In the 1939 classic, The Wonderful Wizard of Oz, you may recall Dorothy Gale was a young orphaned farm girl from Kansas who had been swept away from her aunt and uncle’s home by a tornado. In her desperate journey to get back home she ran across numerous obstacles along the way. At one point Dorothy and her dog Toto, together with their new friends Scarecrow and the Tin Woodsman found themselves on a long walk through a dense forest. The dark shadows on the forest floor began to grow longer as the day matured and soon their imaginations began to run wild. They began to chant, “Lions, Tigers and Bears! Oh, my!” Suddenly the dangers lurking in the shadows of the forest were much more real than they had ever been before.

Like in Dorothy’s quest, the shadows on the floor of the investing jungle have grown longer of late as lurking risks have become much more real. Our chant today might go something like: “Greece, China and Puerto Rico! Oh, my!” In investment circles, lurking dangers are called ‘gray swans.’ It’s a term used to symbolize known risks that could be particularly disruptive if they occur. Grey-swan risks often diminish over time, but sometimes they come to fruition. In the last month, we have had three come much nearer to realization than most reasoned observers had anticipated.

A potential Greek default and/or Grexit (exit from the Euro) has added greatly to market volatility of late. It always seemed likely that cool heads would prevail, to the benefit of all parties, before the situation reached the brink. But that was not the case. We continue to watch this situation play out, but a resolution appears finally at hand. Euro-zone leaders agreed on a roadmap to a possible third bailout for near-bankrupt Greece on Monday, contingent upon Athens enacting reforms demanded by the agreement. Those reforms, both an effort to rebuild trust in the Euro zone and a solid step toward economic restructuring, must be enacted into law by the 15th. Much to the relief of Europe and Wall Street, if all goes as planned we should move beyond the current Greek flashpoint in the days ahead. Greek debt issues will linger for years to come, but the bigger question is whether the political damage from the tough negotiations will lead to more fissures in the Euro zone in the future. The situation also exposed the inadequacy of the Euro area’s present fiscal governance.

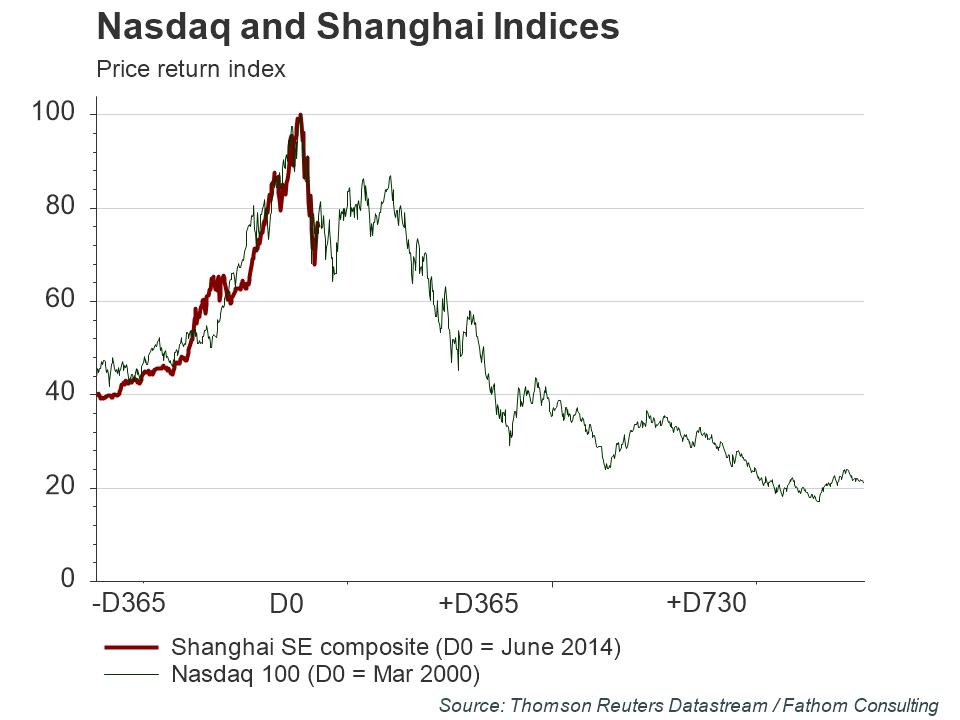

Over the last month we have also witnessed a 35% rout in the China ‘A-share’ market, which are shares in mainland-China-based companies that trade on Chinese stock exchanges such as the Shanghai Exchange and the Shenzhen Exchange. Roughly 85% of these shares are owned by mainland citizens. A correction is not necessarily surprising after a meteoric 150% rise over the previous 11 months, but it was startlingly quick and severe. As you can see in the graph below, the Shanghai index has recently drawn comparisons to the tech-bubble collapse in the U.S. in March of 2000. Moves like that can sometimes foretell a more meaningful economic decline to follow, but not always.

