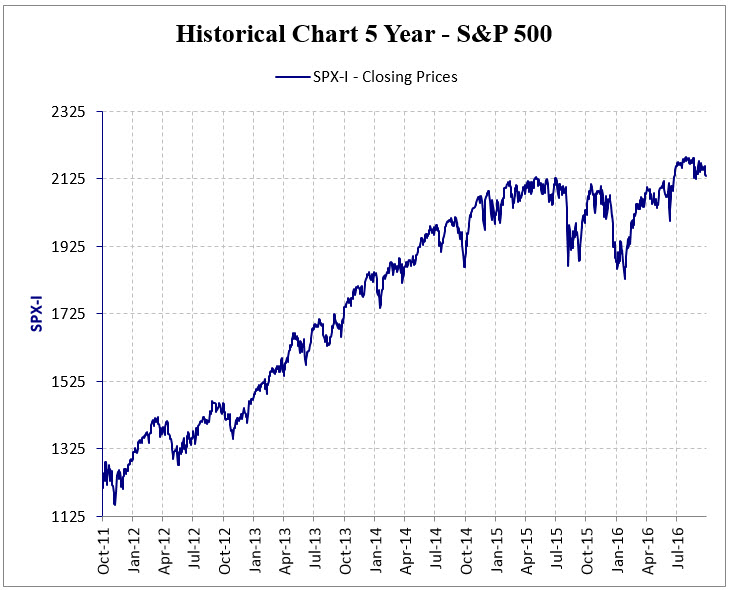

The market continues to grind higher since the election. From the day of the election through July 31, 2017, the S&P 500 Index is up more than 17%, the Dow Jones Industrial Average has advanced 21%, and the NASDAQ Composite is 23% higher. Optimism over the pro-business Trump agenda seems to be the catalyst for the initial boost in stock prices. But continued advances in the market after a very rocky start to the new administration’s efforts to implement its agenda seems to reflect a broader optimism beyond the challenged promises of health care reform, tax reform and infrastructure spending. A steady, synchronized global expansion, coupled with strong expectations for 2nd quarter U.S. corporate earnings (+9.1%, FactSet) have been enough to fuel stock prices higher without the certainty of these reforms being achieved.

While stock prices challenge new highs, unusually strong political discord and gridlock are keeping investors from becoming overly enthusiastic. Jamie Dimon, the chief executive of JP Morgan Chase & Company, voiced his impatience on Friday, July 14th with the media and politicians, complaining that bickering is standing in the way of solving real problems. We could not agree more. He went on to say, “If gridlock goes away we will grow faster. But if it continues we won’t grow slower.” In other words, favorable progress on reforms would aid growth and spur stocks higher.

