Baseball is America’s favorite pastime. It’s the scrawny schoolboy playing catch with his dad in the front yard. It’s a hotdog and a Coke in the bleachers before the big game. It’s a present day Babe Ruth swinging for the upper deck or players making that critical double play. THAT’s baseball. It’s two or three hours of the best escape from the rest of the world known to man. It is a great game that a select few are athletic enough, skilled enough and fortunate enough to play professionally. The greatest of them learn the importance of preparation and the need for calm patience between crucial decision-making moments. Successful investing requires much of the same qualities. Investors that are willing to prepare, have the patience to wait for those crucial decision-making moments, and realize that yesterday’s home runs don’t win today’s games are the most successful.

That’s what makes investing enjoyable, much like baseball. It’s assessing where we are and preparing for what we will do next if we get a fast pitch, or better yet a fat pitch. The outcome of yesterday’s game is irrelevant to today’s game.

“Who’s on first, What’s on second.”

– Abbott and Costello

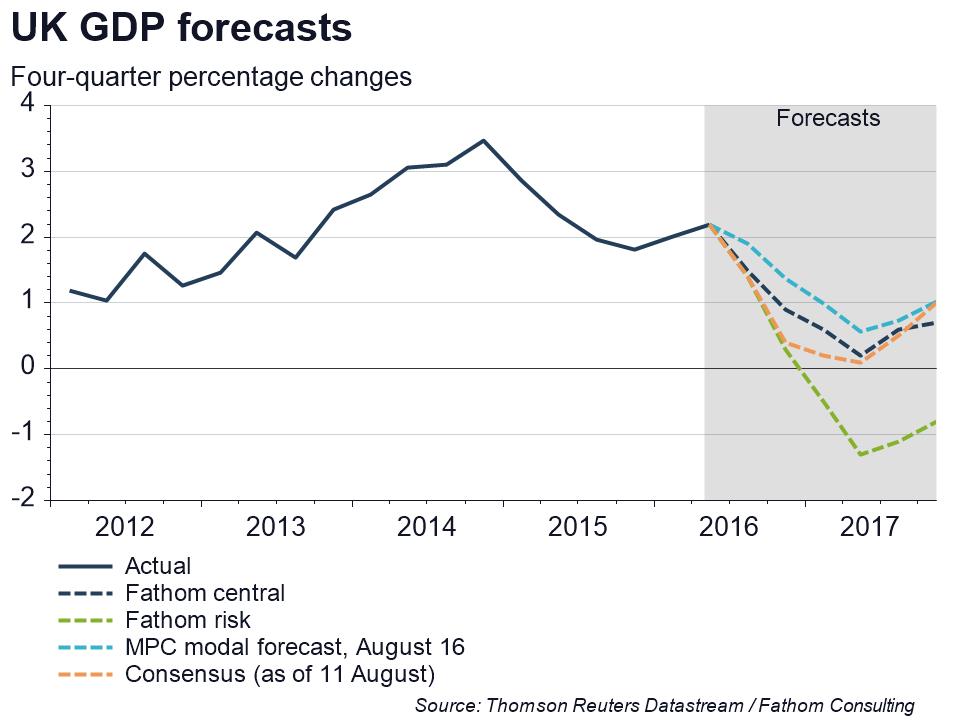

Let’s start by taking a quick assessment of what has happened recently to the markets and the economy and what may lie ahead. It’s been just over two months since the citizens of the UK threw a backdoor slider and surprised the markets with a vote to leave the EU. Contrary to the initial widespread concerns of a severe impact to the UK economy, expectations of a severe downturn have diminished. Below is a chart of forecasted GDP growth produced by leading independent macro research firm, Fathom Consulting.

As the chart shows, Fathom’s central view is the Brexit decision will not trigger recession in the UK. The latest economic forecast from credit ratings agency Moody’s concurs with this view.

