Tony Blair once called education “the best economic policy there is.” With that in mind, let’s take a few minutes to educate ourselves on the environment surrounding our investments of late. To start with a broad observation, global economic growth lacks the zest we would all like to see. Countries such as Brazil struggle with political uncertainty and recession, while China is challenged by a growth slowdown and is trying to borrow its way out. In Europe and Japan, ongoing quantitative easing is providing some support to their economies, but is also suppressing global yields and continuing to make this a difficult environment for savers and retirees.

In the U.S., first quarter GDP growth was reported at only .5%. While that was disappointing, there have also been encouraging signs in recent data. Retail sales increased 3% year-over-year in April. Housing starts for the month rose 6.6%. And April’s non-manufacturing Purchasing Managers Index (PMI) rose to 55.7. Based on data points such as these, most experts expect an improvement in second quarter economic growth. For instance, the Federal Reserve Bank of Atlanta’s “GDPNow” statistical model is forecasting real GDP growth of 2.5% for the second quarter of 2016.

Furthermore, the oil rout appears to be over. This should reduce the drag the energy sector has been placing on business spending and corporate earnings in the U.S., and help push us past this current low point in the profit cycle.

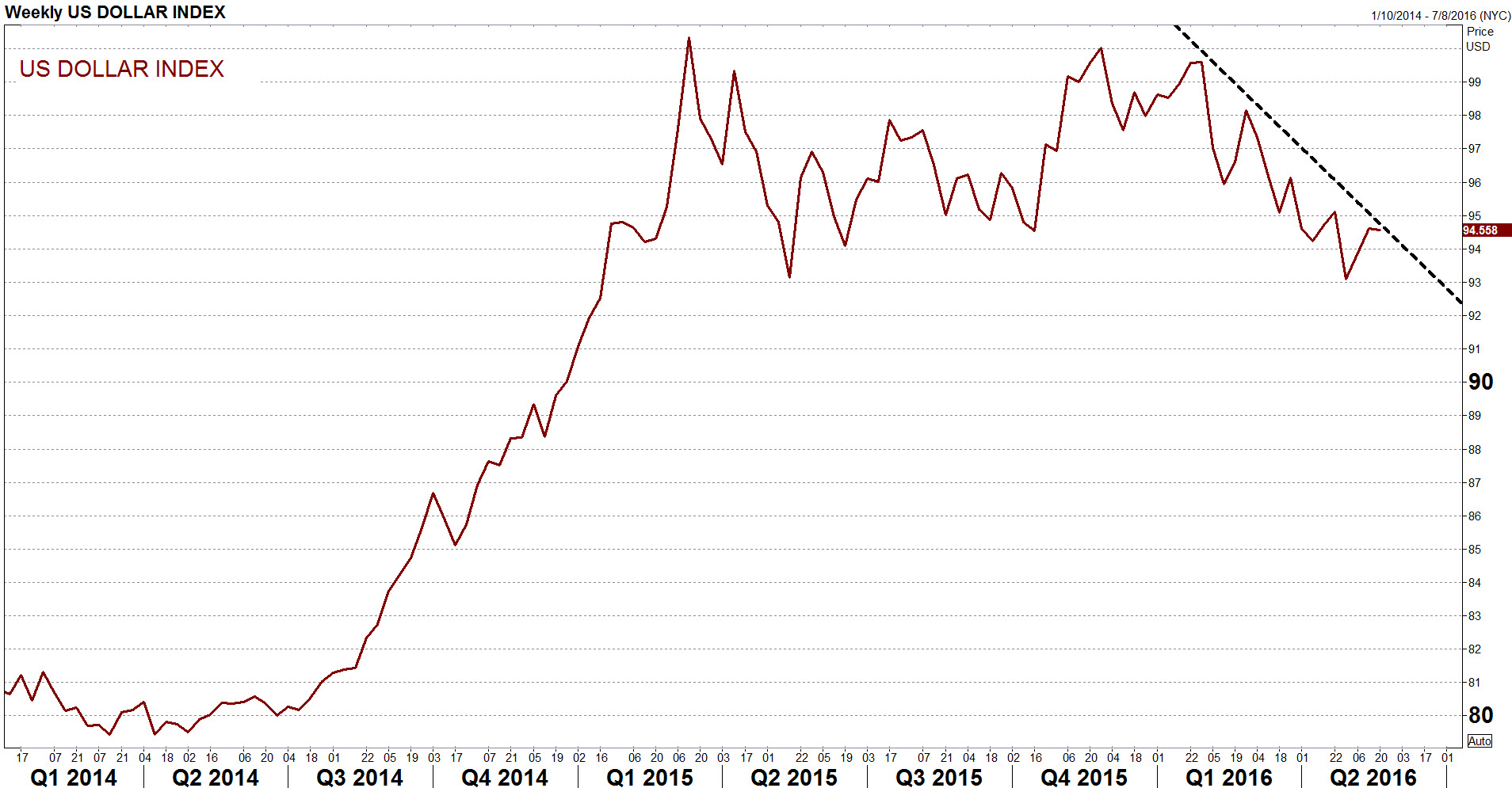