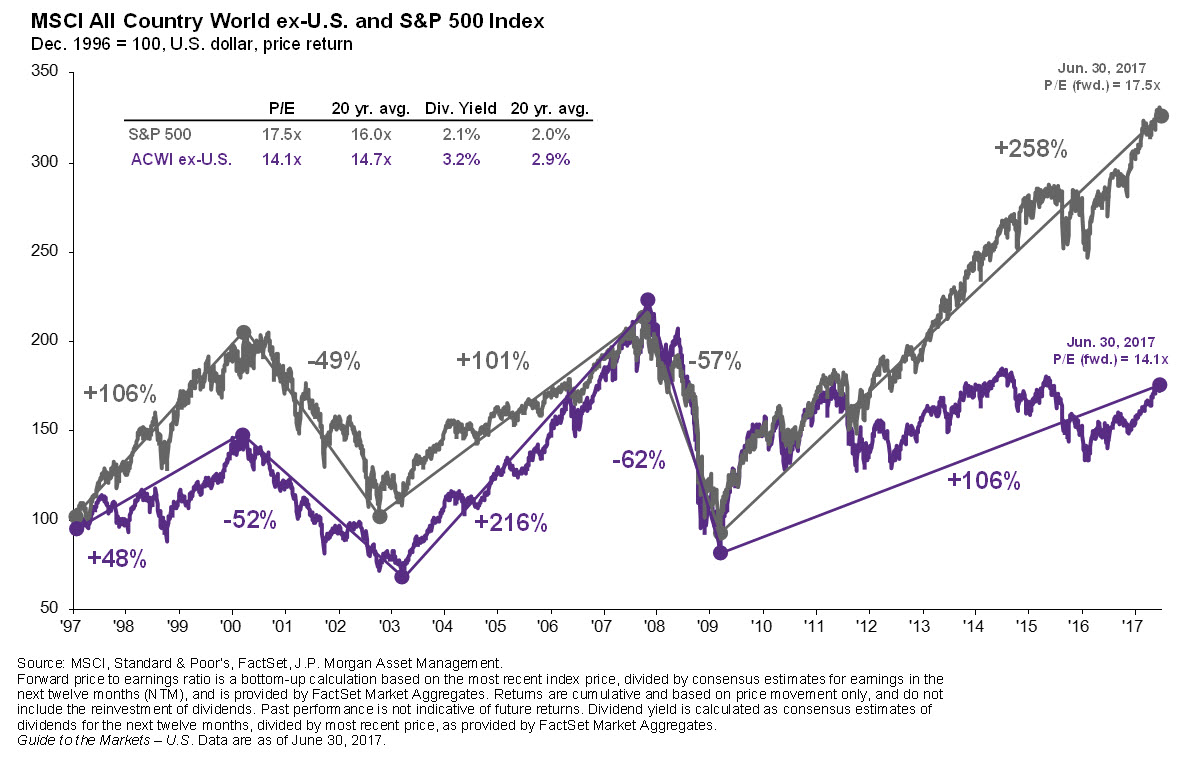

In the meantime, a steady, resilient advance continues. Despite a lot of healthy skepticism, an increasing chorus of strategists are calling for a top in the stock market, pointing to valuations they say are too high in the context of an aging business cycle. They make their case by comparing gauges of value, such as price-to-earnings ratios, price-to-book ratios and other similar metrics over long periods of time. The Fed’s actions to begin to normalize interest rates over the last 1 ½ years and their recently announced plans to start to reduce the size of their balance sheet is further fanning concerns that a bear market and recession may not be far behind these moves.

The angst about valuations and the length of the current business cycle are all legitimate concerns, but we also realize the ease with which data may be misinterpreted. It is important to be sure any analysis we rely upon is not overly simplistic or fails to account for the uniqueness of the current market and economic conditions. We are just a few years removed from the worst financial crisis since the Great Depression. Like the Depression, the Financial Crisis of 2008-2009 caused most major equity indexes around the world to decline over 50% and left many investors afraid to invest again or too willing to flee the market at the least sign of market weakness. No one wants a repeat of an event like that. At the same time, no one wants to sideline themselves unnecessarily from the growth opportunities the markets provide, especially with interest rates so low and the markets performing so well currently. To the extent anyone decides to move to the sidelines, what will trigger them to get back into the market?

At a lecture in London on June 27, U.S. Federal Reserve Chair Janet Yellen said she does not believe there will be another financial crisis for at least as long as she lives (she is 70 years old), thanks largely to reforms of the banking system since the 2007-2009 crash. Will she be right? Maybe, maybe not. There will certainly be periodic corrections and bear markets, but crises of the magnitude of the Great Depression or the Great Recession of ’08 – ’09 will likely be few and far between. If we invest like every market downturn is the beginning of the next great recession or depression, there may be far more opportunities missed than losses dodged.

As a tactical manager, we begin with the premise that no one can be certain about the near-term path of the market; the horrific events of September 11, 2001 should make that abundantly clear to everyone. We believe our client portfolios must be diversified and structured in such a way that even the worst surprise does not leave us flat footed. We are committed to being on our toes, ready to act no matter what unfolds in the markets or the economy.