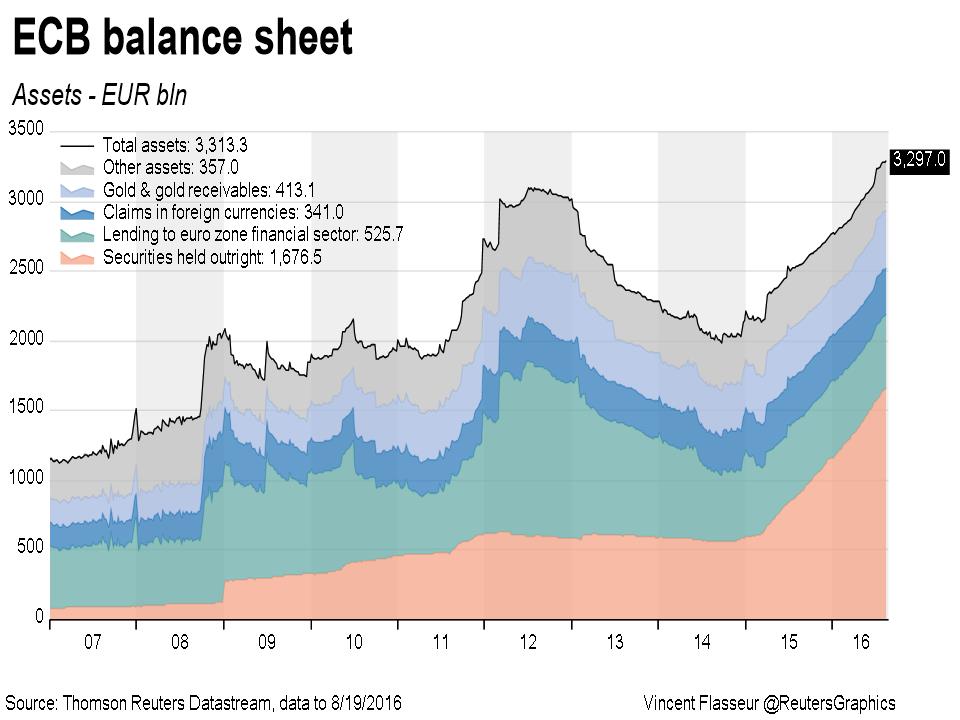

Some of the reasoning for the improved outlook is driven by pronouncements of more monetary stimulus designed to support the global expansion in the aftermath of the vote. Both the Bank of England (BOE) and the European Central Bank (ECB) increased stimulus, while the Fed so far has taken a cautious wait and see approach to tightening pending better economic visibility. These factors have helped strengthen investor confidence and have encouraged a continuation of the positive global economic trends in place before the vote.