The dollar’s strength since the second quarter of 2014 has posed its own challenges to the earnings of U.S. multinationals and exporters. Fortunately, some of the gains have been given back since the first of the year (see chart below), which is diminishing the headwinds to profits. In the second half of the year U.S. earnings and revenues are expected to improve. According to Factset Earnings Insight, analysts are projecting S&P 500 earnings and revenues for 2016 to rise .9% and 1.5%, respectively. And in 2017, earnings are expected to rise a further 6%. That is encouraging news since the first quarter’s earnings decline marked the first time the index has experienced four consecutive quarters of year-over-year decline since the third quarter of 2009.

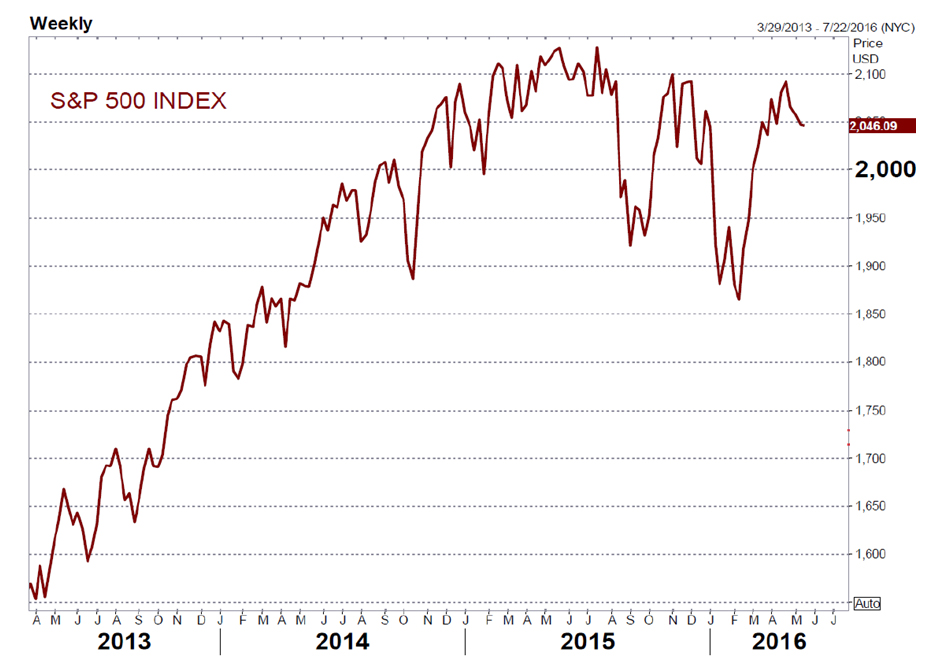

The stall in earnings goes a long way to explaining the flat, albeit volatile, performance of the S&P 500 Index (see chart below) over the last 1½ to 2 years. Expectations of growth during that time proved too high considering the head winds from collapsing oil prices and a stronger dollar. Earnings disappointments caused reassessments and, at times, overreactions. Fortunately, steady job gains over this period have buoyed consumer spending and economic growth, thereby keeping a recession at bay.

While job gains remain solid, consumer demand still seems to be restrained by below-average use of credit. Credit card and mortgage borrowing is relatively low for such a mature point in the business cycle. This seems to reflect a more cautious stance by consumers—perhaps a result of lingering memories of the Great Recession—as well as recurrent European crises and an aging baby boom generation that has under-saved up to now. Lower debt levels could prove helpful whenever the next recession arrives, but in the meantime they also lead to more modest growth rates.