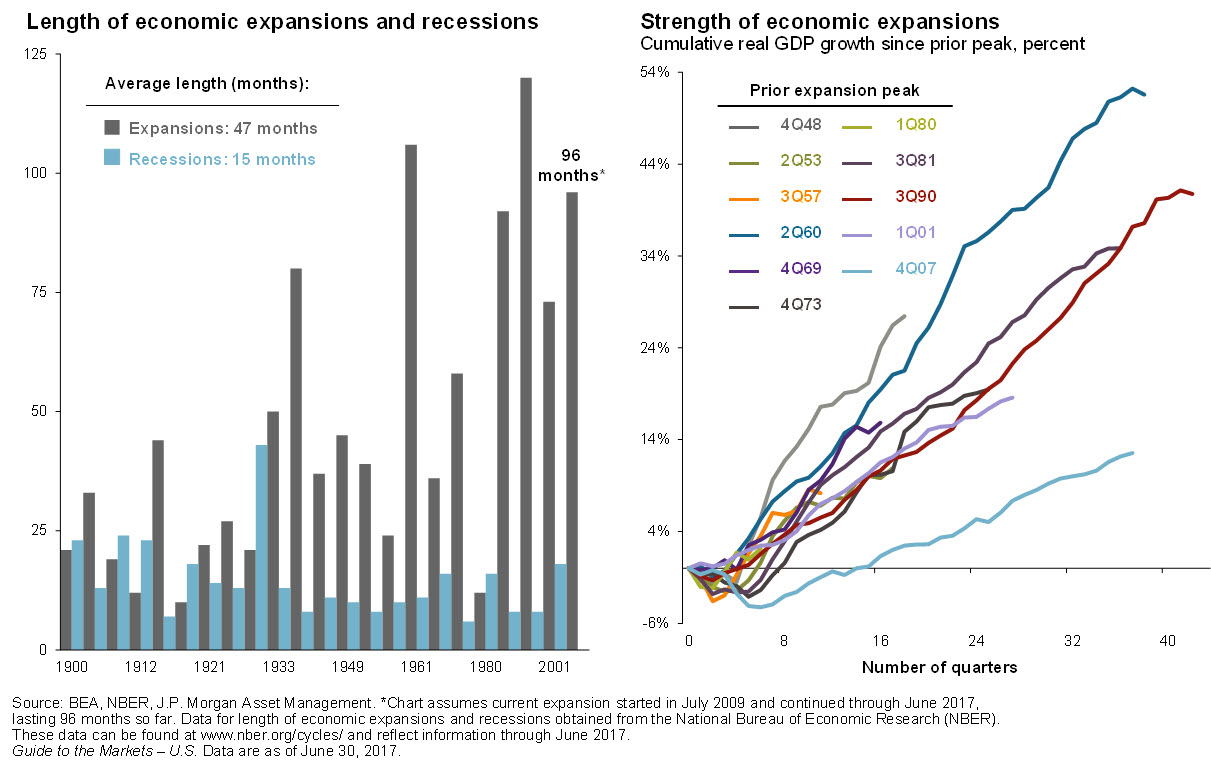

It is true the stock market is not cheap when compared to the valuations at the fear induced lows of the bear market in 2009. The greatest opportunities present themselves to investors at times such as these. As we moved past the fear and gloom and began to look optimistically about the future, a bull market ensued. Underlying this upward trend is a business cycle in the expansion phase. The cycle is mature now and is only 23 months and 9 months away, respectively, from becoming the longest or second longest expansion in the post-war era. The two longest expansions were from March 1991 to March 2001 and from February 1961 to December 1969.

Because the current recovery has lasted longer than average does not mean the end of the cycle is near. Like bull markets, business cycles are oblivious to the passage of time. Economic expansions and recessions occur at irregular intervals and last for varying lengths of time. They don’t have expiration dates, so time alone is insufficient information to forecast their demise. The default mode for the economy is expansion until something significant enough occurs to change its course. Excessive exuberance in the later stages of the business cycle can sometimes lead to a surge in asset prices or a bubble, which can contract suddenly leading to a recession. This was the case after the bursting of dot-com bubble in 2000 and the rapid declines in real estate prices leading up to the financial crisis in 2008-2009. This expansion has had quite a different tempo, expanding at a rate averaging less than 2 percent a year since its inception.