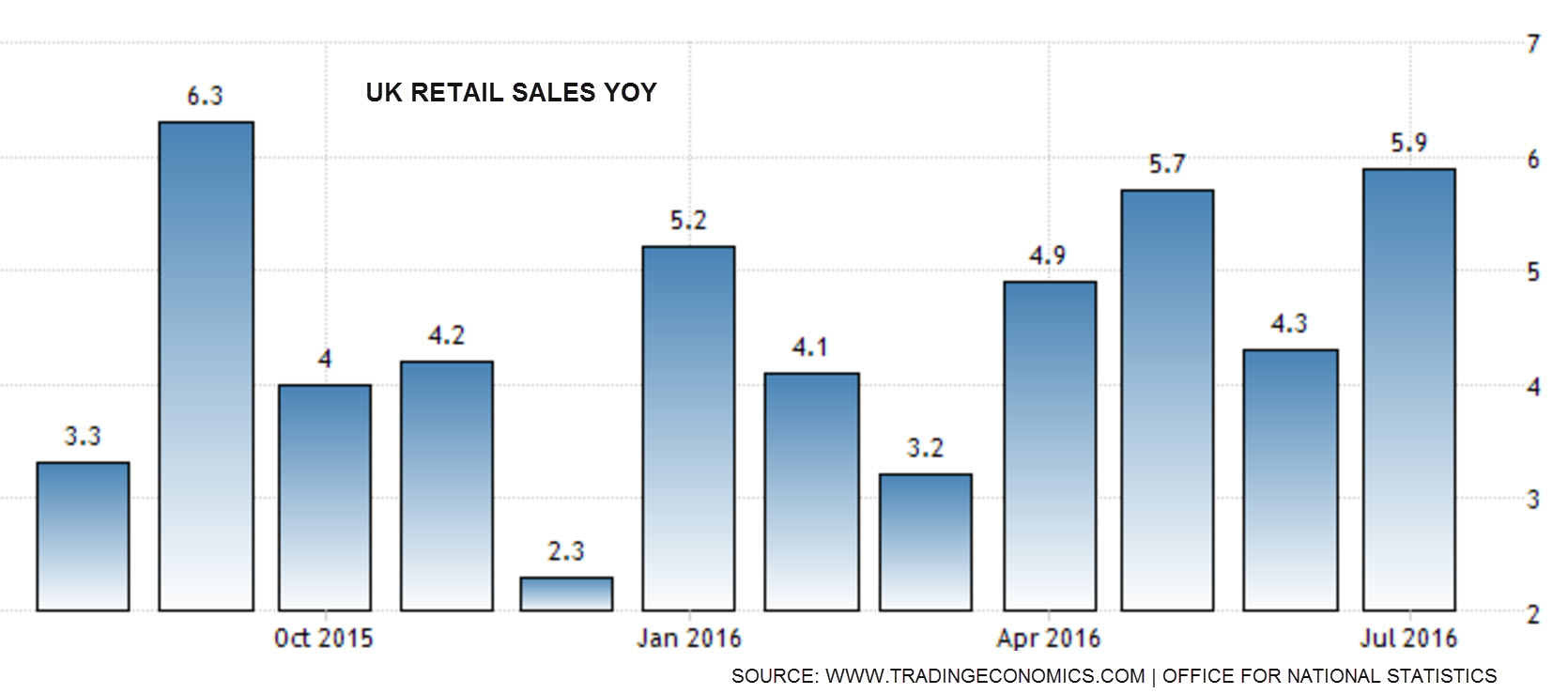

As one of the first official data points on consumer demand in the UK following the Brexit vote, retail sales rose 1.4 percent month-on-month in July and 5.9% year-on-year. There are no clear signs of a significant downturn in consumer spending patterns yet. Euro area economic confidence has shown resiliency so far, too. This is positive in terms of the continuing prospects for global growth.

The UK must now renegotiate trade agreements with the EU and other individual countries that have been in place in many cases for decades. It does not appear this process will lead to severe economic contagion. In fact, the significant sterling depreciation since the vote is presenting UK exporters with an opening to grow market share, while discouraging Brits from buying increasingly expensive foreign goods. This currency adjustment is moderating Brexit’s impact to the UK economy.

