely The Trump Administration will be able to pass meaningful tax reform early on, as there appears to be good support for it on both sides of the isle. The markets would view success in this area as very pro-growth and capable of kick-starting not only the economy, but the broader Trump agenda.

It will not be all clear sailing for the Trump agenda. Early signs suggest there may be some potholes in the immediate legislative road ahead. Senate Democrats have already discussed plans to slow legislative progress by gearing up to challenge every appointee Trump submits. They don’t have the numbers to reject an appointee, but they can drag out the process for some time.

Democrats also plan to exploit any divisions between Trump and his Republican Party. There was an example of this type of division recently when Republicans in the House and the Senate tried to temper one of Trump’s freewheeling populist positions. They declined to endorse one of his weekend tweets that threatened to impose import tariffs on American companies that move jobs overseas. Top Republican leaders suggested the use of free market policies, such as undertaking comprehensive tax reform, would be their preference for encouraging companies to stay and produce their products here. Differences like this could impede progress toward reaching agreement on legislation. At the same time, the scope of infrastructure spending and other initiatives may also be limited by Congress’ willingness to boost deficit spending any more than necessary.

The foregoing describes how politics play a critical role in putting into place regulations and fiscal policies that are economy friendly. Trump was not a conventional Republican Presidential candidate and will conduct his Presidency in an equally different way than we have grown accustomed to – so prepare for twists and turns along the way. Political risk is elevated into the new year as the world gets to know Trump and his leadership style and observes the degree of his early success. We will pay special attention to Trump’s trade policies, as any significant digression into substantial trade disputes could seriously dampen the current enthusiasm markets are having over his pro-growth agenda.

Let’s look closer at several items on his wish list and assess what successful implementation might mean for the markets and our asset allocation decisions:

Reducing and simplifying personal taxes – Significant changes to current tax laws are expected to be a priority as Congress meets early next year. The likelihood of some degree of legislative success in this area is high. If achieved, this would serve to put more money into the pockets of consumers and strengthen the current economic expansion. The proposal to make child care expenses fully deductible from taxes, if enacted, would allow some one wage-earner families to expand to two and others to pocket or spend the tax savings.

