The Federal Reserve left rates unchanged yet again last Wednesday. Fed Chair Janet Yellen explained that overall economic trends remain favorable and strengthen the case for tightening. But she also noted the economy’s slow growth rate gives the Fed a little room to let the economy run a bit further before any risk of excessive inflation down the road becomes a concern. The Fed seems be balancing their desire to normalize rates against their interest in maintaining economic and market stability.

The Bank of Japan also met on Wednesday, deciding to revamp its monetary policy agenda from targeting base money growth to targeting interest rates and the shape of the government bond yield curve. This comes after the European Central Bank (ECB) decided to keep its policy unchanged at its meeting on September 8th.

There are mounting doubts as to the effectiveness of the ongoing zero interest rate policies the BOJ and ECB have been pursuing. There are also concerns the central bank purchases are creating distortions that may eventually lead to financial bubbles.

That brings us to the question, why has the boost to economic growth from such aggressive monetary stimulus been so disappointing?

There are several possible reasons:

- Increased bank regulation and compliance requirements (including fines paid by U.S. banks in excess of $251 billion since ’08) have caused banks to be more like utilities, stripping them of their nimbleness to respond to new opportunities. Many banks have altered their business models altogether and loan growth appears to have suffered as a result.

- New enhanced capital requirements mean that it takes more capital to achieve the same level of loan growth and economic stimulation.

- Central Bank policies have flattened yield curves and made it a much more difficult environment for banks and financial intermediaries to make money. Eight years of reliance on aggressive monetary policy to maintain ultra-low rates is increasingly having less and less impact on spending and investment. These low rates negatively impact the income that insurance companies, pension plans and retired individuals can earn without taking on undue risk. It is hard to fully quantify the costs of such policies.

- Record low interest rates have induced many companies to buy back their common shares in order to boost earnings rather than reinvesting profits into areas that could encourage more sustainable growth and employment. This has been good for stock market performance, but not as good for economic growth.

The Next Phase

The immediate global response to the Great Recession that began in December 2007 was fiscal easing in the form of higher public spending and lower tax revenues. Expansionary budgets lessened the impact of falling demand, but also elevated public debt. Burgeoning debt loads subsequently lead to austerity programs in an attempt to get debt back under control. In much of the developed world there were expectations, or at least hopes, that monetary expansion would be enough to support recovery.

That brings us to today where global demand is still lacking as reflected by subpar global growth and continued deflationary pressures in Japan and Europe as a result of increasingly ineffective negative interest rate policy. It appears that governments need a renewed spending push and/or tax incentives to drive demand enough to break the deflationary cycle.

Government officials from countries that include Japan, Canada, the UK, Germany and the U.S. are increasingly discussing, and in some cases already implementing, additional fiscal stimulus measures. Judicious use of fiscal stimulus to support monetary policy could allow central banks to normalize interest rates sooner. A time for stringent fiscal discipline will eventually come, but that time does not appear to be now.

What Does this All Mean for Financial Markets?

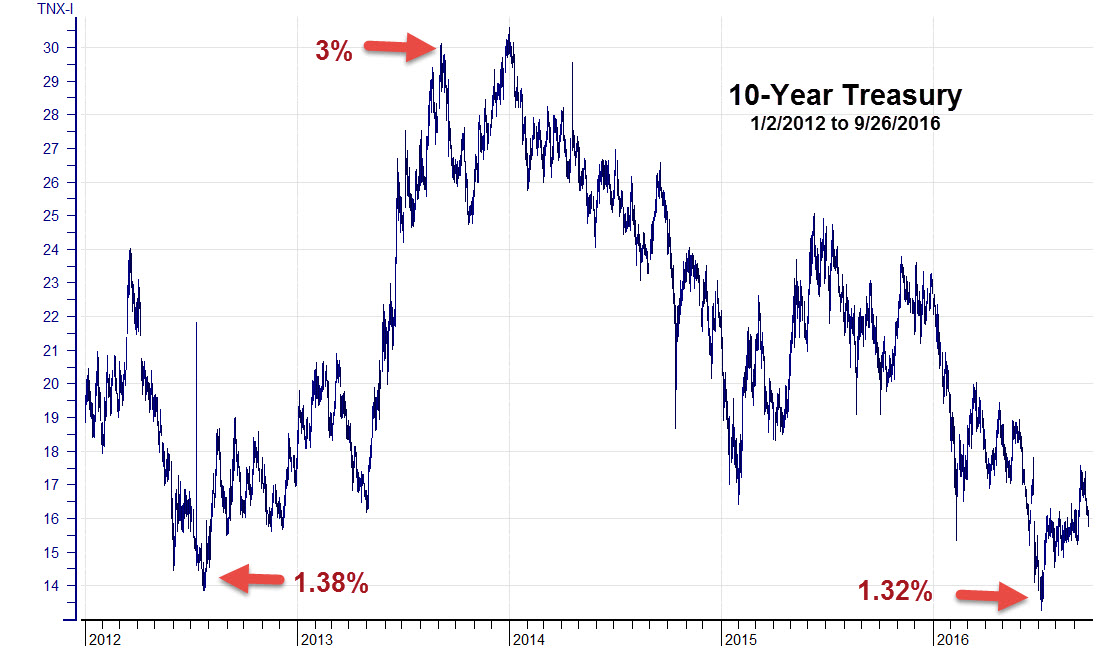

With the days of negative interest rate policy possibly numbered, there appears to be a subtle shift taking place in the markets. You can see this in the U.S. 10-year treasury bond interest rates that stand at 1.56% today (9/27) up almost 18% from the historic lows of 1.32% on July 6, 2016.

As a little background, just three years ago the 10-year treasury yields surged 117% (1.38% on 7/25/2012 to 3% on 9/5/2013) in just over a year after then Federal Reserve chairman Ben Bernanke hinted that the Fed would soon begin scaling back its QE bond-buying. The rise in yields did not last, but it gives us a preview of what could be in store if the markets begin to realize that aggressive central bank stimulus may be supported or supplanted by fiscal stimulus and that increasing demand induced inflation may not be that far behind. With rates so low, especially in Europe and Japan, a turn in inflation expectations, no matter how subtle, could have a meaningful impact on bonds and bond substitutes, i.e., dividend rich stocks held as substitutes for bonds.

Today’s depressed yields mean that there is less cushion to shield investors from a potential change in inflation expectations. This comes at a time when central bankers are much more willing to tolerate nascent signs of accelerating inflation after contending with deflationary forces for several years.

Not only are the sovereign debt yields depressed for much of the developed world, but the supply of debt continues to rise unabated. Here in the U.S. the Congressional Budget Office forecasts that the U.S. deficit will rise to $590 billion this fiscal year ending September 30th and surge in the coming years as baby boomers retire and apply for Medicare and Social Security. Global debt issuance this year may surpass the all-time high of $6.6 trillion recorded in 2006, according to Dealogic.

The Bottom Line

We are beginning to make adjustments to our fixed-income and balanced portfolios to reflect the changing landscape we see for bonds and bond substitutes in the weeks and months ahead. For now, our emphasis is shifting toward shorter duration investment grade bonds. We continue to believe that intermediate to long-dated U.S. government bonds play an important diversifying role in our balanced portfolios.

Our objective is to help our clients achieve their financial goals despite the inevitable ups and downs the markets deliver. We will always do our best to guide you through the bumps and bring you safely home. Thanks for choosing to make the journey with us!

Disclosures: The views expressed are those of Byron Green as of September 27, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 09-27-2016

Click here to download printable PDF of GIM Market Commentary 09-27-2016