Last month I spoke of the disappointingly slow economic growth the US experienced in the first quarter of 2016, along with a stall in corporate earnings. The good news is that since then the first quarter growth rate has been revised upward—from 0.5% to 0.8%. Our GDP cup runneth over! Seriously though, the better news is that the second quarter is shaping up for significantly faster growth. As I write this, the GDPNow model of the Federal Reserve Bank of Atlanta is forecasting second quarter GDP growth of 2.8%. This is in spite of a disappointing May labor report showing that nonfarm payroll employment increased at a surprisingly slow pace of 38,000 for the month.

The weak payroll figures have raised concerns, but such data can be quite volatile month-to-month. It takes a series of data points to really establish a clear trend. And the current three-month average shows a fairly healthy 116,000 jobs being created per month. It is also natural for the pace of job growth to slow as the job market begins to tighten. The unemployment rate dropped to 4.7% in the most recent report. Many would consider the U.S. to now be at full employment, meaning an economy in which:

- Those who want jobs can generally find them within a reasonable search period

- Those hiring can generally find the workers they need

- There is little pressure for wage–driven inflation.

As the unemployment rate continues falling below 5%, it can become difficult for businesses to hire the people they need, at which point wages (and prices) may start to rise. There is some anecdotal evidence that U.S. companies may be starting to experience such hiring difficulties.

But all things considered, the Federal Open Market Committee decided not to raise interest rates at their June15th meeting. If weak employment growth drove the decision, it was not clear from the committee’s press release. They did note the slowing rate of job gains in May, but also pointed out improvements in household spending and the housing sector in general.

The decision probably provided a bit of relief to some investors with concerns the Fed might be moving too quickly to tighten in the face of:

- A potential economic slowdown

- An upcoming referendum by the United Kingdom to either depart or remain with the European Union

- The uncertainty of the November U.S. elections.

In fact, in the question-and-answer period following the meeting and the Chair’s prepared remarks, Chairwoman Yellen did reference the June 23 Brexit vote as a factor in the Fed’s decision to delay a rate increase.

Many around the world are anticipating the vote. Obsessing over uncertainty has always been a popular market pastime. And for some, memories of the Great Recession and the market upheaval of 2008 still linger in their calculus. But history suggests that such a severe economic event as that is no common occurrence, and thus not likely to recur soon. Yet investors remain skittish at present. Once the vote happens it should remove considerable uncertainty.

The Brexit referendum came about as a result of UK Prime Minister David Cameron’s election in 2015, wherein he promised to let voters voice their desires, somewhat in the style of British rock group The Clash’s song Should I Stay or Should I go? The resulting debate has called to mind the lyrics of that 1982 hit. If Britain goes there may be trouble, but if they stay it may be double. Meanwhile, the indecision’s bugging everyone. So on June 23—it’s time to let us know.

While some recent polls seem to be leaning toward a Brexit, the Number Cruncher Politics Probability Index, calculated by Matt Singh (www.ncpolitics.uk) has the chance of a Brexit currently at only 42%. This index looks at polling averages, with consideration for the accuracy of the polls in prior referendums, to predict the outcome of the current vote. Polls are never perfect, but in this case the number of undecided voters is large enough that no one can be sure what will happen. It could go either way.

The referendum is a big deal. The EU is now larger, economically, than the U.S. And the UK is its second largest member by both population and GDP. Some fear a Brexit might cause a domino effect over time with other EU members, possibly even leading to complete dissolution of the union. Others believe a Brexit would be a good thing for the UK and ultimately lead to necessary and positive changes taking place within the EU to benefit the remaining members.

Based on what I read, I believe the most likely scenario will be for Britain to remain with the EU. If that happens, a relief rally in global equities and a decline in defensive holdings such as treasuries and utilities will likely ensue. In this event, we could also see growth improve in the second half of the year for the UK, EU and even the U.S. as general confidence improves and postponed investment decisions are made.

On the other hand, in the event of a vote to exit the EU, a continuation of the recent slide in risk assets is likely, with UK equities being impacted the most. Central banks, which are closely watching the vote, are prepared to support market liquidity as needed, until the uncertainties caused by the vote are sorted out. Goldman Sachs, in a June 17th article (European Views: The UK’s EU referendum – what we expect) projects that a vote to leave the EU would slow the UK’s GDP growth by 1-2% over the ensuing 12-18 months. The other economic consequences of an exit would develop over time as trade and other agreements are re-negotiated. Overall, the impacts would probably not be as dire as what some of those on the “stay” side of the debate have portended.