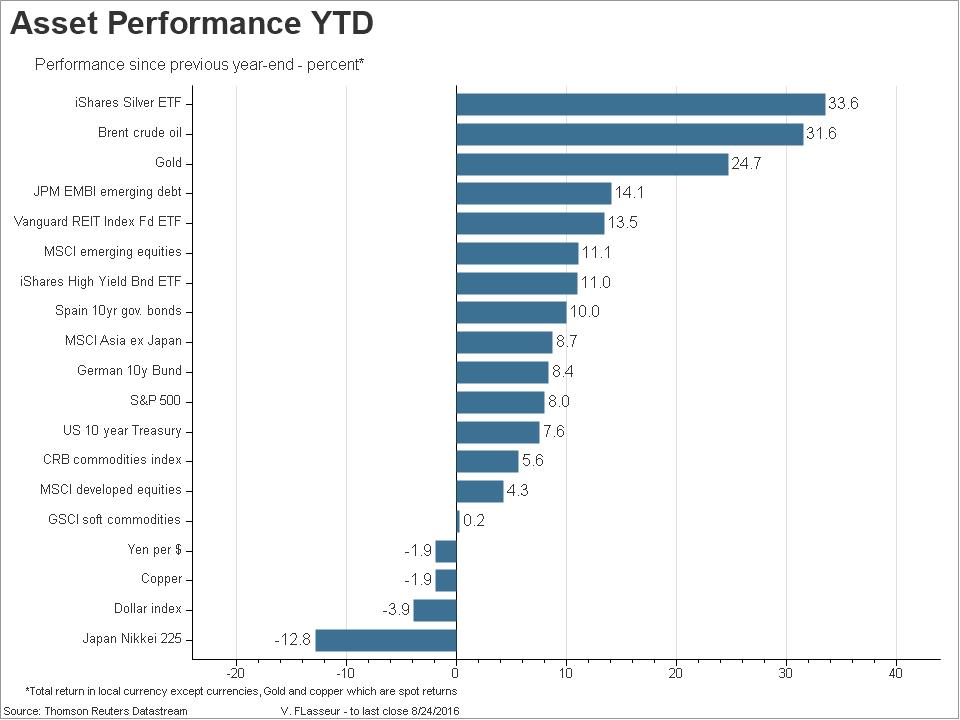

The global markets seem to be embracing these more benign views and have risen nicely over the course of the year. Equities have fully recovered their losses resulting from the initial negative reaction to the Brexit outcome. The S&P 500 is trading near an all-time high and the MSCI Emerging Markets Index is positive on the year for the first time in three years.

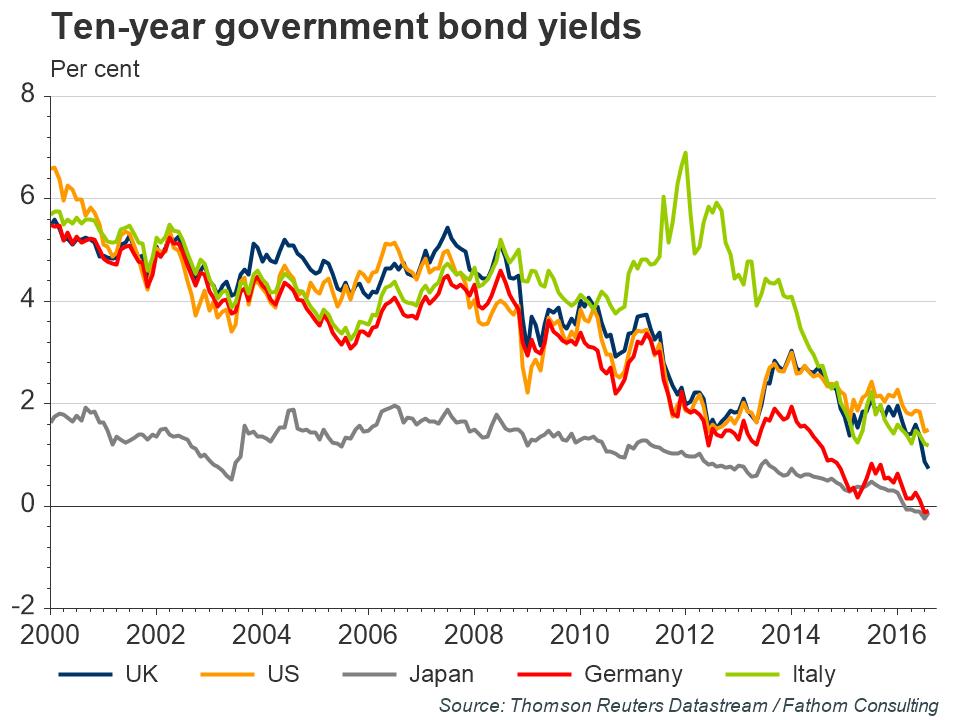

In spite of the surge in risk assets, strong demand for safety and income continues to be supportive of bonds and other income oriented investments. Global sovereign bond yields are near all-time lows, as shown below.