Absent outside influences, the growth in the economy could theoretically continue uninterrupted indefinitely. There is no reason why an economy in full employment must give way to an inflationary boom or fall into recession. The long-term trend of growth in the population and the natural increase in employment and output which result are the primary reasons for this. New productivity enhancing technologies discovered along the way also contribute to growth. Despite these facts, cycles do occur. This is because disruptions to the economy of one sort or another push the economy above or below full employment. Inflationary booms result sometimes from surges in private or public spending, from circumstances such as wars, extreme consumer or business optimism, or strong influences on the level of interest rates by the Federal Reserve’s monetary policy. Recessions can be caused by some of the same dynamics working in reverse. Monitoring these types of potential dislocations within the economy is the key to understanding the risks and opportunities that lie ahead.

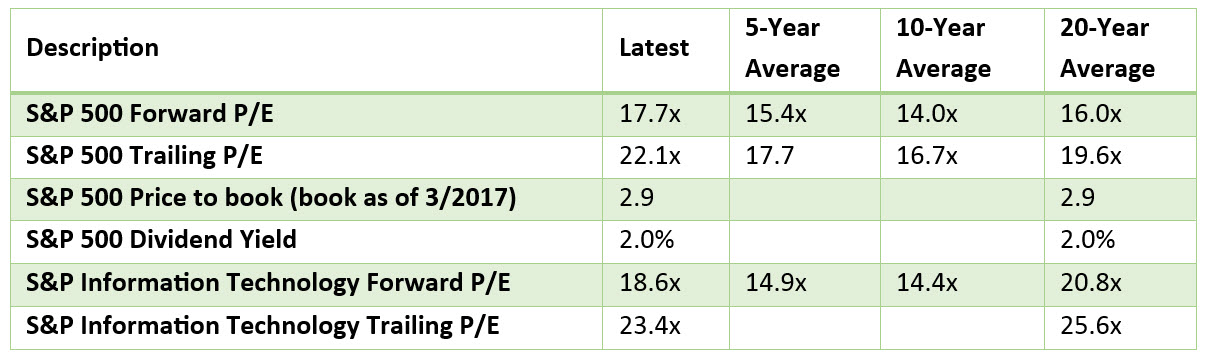

Are there any signs of irrational exuberance? Look at the following table showing some valuation metrics for the S&P 500 Index. Included is data on the S&P Information Technology subset of the S&P 500 for comparison purposes:

Source: FactSet Earnings Insight and S&P Dow Jones Indices. Data is as of July 28, 2017, unless otherwise noted. Note: Over last 20 years, the average rate for the 10-Year Constant Maturity Treasury has been 3.8% versus 2.3% (source: Federal Reserve Bank of St. Louis, monthly data averaged over the period from June 1997 to June 2017). Past performance is no guarantee of future results.

As you would expect in a mature expansion and bull market, the data above reveals that trailing and 12-month forward price-to-earnings multiples for the S&P 500 are a bit higher than long-term averages. There are no signs in this data of excessive speculative buying taking place. There has been talk the technology sector may be overdone, but as you can see from the data, the S&P Information Technology sector’s 12-month forward price-to-earnings multiple is not meaningfully out of line with the broader S&P 500 Index. The ratio is also lower than its 20-year average.

An important point to note is the current yield on the 10-Year Treasury bond is 2.3%, almost 40% below its average rate of the last 20 years of 3.8%. More importantly, yields in March 2000 at the peak of the dot-com boom were 6.3% and 4.5% at the peak in 2007 (not to mention oil prices were over $100). These interest rates were more than double our current rates.

Why is the level of interest rates important? Because the value of a stock or an index of stocks is, in some measure, a function of its future earnings or shareholder dividends discounted back to the present (often referred to as the dividend discount model). The lower the current levels of interest rates (the discount factor used), the higher the price-to-earnings ratio for stocks is likely to be. This theory of valuing stocks supports the idea the market today should, ceteris paribus, be priced at a higher price-to-earnings multiple than other periods when interest rates were higher. A variant of the dividend discount model is the Fed model that theorizes that since stocks and bonds are competing, lower yields on bonds should allow for higher price-to-earnings multiples on stocks until an equilibrium level is reached. Historical data makes a compelling argument supporting the Fed model, showing a high correlation between interest rates and earnings multiples.