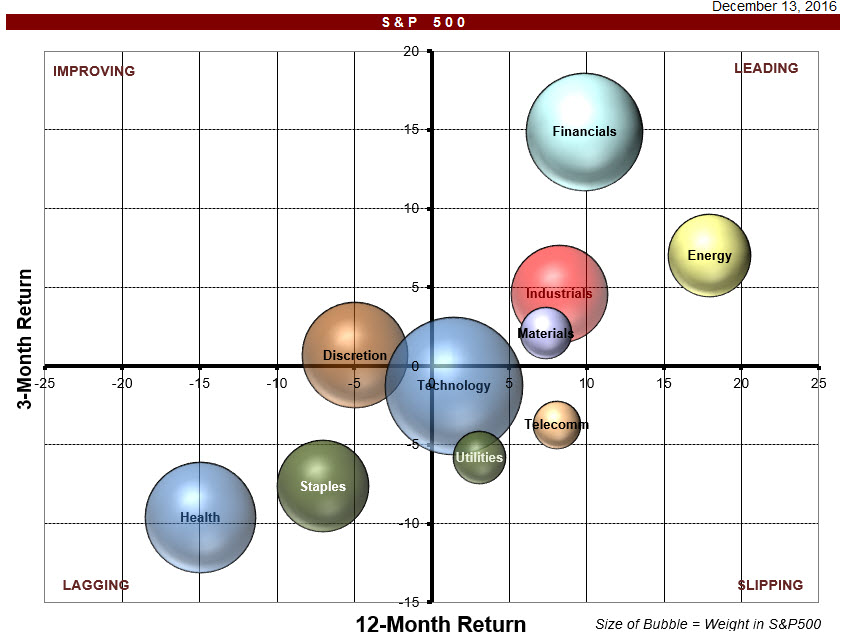

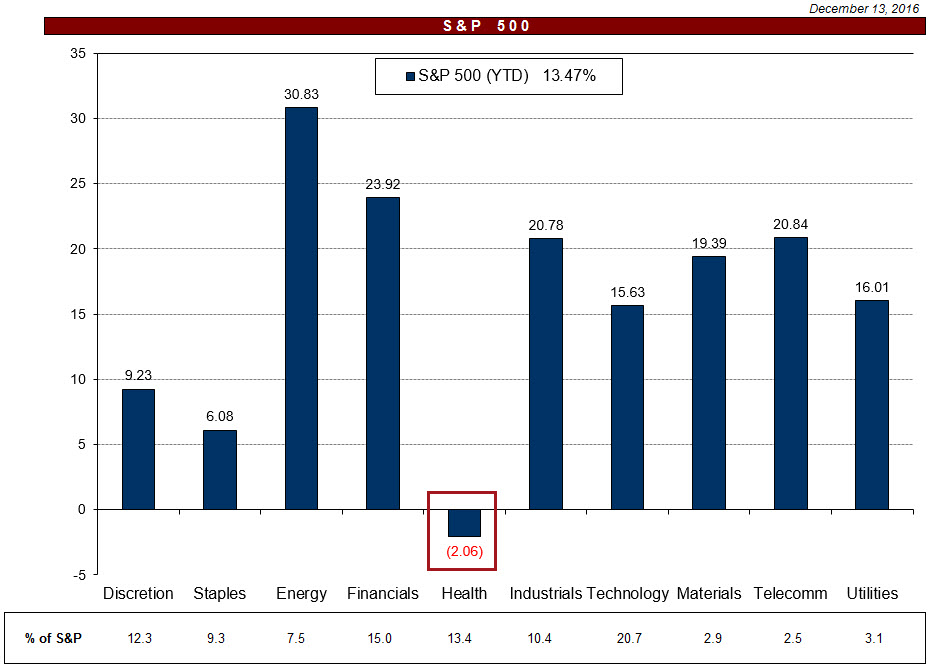

Tax rate reductions and simplification should spur additional economic growth and especially benefit cyclical stocks that are sensitive to the economy, including consumer discretionary, energy, industrials and materials sectors. Financial stocks have also been responding well to increasing yields that should lead to better margins and greater loan growth. Defensive sectors such as staples, health care, utilities and telecom are beginning to be left behind as expectations of greater growth ahead have reduced the appeal of defensive sectors.

Anticipation of favorable tax legislation and faster economic growth ahead is already reflected in recent returns in each of these sectors (see chart below).

Lowering the business tax rate – The current U.S. corporate tax structure has increasingly presented a problem for American companies that have garnered a larger share of their revenues from overseas. Trump’s tax proposal to lower the corporate tax rate from the current maximum of 35% to 15% has a good chance of some measure of legislative success because the current rate is one of the highest in the world. This high tax rate combined with our taxation of repatriated profits has caused many companies to build up huge cash stockpiles overseas – an estimated $2.5 trillion. For example, Microsoft and GE have more than $100 billion abroad each, while Apple and Pfizer have more than $80 billion each. If the Trump Administration is successful in lowering the tax rate to 15%, it would become one of the lowest in the developed world.

Lower taxes, especially on foreign earnings, could draw much of this vast pile of cash back into America and provide a considerable boost to GDP. The tax savings to corporations could be used to increase wages or to hire more employees, to expand operations, to update facilities, to increase research and development, buy back shares or to pay out more dividends to stockholders, among other possible uses. The proposed tax cuts along with new provisions to enable the immediate expensing of capital expenditures could spur capital investment and support stronger economic growth.

Repealing the defense sequester and increasing the military budget – According to the Defense Department, the biggest challenge to the military’s state of readiness is sequestration. Sequestration is the hard cap on military and other categories of spending imposed in 2013 as part of budget negotiations. Other sources mirror the Defense Department’s concerns about the current size and readiness of our forces. Naval History and Heritage Command has reported that our Navy is among the smallest it has been since before World War I, while ArmyTimes, an independent voice for military news, recently described our Army as the smallest it has been since before World War II. Air Force Times informed readers on Jan. 19, 2016, that the average age of our Air Force aircraft is 27 years old. With this disturbing data, it seems likely efforts to repeal the defense sequester and increase military spending will garner enough Congressional support to have some degree of success.