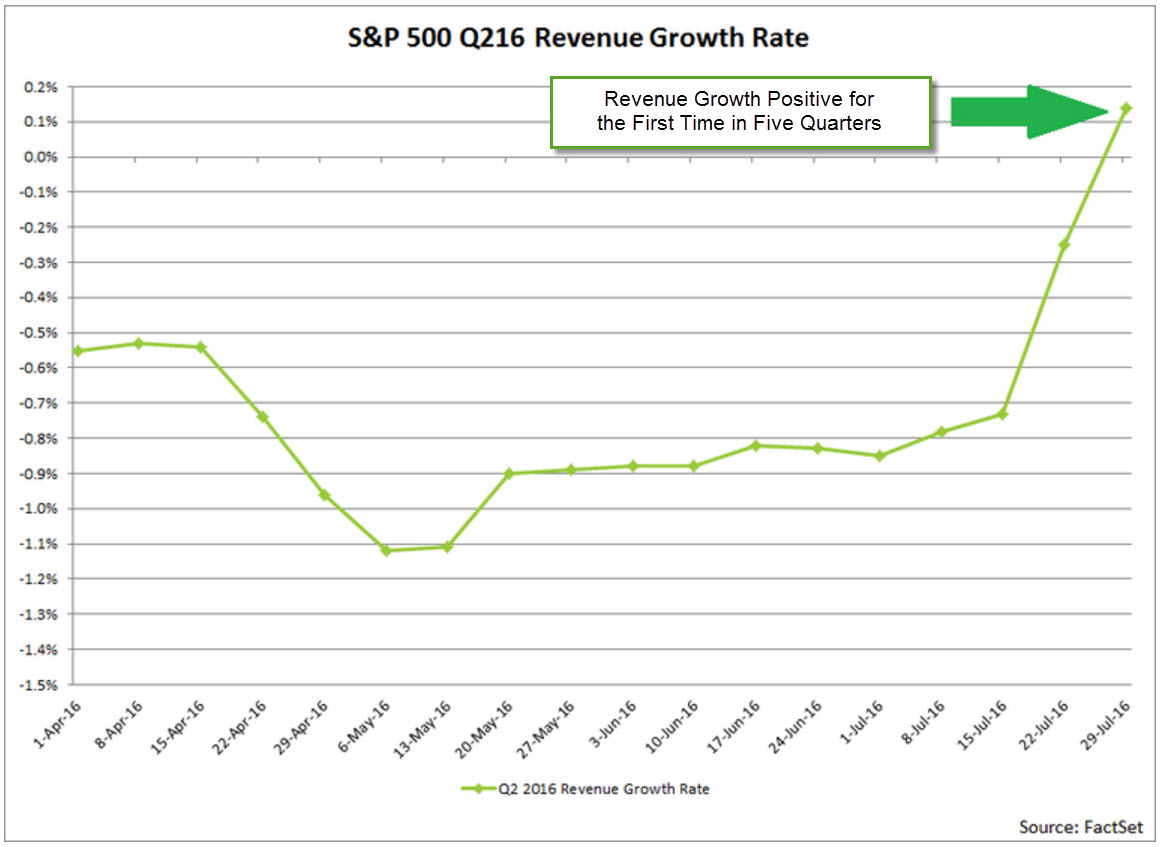

Considering the recent advance, the S&P 500 Index is trading at 17.1 times 12-month forward earnings according to FactSet. There are emerging signs that growth in the U.S. may be picking up along with the PE multiples. The 2nd quarter will show the first positive quarterly increase in revenues for the S&P 500 after five consecutive declines. Earnings appear to be recovering, too. After relatively flat expectations for the full year 2016, FactSet reports that improving trends point toward earnings growth of 13% next year. About the same is anticipated for global earnings measured by the MSCI World Index that are expected to rise only 1% for 2016 but accelerate to 13.1% for 2017 (I/B/E/S consensus).