Based on our position in the business cycle and the current low level of interest rates, it is difficult to view current stock prices as very expensive, let alone excessive. Any valuation metric that fails to consider the level of interest rates is flawed, in our opinion. There is no clear sign speculative buying into stocks is sufficient enough to cause an economic dislocation on its own to trigger a bubble bursting event. But because stocks are in a bull market and reflect a certain level of optimism, there is always the potential for market declines due to disappointing news or changes in investor confidence.

Economy – The global expansion is the broadest it has been in several years, led by developed markets and reinforced by recovery in emerging economies. Recent robust PMIs out of the US, Euro area and China, provide a solid growth backdrop. Business confidence is generally high and Germany, the biggest economy in Europe, recently reported its highest confidence readings in 25 years.

In the U.S., the economy is moving into a period driven by improving fundamentals, rather than one dependent upon Fed stimulus. Let’s look at some key economic data points:

The U.S. payroll report provides some of the most important information about the economy because jobs are by far the primary source of income for U.S. households. The 220,000 new jobs created in June is a very good sign, as more and more people continue to find work. Claims for unemployment insurance are at historic lows and some employers are beginning to have difficulty finding qualified workers without boosting compensation packages. This could be a warning sign of increased inflationary pressures down the road, but for now annualized wage growth is only 2.5%. We are enjoying good jobs growth with modest wage pressures. We will get the next important jobs report for July on August 4th.

The outlook for U.S. corporate earnings is strong. Consensus expectations from FactSet for year-over-year earnings-per-share growth is 9.1% for the second quarter, 9.5% for the full year 2017 and 11.2% for 2018. Improving corporate earnings are a key ingredient needed to sustain the stock market at current levels and potentially move prices higher. The global economic expansion is also looking good and is increasingly generating positive surprises versus expectations. An improving profits outlook in 2017 and 2018 has extended to nearly every major economy in the world. This globally synchronized expansion is a supportive environment for equity investing. It also points toward a low risk of recession in the U.S. in the year-a-head.

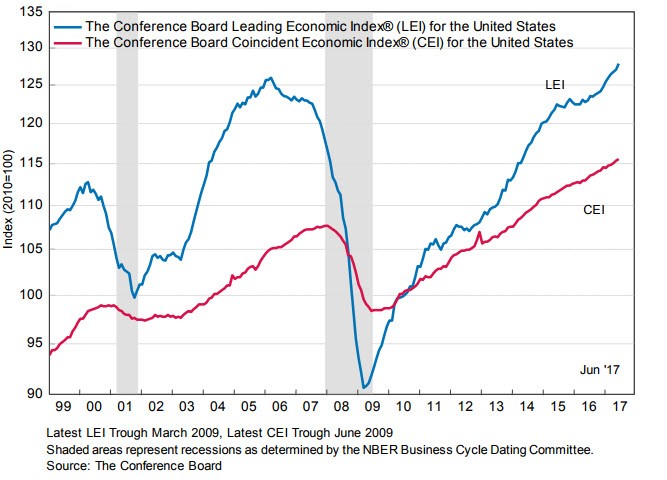

Despite the signs of the advancing maturity of the current business cycle, there are still no significant indications of overheating or that a recession is on the horizon. The Index of Leading Indicators, an index of economic variables reported by the Conference Board, have historically turned down prior to the beginning of a recession. It currently stands at its high for this cycle. The index forecast each of the eight recessions since 1959 and turned down eight months before the start of the recession in December 2007. Currently the risk of recession appears to be low.

The July flash US PMI surveys announced on July 24, 2017 by IHS Markit show an economy gaining growth momentum at the start of the third quarter. The report showed the strongest monthly improvement in business activity since January. Growth was driven by a steeper increase in manufacturing production in July (the output index at 54.3, up from 52.6 in June). Meanwhile, service providers indicated that activity growth was unchanged from June’s five-month peak (business activity index at 54.2 in July). Growth could accelerate in the coming months due to an upturn in new order inflows to the second-highest seen over the past two years.