Rebuild and improve infrastructure – Priorities here for Trump are to target transportation, clean water, telecommunications, a modern and reliable electricity grid and other pressing domestic infrastructure needs.

Historically, infrastructure spending has been promoted by Democrats more frequently than by Republicans. In an interesting twist, by supporting Trump’s push for infrastructure spending, Democrats may be able to pit the new President against some conservative Republican leaders that favor less government involvement in such programs, favoring instead to put more emphasis on free market principles. Bi-partisan support, albeit potentially fractured, may improve the chances of getting legislation passed here. Concerns over the expected growth of government deficits may keep a lid on the size and scope of the legislation that can get passed.

Fiscal stimulus from an infrastructure bill should increase jobs, and help growth. It should also strengthen the already improving trend in commodity prices. Just the prospects of an infrastructure plan have already caused the construction materials and machinery industry to gain sharply.

Repeal the Affordable Care Act (ACA) – Trying to repeal ACA (often referred to as Obamacare) is a clear priority for many Republicans. Passing “reconciliation” legislation early in 2017 to repeal most of the existing law is one scenario. But more details of how the current plan would be replaced are critical to its success. There is substantial uncertainty regarding whether this approach will be followed or whether amending Obamacare is a better route to gain broader Congressional support. Regardless, it will take time to advance a comprehensive plan to reform the system and months more to pass it. Whatever route is taken, Obamacare will need to be repealed or face significant changes to continue to be viable. Enrollment in health insurance through the exchanges has disappointed estimates and several insurance companies are pulling out of the program – leaving limited choice and rising costs.

Since Obamacare’s long-term viability has been in question, any reasonable resolution to the healthcare dilemma will provide better visibility to healthcare stocks, which have been the worst performing sector this year.

Negotiate fair trade deals – This promise is probably the biggest wildcard in Trump’s basket of campaign promises. He has said he wants to find all foreign trading abuses and then push for fairer trade. The President has significant latitude to do this. As he takes over his leadership role we will see how this develops.

We can expect new conversations regarding trade with other countries. He wants to renegotiate a fairer deal from NAFTA or withdraw from it and withdraw from the Trans-Pacific Partnership. Everyone is for fairer trade with foreign countries, but it is unclear how much of Trump’s get-tough dialog is designed to stake out a stronger negotiating position for talks. Regardless, the prospect of increased tariffs and other trade restrictions the U.S. might enact is a noteworthy cause of anxiety in many countries. China and Mexico could respond in kind if we raise tariffs on them, risking an all-out trade war that would benefit no one.

>Will Trump’s negotiating skills work to the advantage of American business or pose new concerns? We simply do not know yet – time will tell. Fairer trade arrangements with other countries is desirable and would have a long-term positive influence on the U.S. economy. However, if a disruptive global trade war ensues, it could pressure inflation higher and have a negative influence on both U.S. and global growth. This in turn would be troubling to global markets, especially the heavily export dependent emerging markets. We will monitor these developments closely.

Control the borders – Trump’s plans here are to triple Immigration and Customs Enforcement (ICE) agents, build a physical wall on the border with Mexico, reform and enforce immigration laws, end catch-and-release and funding for sanctuary cities and to deport more than 2 million criminal illegal immigrants.

Speaker of the House, Paul Ryan, recently told “60 Minutes” in its Sunday, December 11, broadcast that he is working with Trump on securing our border. He stated, “Here’s what we’re working on with respect to immigration — securing our border, enforcing our current laws,”. Ryan said Trump along with other Republicans had no plans for a deportation force to round up people in the U.S. illegally. There has also been some softening on the idea of the wall along the border with Mexico to include possibly fencing in some areas rather than a solid wall.

What’s Next?

Given the agenda that is expected to start taking shape in the first 100 days of Trump’s administration, it appears likely US corporations and US investors alike will benefit. Since his surprise win, cyclical stocks have outperformed defensive stocks, commodity prices have climbed, the dollar has strengthened and inflation expectations seem to be on the rise as well – all of which seem to reflect expectations of increasing future economic growth.

