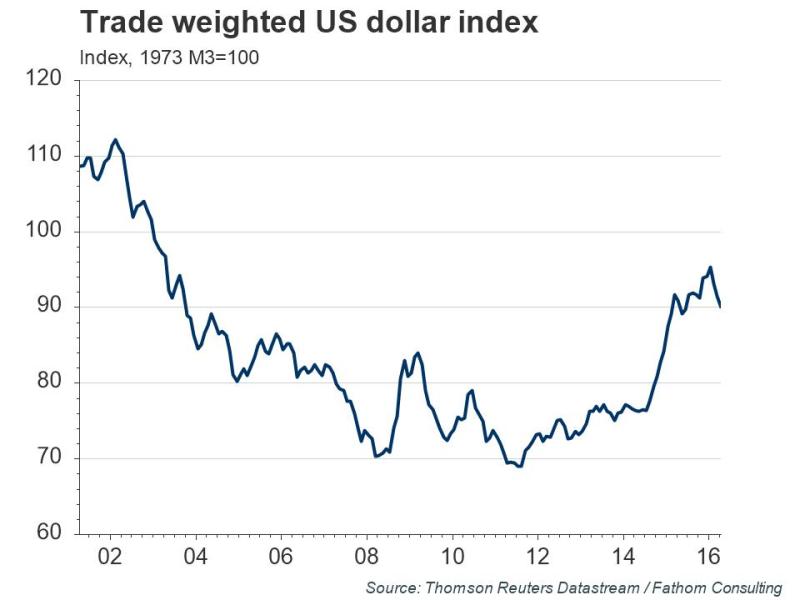

After capturing the headlines for almost two years now, oil once again grabbed our attention during the first quarter by falling another 28% in the first six weeks of the year. This capped a combined loss in value of 75% from highs just 20-months prior (a fall from $107.73 to $26.05!). Driving the decline was a strong rally in the US dollar of over 20% during the same period and an ongoing imbalance between the global supply of and demand for oil. Since oil is largely priced in U.S. dollars, a stronger dollar weakens prices, other things being equal. Exacerbating this, global supply has been outpacing demand since the third quarter of 2013, and continues to be an issue. Much of the credit for the surplus lies with the shale oil boom in the U.S.

In the early months of the oil decline, the energy sector was expected to bear the brunt of the damage—to revenues, earnings and deteriorating balance sheets. At the same time, there was an expectation that ‘winners,’ namely consumers as well as countries and industries that are net importers, would provide an offset to the energy sector’s losses. However, as oil price declines continued and exploration and capital budgets were cut, it became clear that in the U.S., losses in the energy sector would overwhelm, at least in the short-run, benefits to the winners. This was especially true considering the tepid growth being experienced elsewhere in the economy.

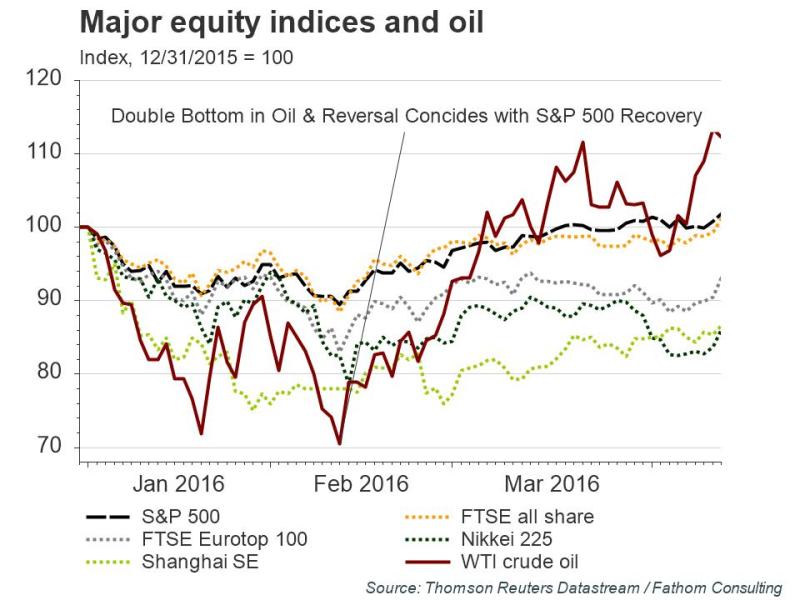

As the cumulative severity of declines mounted, supply-induced selling was reinforced by concerns about the demand side—that price weakness also reflects anemic global economic growth. Such concerns can self-fulfill, and slowing growth (not to mention policy mis-steps) in China have fanned those flames even more. New lows in oil were met with anxious selling in stocks, high yield bonds and other risk assets.

The good news is that oil markets have now staged a 61% rebound from lows just two months ago. This has been the result of a number of factors, from decreased non-OPEC production to supply disruptions (and a coming maintenance outage in the North Sea). While it still leaves prices 60% below their former highs, it also has been a huge relief to investors. The S&P 500, which had slumped 9.5% from the beginning of the year to February 11, reversed course and has now turned positive for the year! As usual, the risk assets that suffered the most during the decline have participated the most in the mini-recovery.

Of course, demand for commodities such as oil and the strength of the global economy remain closely intertwined. It is difficult to separate the price action of one from the outlook for the other. Currencies are also intertwined with the global economy and correspondingly affected by the nuances of relative growth rates, inflation, monetary policy and interest rates between each country or currency bloc in the world.

