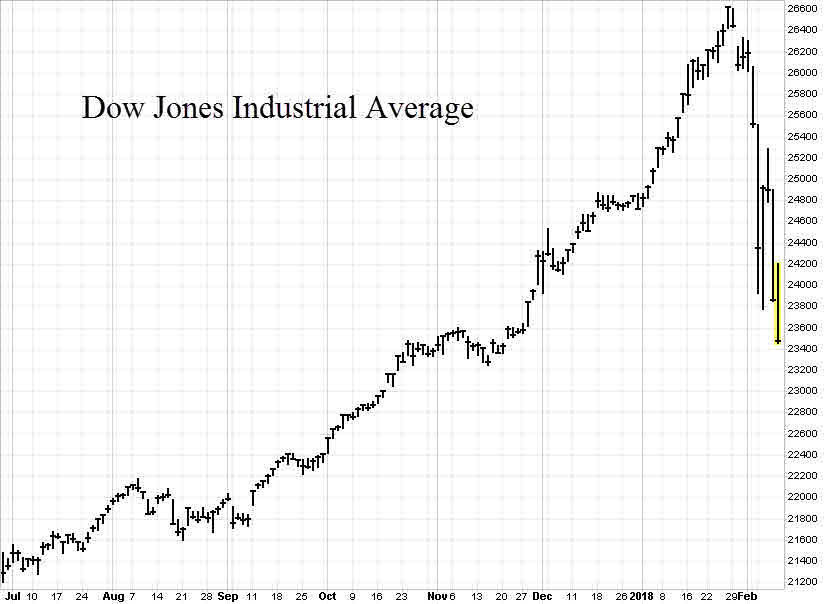

If you were one of those people beginning to wonder if market volatility was gone to stay, well, think again. On Monday, February 5, the Dow Jones Industrials Average saw its greatest intraday point drop ever, falling 1,597 points from its high before closing 1,175 points lower. It was the biggest drop in more than 6 years and reminiscent of the 508 point, 22% one-day slide on October 19, 1987. Monday’s decline was less fortunately 6.3% (4.6% at the close), but it punctuates an end to the low volatility regime we have been enjoying. It also marks the beginning of a correction that we believe is likely to be short-term in nature within the context of an ongoing, albeit aging bull market.

Because of the unusual surge in volatility, we thought it would be timely to provide answers to our readers to some of the questions we have been receiving. If we fail to address your specific questions or concerns, please let us know by giving us a call or dropping a note.

What Caused the Recent Sharp Decline in the Stock Market?

The stock market had become accustomed to extremely low volatility since the first quarter of 2016. The benefits of a broad-based global economic recovery combined with low and stable interest rates, had enabled the S&P 500 index to enter its longest period since 1929 without a correction of more than 5%. This environment of suppressed volatility encouraged a rise in investment approaches designed to exploit these types of conditions, called ‘low-volatility’ and ‘short vol’ strategies. In recent days as interest rates began to rise and stocks sold off, many traders had to close positions and unwind their strategies. The sheer size of these strategies had grown so large over the extended period of low volatility that their unraveling contributed significantly to the speed and magnitude of the decline.

Beyond Program Trading, What Were the Underlying Catalysts for the Decline?

Several catalysts could have contributed to the initial increase in volatility. It appears the most significant factor was the recent rapid rise in interest rates punctuated with a pickup in last Friday’s average hourly earnings data. Rates on Treasuries maturing in two years rose to levels not seen in almost ten years and the hourly earnings data suggested annual wage inflation of 2.9%, the highest since April 2009. These factors along with a tightening labor supply, a strong economy and the fiscal stimulus of tax reform, have raised fears the Federal Reserve may be forced to raise rates faster than previously expected. The rise in rates in the U.S. is not an isolated event but is occurring across much of the developed world as the global economy continues to strengthen.

The new Federal Reserve Chair, Jerome Powell, will no doubt have challenges ahead as he navigates through tight labor markets and the potential for rising inflation pressures. Markets have been generously supported by easy money central bank policies since 2008, but that too is beginning to change. Before the year is out, it is widely expected global liquidity growth provided by the combined easy money policies of the European Central Bank and the Bank of Japan will likely have peaked. The Fed is already shrinking its balance sheet and raising short-term rates. The good news is that interest rates are still relatively low and higher yields reflect greater confidence in the growth outlook that is unfolding.