Moving forward from here, tightening labor markets (unemployment is now at 5%) have begun to put upward pressure on wages. Wages and salaries for civilian workers increased 2.6% for the 12-month period ending in March. While these wage increases may propel additional consumer spending, they also put upward pressure on inflation as reflected in the consumer price index (CPI). “Core” CPI (minus food and energy) increased 2.1% for the 12-months ended in April. This is significant in that it may lead the Federal Reserve to tighten monetary policy more rapidly than thought. That could prove troubling to risk assets, at least temporarily, as it did when the Fed raised rates .25% in December of last year and the S&P 500 fell almost 8% over the following month.

On the other hand, normalizing monetary policy could also be interpreted as a positive signal to Wall Street. It will, after all, announce that the U.S. no longer needs unusual monetary measures to support the economy. Enhanced confidence in the recovery might even overcome sluggishness better than the present policy of keeping rates artificially low in hopes that it will spur new investment. Much will depend on the environment in which the policy happens (whether GDP growth is strong, etc). There might also be a period of volatility, after which markets realize the sky has not fallen, letting the “better angels” of investors’ nature take over. Regardless, modestly higher rates would at least significantly enhance the investment options available to savers and retirees seeking conservative income production.

Mark down June 14-15 on your calendar. That’s when the next Federal Open Market Committee meeting will be held, and the next step in these issues will be taken. As things stand, expectations are that the Fed is most likely to wait until fall to actually raise rates.

Asset Class Outlooks

Domestic Stocks: I expect improving U.S. corporate earnings as we move into the second half of 2016, supported by healthy consumer spending and modest economic growth. The current forward P/E Ratio of 16.6 for the S&P 500 index (FactSet Research) is above its 10-Year Average of 14.3, and may compress the upside available in domestic stocks, even with the expectation of improved earnings. Still, my overall outlook for domestic equities is favorable.

Bonds: High yield bond valuations remain favorable, especially when supported by the recent rebound in oil prices. I also like quality corporate bonds. Treasury securities are desirable as a risk offset to credit bonds and equities, but are not compelling on a yield basis. Strong job growth and low levels of unemployment generally signal the beginning of rising inflationary pressure. In this environment, we decrease duration and add bonds with inflation resistant properties, such as TIPS. Risks: Any change in the pace of Fed rate hikes will alter the outlook between Treasuries, high-yield bonds and inflation-hedge instruments. This explains why there are so many “Fed watchers” out there (including us).

International Equities: There are some attractive valuations in global stocks. Positive trends in the European household and service sectors support continuation of the eurozone’s (admittedly slow) rate of expansion. Japan’s version of the slow-growth economy is very dependent on global trade, and the Japanese Central Bank will likely be forced to ease further in an effort to boost growth. The consumption tax hike planned for 2017 might also get postponed. Risks: The United Kingdom’s June referendum on continued membership in the European Union (EU) will be watched closely by European (and other) markets. We do not expect the UK to exit the EU. But if it were to, it would likely trigger a negative market reaction until the ultimate impact is sorted out. This referendum will likely prevent any meaningful gains in Europe until the decision is made. Once past, it could unleash pent-up equity strength.

Emerging Markets: Continued quantitative easing in Japan and Europe should help support the emerging markets, as lower developed-market rates encourage investment in (higher-yielding) emerging market issues. The recent rebound in oil is also taking some pressure off of emerging oil-export economies such as Russia, as reflected in the rebound of that market.

In geopolitical news, in Brazil the Senate voted to impeach President Dilma Rousseff. The interim President Michel Temer is expected to move the country toward more market-friendly policies, and away from the interventionist approach which has deepened their current economic woes. This is encouraging news, but we will have to see what political support Temer can build for moving the country in the “right” direction. Stay tuned.

That is how things look from our perch late in the second quarter of 2016. Staying educated on the economy and markets requires a constant re-learning of things as conditions change. It’s a never-ending process, but also a never-boring one! We will continue to monitor developments and be in touch with important news. Thank you for reading and if you happen to be a client, thank you for your business!

Disclosures: The views expressed are those of Byron Green as of May 18, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 05-18-2016

Click here to download printable PDF of GIM Market Commentary 05-18-2016