The dollar’s strength over the last couple of years has been driven largely by a monetary policy divergence between the US and its significant trading partners, and by a comparatively strong U.S. economy. As the Fed began its first steps toward ‘normalization’ of rates in December, after more than eight years of essentially zero interest rates, the dollar’s strength increased further. This in turn helped accelerate oil’s fall. As they say, everything is connected.

To summarize this eagle’s-eye view, we came into 2016 with oil prices finding new lows and the Federal Reserve ready to begin moving interest rates back toward levels considered normal for a healthy economy. In the meantime, Europe and Japan continued to struggle with slow growth and deflationary pressures, bringing yet more quantitative easing from their central banks.

So it’s not really surprising that stocks started this year on the rough side. Fears were mounting that the Fed might raise rates too quickly, while the dollar was already surging and global growth concerns were mounting. Not only could all of this lead to slower economic growth, but it might flatten or invert the yield curve, pressuring both bank profits and lending.

As a result stocks retreated. And a cautious Fed second guessed the speed at which it should normalize rates. On March 11, Janet Yellen announced that the Fed had modified their position and would proceed cautiously in adjusting policy, due to economic developments and low market-based inflation expectations. The comments seemed to point to a much slower path to normalization of interest rates. The markets approved.

That brings us to today. The dollar has declined 3%-4% against our primary trading partners since the Fed’s March announcement. Oil has continued the rebound that began on February 11. These are both excellent developments. On the negative side, corporate earnings have been pulled down by the battered energy sector, the negative effect of a stronger dollar on exports and continuing slow economic growth. FactSet Research expects US companies to report year-over-year declines in both earnings (-9.1%) and revenues (-1.2%) for the first quarter of 2016. Analysts are not expecting earnings and revenue growth to resume until the third quarter of 2016. For all of 2016, earnings are expected to rise 2.1%. That’s pretty tepid considering the forward 12-month P/E ratio is now at 16.7, above the 10-year average of 14.2.

The good news is that the bar for upside surprises in earnings is unusually low given depressed expectations. And a stabilizing oil market could help that immensely. Furthermore, the US economy remains reasonably healthy, especially compared to the rest of the world. Jobs growth has been excellent, payroll employment is more than 5 million above its 2008 peak, and the unemployment rate has fallen to 5%. Manufacturing is beginning to improve too.

All of these things contribute to our current macro-view, which is cautiously optimistic. Now for our outlook on more specific asset classes:

U.S. Equities: Values are no longer cheap. The easy money created by the Fed’s quantitative easing program has come to an end. But the U.S. consumer remains strong, supported by solid employment gains. A recovering housing sector and strengthening manufacturing sector should create additional updraft. But returns will probably be driven more by the outlook for earnings. Here, as mentioned before, the bar has been set low of late, creating room for potential upside surprises.

Risks: Any upside growth or inflation surprises could put pressure on the Fed to step up rate increases, which could dial up market volatility.

International Equities: There are some attractive valuations here. Economic growth remains an issue overall, but continued quantitative easing in Europe and Japan should help avoid recession in those areas.

Risks: The United Kingdom’s continued membership in the European Union (EU) will be watched closely by European markets, as a June referendum approaches. We do not expect the UK to exit the EU. But if it were to, it would likely trigger a negative market reaction until the ultimate impact is sorted out. The referendum will likely overshadow any meaningful gains in Europe, until the decision is made. Once past, it may unleash equity strength.

Regarding Japan, the Bank of Japan may be reaching its limit on weakening the currency. With a potential tax hike planned for next year, upside may be hard to find in the short run.

Emerging Markets: Continued quantitative easing in Japan and Europe are also supportive for the emerging markets, as lower rates encourage investment in (higher-yielding) emerging market issues. It has also been helpful of late that the Fed has scaled back its U.S. rate hikes. Not only is this helping to stabilize currency fluctuations across emerging markets in general, it has also helped reduce the volatility between the U.S. dollar and the Chinese yuan. Another positive is that the recent rebound in oil is taking some pressure off of emerging oil export economies such as Russia, Columbia and Malaysia.

Risks: Continuing growth challenges in Europe and Japan could harm the export-base of many emerging nations.

Bonds: The Fed’s decision in March to slow its rate-hike path boosted returns in the investment-grade market. The firming of oil prices also took some selling pressure off the corporate high-yield market, allowing for a little price recovery and a narrowing of credit spreads. Yields in the high-yield space are attractive, but headwinds remain as downgrades and defaults continue to increase and could potentially push spreads higher. In spite of this, we believe high-yield bonds still offer attractive relative value.

Strong job growth and low levels of unemployment (such as we are beginning to see in the U.S.) generally signal the beginning of rising inflationary pressure. In this environment, we decrease duration and add bonds with inflation resistant properties, such as TIPS.

Risks: Any change in the pace of Fed rate hikes will alter the outlook between Treasuries, high-yield bonds and inflation-hedge instruments such as TIPS.

That is how things look from our perch early in the second quarter. We will continue to monitor developments and be in touch with important news. Thank you for reading and if you happen to be a client, thank you for your business!

Disclosures: The views expressed are those of Byron Green as of April 15, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 04-15-2016

Click here to download printable PDF of GIM Market Commentary 04-15-2016