Consumer confidence is very important to the health of the economy because there is a strong correlation between consumer confidence and consumption. Some of the initial hopes of stronger economic growth because of Donald Trump’s election spurred consumer confidence higher in the early months after the election, peaking in March of this year. The following three months declined, but the Conference Board Consumer Confidence Index rebounded 3.2% (25% yoy) during July to 121.1, within 3% of its March peak. A surprisingly strong 33.3% of respondents indicated that business conditions are “good”, a seventeen-year high. Confidence is very strong, but recent data suggest it could weaken if there is no progress made on healthcare, tax reform or infrastructure spending soon.

Inflation and the Demise of QE – Core inflation has bottomed in both Europe and Japan, leading to an increasing debate about how rapidly the forthcoming global exit from QE will occur. Since raising rates in December of 2015, the Fed has taken the lead to begin to gradually remove accommodation in the U.S. It is expected to announce plans to start the process of shrinking its balance sheet in the next few months. Because inflationary pressures remain low in the U.S. and there are no signs of overheating, the Fed is expected to continue to withdraw its accommodation very slowly until inflation targets are reached.

In Europe, the recent strength of the Euro combined with lower oil prices is working to restrain inflationary pressures. The European Central Bank (ECB) is expected to trim its bond buying program in the months ahead, but may decide to wait even longer before raising their key rates to alleviate any market concerns. Japan’s central bank has scaled back its volume of purchases of government bonds, but is maintaining a zero percent target for 10-year yields. Japan’s poor demographics make it nearly impossible to augment inflation currently, so don’t expect major changes to their easy money stance anytime soon. Even though the flow of QE has moved beyond its peak globally, the path to removing global accommodation will be a very slow transition that will likely be accompanied by low inflation and low interest rates for some time to come.

Outlook for Equities – Equities and other risk assets delight in the very accommodating low interest rate, slow growth environment that exists presently. After a strong start to the year, we would expect U.S. equity returns to moderate for the remainder of the year aided by the ongoing expansion and improving earnings. We are not concerned about rising rates for now, as they are low and are being raised to normalize interest rates rather than to smother runaway inflation. Despite policy uncertainty for Trump’s agenda, the markets are detecting a more business friendly administration where regulations will get no worse at a minimum and possibly much better. This creates the potential for positive surprises, especially if meaningful tax reform or infrastructure programs get passed.

We believe Europe and Japan are well positioned to benefit from a broadening expansion. Earnings are strong at Japanese companies and cash holdings are at record levels. MSCI EAFE and MSCI Emerging Market indices have yet to get back to 2007 highs and still offer attractive relative valuations. They should be able to play catch-up with U.S. stocks through strong earnings growth tied to global trade. Emerging Markets have led the way higher this year due to the backdrop of stronger global growth, which has historically been a positive for developing markets. This strength appears warranted and may continue for as long as the rise in developed market yields remains gradual.

Bonds – As we move into the final months of the year, we expect the Fed to raise interest rates at least one more time this year. We continue to hold a larger concentration of short duration credit positions, both high quality and high yield. Because we don’t see signs of a recession on the horizon soon, corporate bonds offer premium returns over treasuries as they benefit from underlying economic strength that improves their balance sheets and reduces their likelihood of default. We will be watching for a widening of credit spreads in the coming year, as that could be an early warning sign of a looming recession. Since increasing interest rates will likely compromise the returns of interest rate-sensitive debt, like treasuries, we continue to favor inflation-linked treasury debt that will benefit when the rate of inflation does turn up.

Opportunities in the European Union are likely to be scarce in the fixed income space as the ECB begins to consider a change in its negative interest-rate policy. A shift in their stance could push EU bond prices lower. Like U.S. high-yield debt, emerging market corporate debt may offer attractive return prospects, as improved global growth enhances their appeal.

REITs – Fundamentals generally look good, but returns may be challenged by the prospect of rising rates.