But until the vote, markets are likely to continue to be unsettled. The results will likely be known very early in the morning of June 24 for the mainland U.S. Since defensive assets have already been bid up to some extent, and risk assets have been so volatile in recent days, I see the best course of action to be maintenance of a globally balanced portfolio containing both defensive and pro-growth holdings, and broadly diversified across asset classes and countries. I believe the economy and financial conditions are relatively stable and that easy global monetary policy will keep near-term sell-offs, if any, limited in scope.

Asset Class Outlooks

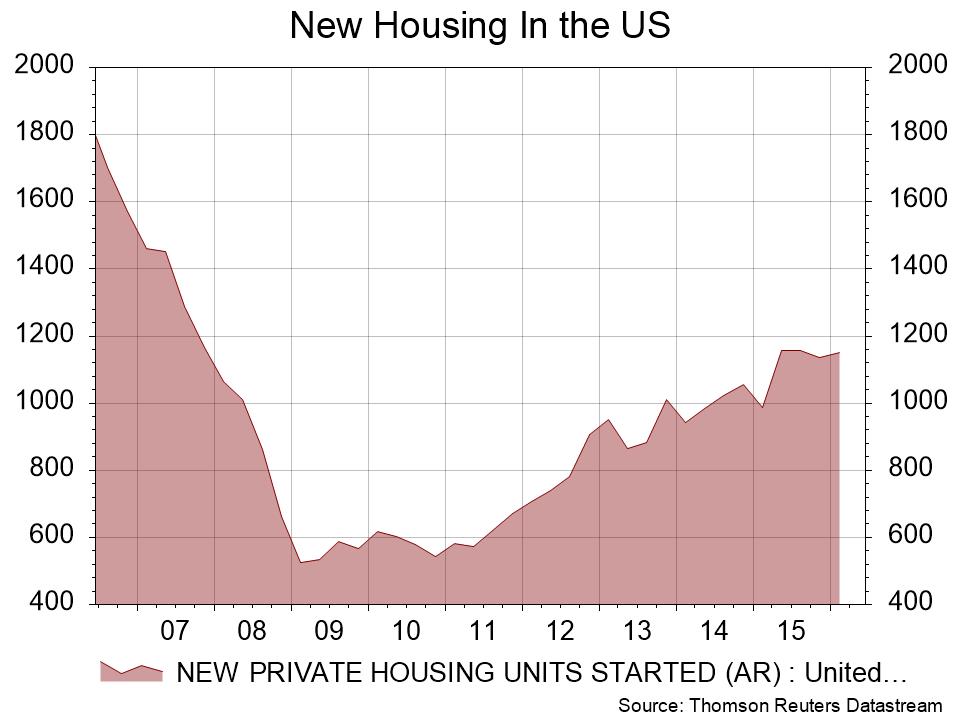

Domestic Stocks: I continue to expect improving U.S. corporate earnings as we move into the second half of 2016, supported by healthy consumer spending, a favorable housing market and modest economic growth. All of this should bode well for stocks.

Bonds: Treasury securities remain desirable as a risk offset to credit bonds and equities, but fail to be compelling on a yield basis. Within our fixed income portfolios, we are following a barbell approach—seeking both yield and safety by holding treasuries and corporate bonds. Moderate job growth and low levels of unemployment should put increasing pressure on inflation. In this environment, we will continue to keep duration low and add bonds with inflation resistant properties, such as TIPS.

International Equities: There are some attractive valuations in global stocks. Positive trends in the European household and service sectors support continuation of the eurozone’s rate of expansion. In Japan, the Central Bank will likely be forced to ease further in an effort to boost economic growth. A sales tax hike planned for April 2017 has now been postponed by Prime Minister Abe until October 2019, due to the fragility of the recovery in Japan and the, thus far, limited success of Abe’s economic program.

Emerging Markets: Continued quantitative easing in Japan and Europe should help support the emerging markets in general, as lower developed-market rates encourage investment in (higher-yielding) emerging market issues. There is some new uncertainty in India, where the economy has recently been performing strongly. Raghuram Rajan, who heads the Reserve Bank of India, the nation’s central bank, announced he will leave his post when his term ends on September 4. Rajan has become internationally popular for his efforts to streamline the Indian economy’s considerable red tape. There are some reports this drew envy and a lack of support from Prime Minister Modi’s administration. It is difficult to know the truth as there are conflicting stories and accusations going back and forth. But at this point the main thing will be who is selected to replace Rajan, which will bear close watching.

That is how things look from where I stand in the second quarter of 2016. Staying on top of the economy and markets requires constant vigilance as conditions change. It’s a never-ending process, but also a never-boring one! I will continue to monitor developments and be in touch with important news. Thank you for reading and if you happen to be a client, thank you for your business!

Disclosures: The views expressed are those of Byron Green as of June 20, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 06-20-2016

Click here to download printable PDF of GIM Market Commentary 06-20-2016