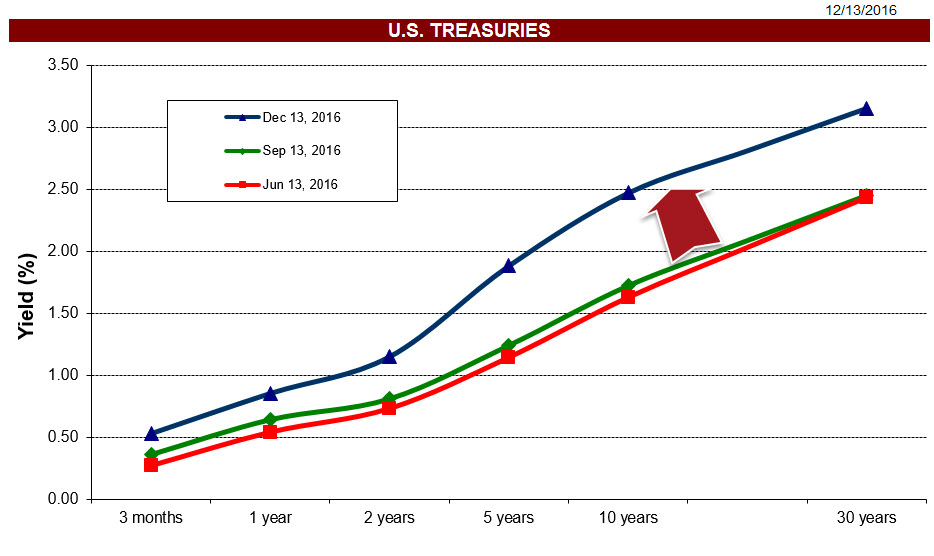

The US Treasury market’s rise in yields, especially at the long-end of the yield curve also reflect a dramatic upgrade in growth expectations since the election. A steeper yield curve reflects enhanced expectations of future growth (see chart below) and a demand by investors to be compensated for future inflation risks.

Some industries and countries have been negatively affected by Trump’s proposals, but the broader markets are expecting a much friendlier growth environment ahead. Investors are anticipating an effective fiscal stimulus package, a more favorable regulatory environment and limited disruptions to trade. Much hinges on the early legislative successes the Trump administration achieves and whether trade and immigration issues become a meaningful impediment.

Our Outlook for Asset Classes

Domestic Equities – The potential fiscal boost from the Trump administration is expected to come by mid-to-late 2017. It should increase GDP growth in the US and boost the earnings outlook that is already improving on the back of higher oil prices. This environment should be more supportive to the cyclical and value oriented sectors of the economy, which have already responded strongly to improving growth expectations. As stronger growth materializes, late cycle industries, such as, financials, materials, energy, industrials and technology sectors should continue their recent outperformance.

Higher yielding equities, often referred to as “bond proxies”, such as utilities, REITs, consumer staple stocks and telecom stocks, have recently come under increasing pressure as rising fixed income yields are once again competing as conservative income vehicles.

Small and mid-cap companies tend to be more domestically focused and less affected by trade disputes or by dollar strength than their larger, more globally oriented counterparts. That explains much of their recent outperformance and why we expect they may continue to perform comparatively well in the immediate months ahead, especially with domestic growth expected to accelerate.

Bonds – The shift in focus from using monetary policy to fiscal policy to stimulate growth will likely continue to push interest rates higher as we move into next year. We probably have seen the lows for interest rates in this cycle. As more and more investors realize this, an outflow from bonds to equities may accelerate leaving longer-dated bonds vulnerable to further decline. Therefore, we continue to prefer shorter duration bonds.

We maintain our recommendation that investors consider holding or increasing their holdings in Treasury Inflation-Protected Securities (TIPS). We also like floating-rate bonds that will benefit from their shorter durations and ability to reset to higher yields. Bond ladders that marry client’s income needs with bond maturities also make sense in this environment for some investors.

High yield bonds should benefit from an improving corporate earnings outlook that is supported by potential tax cuts and an improving energy sector. However, rising yields and a maturing business cycle warrant maintaining relatively short durations and a degree of caution in this equity-like bond category.

Municipal bonds have been under recent pressure due to the prospects of tax reform and may stay under pressure until there is greater clarity on the actual tax rates that will exist. We believe this weakness may present attractive investment opportunities in the immediate weeks and months ahead.