Dollar – After depreciating relative to the Euro recently, the US dollar may outperform most major currencies in the second half of the year as interest rate differentials favor the US. Emerging market currencies should benefit from the global growth backdrop and low inflation.

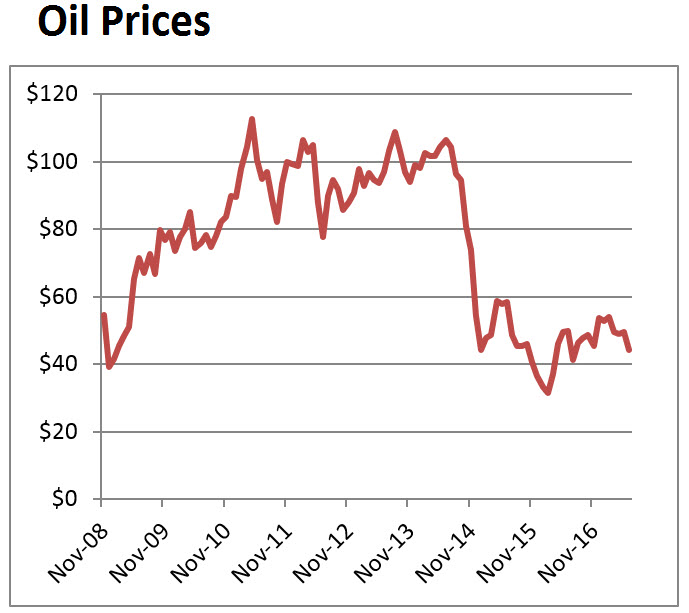

Oil – High oil production levels from increased shale supply and relatively soft demand is keeping oil prices range bound. OPEC cuts to supply have helped provide a floor to oil prices at around $40/barrel, but will likely limit upside to around $60/barrel over the next year as any meaningful increase in oil prices will be met with a resumption of supply.

What risks are there to the outlook? There are a number of risks on our radar screen. Here are three risks we are monitoring closely, among others:

- The unwind of QE by the Fed or the transitioning towards reduced asset purchases by the European Central Bank could lead to a risk-off reaction like the ‘temper tantrum’ of a couple of years ago. This would most likely be the result of a communication mishap or policy missteps of some kind. Even though we consider this a meaningful risk, we think the likelihood of this as low as we expect both central banks to proceed with caution and communicate clearly. They do not want a sharp and significant tightening in financial conditions and will go to great lengths to avoid it.

- There are several potential geopolitical events that could prove disruptive to the markets if they were to lead to a potential conflict. One of the most obvious situations currently is the efforts by North Korea to advance their capability to launch intercontinental ballistic missiles carrying nuclear bombs. There is no clear path to a resolution of this intolerable situation. The conflict in Syria also has the potential for mishap as both Russian and the U.S. militaries are operating near each other and with competing interests.

- U.S. inflation data begins to surprise to the upside, requiring the Fed to hasten the rate they remove accommodation.

In conclusion – At GIM we recently dialed back our equity exposure in our tactical portfolios from overweight to neutral (normal). This reflects the strong performance we have experienced recently in equities. Forecasts of another couple of years of solid earnings gains globally in 2017 and 2018, along with low inflation and interest rates continue to provide a supportive environment for equity investing. This is especially true for emerging market, Japanese and European equities, where valuations are attractive relative to U.S. markets.

Is now the time to de-risk your portfolio? We think it is still too early to become too cautious. The slow growth expansion has enabled us to avoid the excesses that often appear at this point in the business cycle. It also presents the prospect that the length of the business cycle and the bull market can be extended still further. Despite repeated predictions of the end of this bull market over the last several years, it appears to continue to have legs. It is important to understand that the stock market often produces some of its best returns in its final year as the remaining bears finally throw in the towel and turn bullish. We will be watching for signs of excessive speculation and other signposts as they appear. In the meantime, enjoy the ride.

Disclosures: The views expressed are those of Byron Green as of August 1, 2017 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 08-01-2017

Click here to download printable PDF of GIM Market Commentary 08-01-2017