The U.S. economy appears to be on pretty solid ground. Job growth and retail sales have been healthy while manufacturing inventories have been declining. This appears to be a recipe for an improvement in manufacturing activity and economic growth over the coming months. The housing sector of the economy is also performing well. Sales of new single-family homes in the U.S. surged in July by 12.6%, the highest figure since October 2007.

All of this good economic data means there is an increasing chance the Fed may increase interest rates in the near future. This could happen as early as their September 20-21st meeting, but will more likely take place in December after the elections. The Fed is expected to move rates very gradually and deliberately higher over time in an effort to avoid disrupting U.S. growth.

Domestic equities do not usually peak until well into a Fed tightening cycle and a gradual increase in rates may extend that time even longer. Low bond yields and an improving earnings outlook should be supportive for equity prices as we move forward. After the presidential election, increased fiscal spending may also contribute to growth. While positive sentiment doesn’t appear excessive, generous valuations and a maturing investment cycle do mean that a surprise earnings curve ball could rattle the markets. Increasing hints by global policymakers that fiscal stimulus may be used to complement existing monetary stimulus may provide additional fuel to keep equity markets advancing.

Another encouraging sign is that volatility has remained low recently for both the stock and bond markets. This is positive because low volatility is much more characteristic of bull market advances than bear market declines. It is also reflective of the low yield environment that embodies very accommodating central bank monetary policy across much of the developed markets. The search for yield is compressing credit spreads and enhancing cross asset correlations across the global landscape. Because of this and due to historically low rates, bonds are not as anchored by their credit strength anymore, but overwhelmed by the potential impact from central bank policies. A small increase in rates could easily spark a sell-off in bonds that could quickly turn total returns negative and bring about greater selling.

This leads to the realization that in this environment it is no longer about the number of bonds versus stocks you have in your portfolio, but much more about the kind of stocks and bonds you hold. Paul Singer, the manager of the $28 billion Elliott Management Fund framed it well last year in his letter to investors by suggesting that a safety warning should be attached to the $12 trillion government bond market now trading at negative yields. The warning was, “Hold such instruments at your own risk; danger of serious injury or death to your capital!”

In the eight years or so since the Great Recession, the markets have been driven almost as much by the liquidity wave created by central bankers as by earnings growth. There are growing signs that we may be reaching the limits of what this aggressive, unconventional type of central bank policy can achieve. Negative interest rates in the EU and Japan seem to be producing diminishing results in their efforts to revitalize their economies in spite of their burgeoning balance sheets. European and Japanese investors are increasingly searching for yield in the U.S. and other countries, thereby reducing the desired domestic affect and suppressing yields worldwide. Both the ECB and the Bank of Japan are increasingly having difficulty finding enough bonds to buy to achieve their goals. And now Japan, already a top-five owner of 81 companies in the Nikkei 225 Index, owns more than 60% of the nation’s ETF market.

“Nobody goes there anymore. It’s too crowded.”

– Yogi Berra

In spite of these extraordinary times and unprecedented measures, many investors will continue to invest as if the same assets that have ridden this wave of liquidity higher will continue to do so indefinitely, often referred to as a crowded trade. That is tantamount to a batter expecting another fast ball rather than a change-up, simply because the previous pitches were all fast balls. We all know an assumption like that can lead to a strike-out and maybe even to the loss of the game.

“It helps if the hitter thinks you’re a little crazy.”

– Nolan Ryan

The biggest beneficiaries of the post Great Recession period have been long duration assets. Any asset that has reasonably predictable cash flows that are expected to continue over an extended period of time would fall into this camp. That would include assets such as long-term bonds, dividend paying stocks, real estate and private equity. Short-duration assets have been penalized the most in this environment, as exemplified by the inadequate returns available in very short-term assets, such as cash, money market instruments and commodities.