Do You Expect the Decline to Last Long?

As this response is being written, it appears we have retested the lows of the initial decline of the Dow Jones Industrial Average after a failed attempt to recover. The market appears to be finding its footing. The abrupt sell-off has the characteristics of more of a technical sell-off rather than one focused on fundamentals. The macro outlook in the U.S. remains positive as economic growth and earnings continue to improve, buoyed by tax cuts for corporations and individuals and improving global growth. Analysts are currently projecting U.S corporate earnings will grow about 20% during 2018. The first quarter of 2018 appears to be off to a great start as the Federal Reserve Bank of Atlanta’s GDPNow model is forecasting a 4% rise in GDP for the quarter. Global economic growth and earnings continue to look good as almost every country is experiencing growth.

Bull market corrections that are not accompanied by a recession tend to be short-lived, as opposed to those that are the result of an economic bubble bursting, i.e., tech bubble of 2000, or the end of a business cycle. According to a January research paper by Goldman Sachs that examined all of the corrections since WWII, “the average bull market ‘correction’ is 13% over 4 months and takes just 4 months to recover”. We think there is still some rope left in this business cycle and the risk of a recession in the year ahead is low. It is unlikely this spike in volatility is a signal that a bear market is at hand.

Considering the Recent Increase in Volatility, Has Your Outlook Changed?

Not really. We do not expect this correction to be the beginning of the end for this bull market, even though stocks may not snap immediately back to their precorrection highs. A valuation adjustment process may continue to play out in the weeks ahead as issues pertaining to interest rates are sufficiently resolved and investors gauge what multiples they are willing to pay for stocks in a more volatile environment.

The strong macro backdrop should allow earnings to drive stock prices higher as the year progresses within the context of a more volatile environment than we have become accustomed to. As far as the recent spike in yields, it is still far from clear the velocity of the move was completely warranted or that it is the beginning of some larger repricing of fixed-income markets immediately ahead.

What is your Outlook for Stocks and Bonds?

U.S Equities: “January was the strongest start for global equity markets in any year for at least 30 years”, according to Goldman Sachs.” Although those gains have been essentially given back in recent days, stocks remain our asset class of choice. Business confidence is high, and a capital spending revival is taking place. Consumers will be motivated to spend more as the recently passed tax cuts free up extra cash in paychecks starting this month. Equities should benefit from this environment as long as inflation expectations do not get out of control. As the year progress, global monetary normalization may reduce liquidity growth and remove some of the buoyancy the stock market enjoyed in 2017. Nevertheless, the outlook is still favorable for equities.

Foreign Equities: Last year foreign equities outperformed the U.S. stock market for the first time in five years. A weaker dollar and an improving economic backdrop made this possible. The fact that most of the major economies of the world are experiencing early to mid-cycle characteristics, means there is a possibility that the cycle can be stronger for even longer. Currently we especially like emerging market equities, as the macroeconomic outlook is favorable, and valuations are reasonable compared to developed markets. Emerging equity markets are prone to outperform and underperform developed market equities for long periods of time. We believe they may be overdue for an extended upcycle of 3 or 4 years as global fundamentals improve.

Bonds: While equities soared in January of this year, U.S 10-year bonds posted one of their worst returns for the month of January ever. And while bonds are still relatively expensive across sectors, they are less so now. This is a challenging environment for bonds as yields are still low and rising against a backdrop of improving global financial conditions and central bankers that are becoming less accommodating.

The corporate credit market has been calm in comparison to the stock market in recent days. We attribute much of this to an improving outlook for corporate earnings and reduced expectations for defaults. Despite these favorable earnings trends, we would expect high yield credit spreads to rise as the credit cycle matures.

Notwithstanding the difficult environment for bond investments, we believe that by managing interest rate risk and credit risk we are likely to outperform cash. Interestingly, cash in the U.S. now earns more that long duration government bonds in Europe and Japan. For some investors, bond ladders are an excellent way to address both liquidity and income needs in a rising rate environment. The good news is that as interest rates adjust to an improving economy, the higher interest rates will eventually provide the income that investors used to expect from their bonds and make them more competitive against equities once again.

Disclosures: The views expressed are those of Byron Green as of February 8, 2018 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 02-09-2018

Click here to download printable PDF of GIM Market Commentary 02-09-2018