Although the environment for bonds has become increasingly difficult lately and may remain that way for a while, bonds still provide very important diversification from higher-volatility asset classes. They provide a dependable stream of income to meet cash flow needs or to match future liabilities. If we continue to transition to higher interest rate levels as we expect, future portfolio rebalancing into higher yielding bonds holds the prospects of enhancing portfolio returns going forward.

European Equities – Trump’s victory, the Brexit vote and a recent Italian referendum all suggest there is a rising anti-establishment and anti-incumbent populism mood in both America and Europe. In this politically charged environment, reasonable valuations and an improving earnings outlook in Europe may not be enough to make a compelling case for much higher prices. Since France, Netherlands and Germany have important elections looming in 2017, political risk will remain elevated. Upside may be limited relative to the U.S. and Japan until the elections are resolved and political anxiety is reduced.

Japan – In Japan, policy emphasis is also shifting from monetary stimulus toward fiscal stimulus. Prime Minister, Shinzo Abe and the Bank of Japan are pulling out all the stops to spur growth and inflation – with promises to do more if needed. Fiscal stimulus should have a more direct impact on demand and inflation and help augment Japanese growth. With the US dollar rising and global growth improving, this provides a favorable backdrop for Japanese stocks.

Emerging Markets – Rising U.S. interest rates, a stronger dollar and the potential for rising trade tensions with the Trump administration have all been weighing on emerging market stock prices since the U.S. election. As the emerging markets absorb and adapt to these changes, the positives for investment into emerging markets are improving along with global growth.

Cyclical data across much of the emerging markets is positive. If the Trump administration can implement policies that are broadly supportive to U.S. growth, this will boost the outlook for emerging markets, too. We also expect China to maintain fiscal and credit support to its economy to meet its official growth targets.

Commodities – As the economy enters a late phase of the business cycle, expectations for the infrastructure bill and improving growth are providing a boost to already strengthening commodity prices. This is despite a stronger U.S. dollar, which would generally be negative for commodity prices. Going forward, we would expect commodities to continue to benefit from both rising demand and rising inflation expectations, as commodities are generally positively correlated to inflation.

The recent OPEC agreement to cut oil production is firming oil prices. This should be a positive driver for emerging market stocks going forward, especially those with meaningful oil production, i.e., Russia, Brazil, Mexico. Trump seems to view oil company production as a very positive contributor to U.S. growth and is supportive to policies that should benefit growth in the sector.

Summary – Investors are turning more optimistic about growth because of the recent U.S. elections. This is being reflected in rising stock prices, rising interest rates and increasing inflationary expectations. As always, there are risks to the outlook. Difficulty in passing tax reform or infrastructure spending bills, an escalation in trade protectionism or a significant snag in dealing with the ACA could derail the positive outlook the markets are enjoying. We will have a much better idea about these risks during the first 100 days of the Trump Presidency. During this time, political risks will be elevated until the markets gain comfort the pro-growth agenda will largely be implemented.

>We believe the current pro-growth developments likely to take place at the first of the year combined with our current position in the business cycle could materially change the outlook for asset class performance going forward. Interest rates have experienced a 35-year decline from 15.68% on a 10-year Treasury bond in 1981 to the paltry lows of 1.38% on July 8th of this year. Investors have increasingly been forced to hunt for yield in uncommon places to have enough income. This has led a large portion of the investment community to reach for yield in higher-yielding equity investments, longer dated bonds or lower quality investments. We believe the recent lows in interest rates probably represent the bottom of this interest rate cycle. The steep rise in rates since then to 2.4% on a 10-year Treasury bond and our expectations of higher rates may increasingly cause a reversal in the flows that were a result of the prior reach for yield. This is likely to have broad ramifications to how your portfolio should be positioned going forward.

In closing, we take responsibility for making these changes to our client’s portfolios and welcome others that would like for us to review theirs. Staying educated on the economy and markets requires a constant monitoring of things as conditions change. It’s a never-ending process, but also a never-boring one! We will continue to monitor developments and be in touch with important news. Thank you for reading and if you happen to be a client, thank you for your business! We sincerely hope your holidays are special.

Disclosures: The views expressed are those of Byron Green as of December 14, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 12-14-2016

Click here to download printable PDF of GIM Market Commentary 12-14-2016