Since rates are so low, reaching for the higher yield available from long-duration assets has generally been rewarded. If the present value of those future cash flows were to be diminished materially due to an increase in the prevailing interest rate or discount rate, long-duration assets would tend to decline in value unless offset by expectations of improving future cash flows. This relationship between long and short duration assets is of paramount importance to understand in order to manage portfolio risk. At the risk of appearing a little crazy, it may pay to be sure you are properly diversified across a broad spectrum of assets and to shorten portfolio durations as the markets move higher.

Asset Class Views

U.S. Equities: Stronger earnings for the remainder of the year and into next should help support equity prices. If yields remain low, equity valuations have some room to advance higher. Oil prices have stabilized somewhat and are becoming less of a factor affecting the markets. Increasing demand for borrowing by households has the potential to fuel the economic expansion still further, especially considering consumers reduced indebtedness. Post-election, fiscal policy may take up the slack from the increasingly less accommodative monetary policy that is expected.

According to Fidelity Investments, 22% of a portfolio’s equity performance is driven by sector factors compared to only 4% for market capitalization and 13% for style. Historically, when earnings have become challenged the defensive sectors of the market, i.e., consumer staples, health care, and utilities, have most often outperformed the other sectors. That has been true this year, with the exception of healthcare. Since we are expecting an improvement in growth and profitability in the months ahead, our sector strategy is currently emphasizing financials, industrials, materials and energy.

Europe: European and UK equities look attractive from a broad income and valuation perspective, but the long-term impact from the Brexit referendum remains unclear. German Chancellor Angela Merkel recently said she “can allow the time” for the U.K. to decide what it wants from the EU. This is encouraging and establishes a more accommodating tone, especially since the U.K. is Germany’s third-largest export market. Some troubling developments that cause us to be a little cautious toward Europe are the continuing political strains from the largest influx of refugees since WWII, the rash of terrorist attacks and the recently attempted coup in Turkey. Turkey is an important ally and member of N.A.T.O. in the region that serves as an important counterbalance to Iran and Russia. All of these situations bear watching.

Emerging Market Equities: The emerging markets have outperformed developed markets year-to-date. Weak commodity prices and a strong dollar were a significant challenge in recent years, but those two negatives have been removed of late. After several years of underperformance, they are finally playing a little catch-up. We maintain a favorable outlook for the emerging markets broadly based upon relative valuations and improving fundamentals.

We are closely monitoring the pace of tightening the Fed chooses to take, as anything more than a measured approach risks posing a liquidity challenge for these markets. The U.S. elections may also be impactful if a Trump win were to lead to expectations of a protectionist policy toward world trade.

Bonds: We expect upward pressure on bond yields in the U.S. over the remainder of the year due to improving economic growth. The Fed wants to keep financial conditions stable so they will likely tighten policy very methodically, if at all. As such, bond yields are unlikely to increase sharply in this environment. We like investment grade and high yield credit over Treasuries and prefer them to be of short to intermediate duration. Treasury securities are desirable as a risk offset to credit bonds and equities, but fail to be compelling on a yield basis. We continue to like both 5 and 10-year Treasury Inflation-Protected Securities (TIPS). These are currently priced for inflation expectations of 1.5% or below. Since core inflation has been running at 2.3% over the last year through July and have averaged 3.7% over the last 60 years, TIPS look attractively valued.

“There are 3 types of people: those who watch it happen,

make it happen, and wonder what happened.”

-Tommy Lasorda

That is how things look from where we stand here in the outfield in late August. Staying on top of the economy and markets requires constant vigilance as conditions change. It’s a continuous process in a never ending season. We will continue to monitor developments and be in touch with important news. Thank you for reading and if you happen to be a client, thank you for your business!

Disclosures: The views expressed are those of Byron Green as of August 26, 2016 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 08-26-2016

Click here to download printable PDF of GIM Market Commentary 08-26-2016