China’s interventions in the market to limit the downside is alarming and of questionable value. It alerts us to watch the situation more closely in the weeks and months ahead, to make sure it does not portend something more ominous or become part of a broader contagion. For now, I don’t see enough evidence that such a situation is imminent.

Last, but not least, we got word from Puerto Rico’s Governor at the end of June that it would default on its $72 billion in debts in the absence of significant outside help. This came just weeks after he scoffed at the possibility of default. The island territory of the U.S. is mired in debt that is magnified by a shrinking tax base. The population of Puerto Rico has shrunk 7% over the last ten years as many citizens have opted to move to the mainland. For now, the focus has turned to legislation recently introduced in the U.S. House which would grant the island the ability to use Chapter 9 of the U.S. bankruptcy code to restructure its debt. This has become something of a political hot potato, so expect twists and turns to appear in the weeks ahead. Much like Greece, the path may be difficult and words like austerity will pop up often, but a resolution should ultimately be reached.

It doesn’t take Scarecrow (who didn’t have a brain) to tell you that each of these three ‘gray swan’ events became more like lions, tigers and bears recently. But I am encouraged that most markets held up as well as they did, considering the length of the shadows cast by this trifecta. Assuming the Greek plan is approved, I expect to continue to see an uncertain implementation process going forward. But for now, I also expect the risks emanating from Greece to be somewhat diminished. This should help European stocks regain some lost traction.

In other news, economic growth coming from Europe has been surprising to the upside for several months, with GDP growing at its fastest pace in almost two years. The growth has been aided by a weaker euro, lower energy prices and improving wage and loan growth. It also appears that many European countries are beginning to reap the rewards of their structural reforms that were implemented in the aftermath of the financial crisis. The ECB is scheduled to continue its aggressive monetary policy to aid in the paying down of debt and to support its economy. All-in-all, the European realm should attract more investment dollars in the months ahead, especially if we successfully navigate past the current Greek crisis that has clouded the outlook.

Back in the U.S., the economy at large is seeing strength in housing, construction and consumer spending. Labor market slack is quickly diminishing, leading to expectations of additional wage increases to come. As this strength builds, it is setting the stage for the beginning of a Fed rate tightening cycle that may begin as early as September. The pace of tightening by the Fed should be very slow, but despite this, stock and bond volatility may increase as the tightening approaches. As long as the underlying economy remains strong, stock market turbulence should be temporary. I expect higher yields on bonds to strengthen the dollar, especially as long as the ECB and BOJ continue their aggressive monetary policies.

Based upon the place we are in the business cycle and the current valuation of U.S. equities, it suggests to me that performance from U.S. equities going forward will be driven primarily by earnings. This has tempered my expectations for domestic stock performance this year, since during the first half of the year corporate earnings growth has been non-existent. FactSet Research estimates that year-over-year earnings on the S&P 500 index will decline 4.4% for the 2nd quarter, the largest decline since the 3rd quarter of 2009. This is largely due to the impact from the decline in oil prices and a strong rise in the dollar. If the energy sector was excluded from this data, FactSet estimates that the growth rate for the S&P 500 would be closer to 2%. From here the earnings outlook does start to improve as FactSet expects bottom-up earnings to rise 2.2% for all of 2015 and to accelerate to 11.7% growth for 2016.

The QE programs in Europe and Japan are expected to continue pouring a US-dollar-equivalent of $130 billion into the global economy monthly. This will serve to dampen any meaningful rise in global rates. The extra liquidity should also help support U.S. stock prices until the market is more confident of the forecasted acceleration in earnings. Positive surprises in the upcoming earnings season (starting now) could assist in this regard.

In Europe and Japan, the printing presses should ensure further currency weakness and support further economic recovery. Their market valuations, while not cheap, are appealing because their profit cycles still have significant room to run.

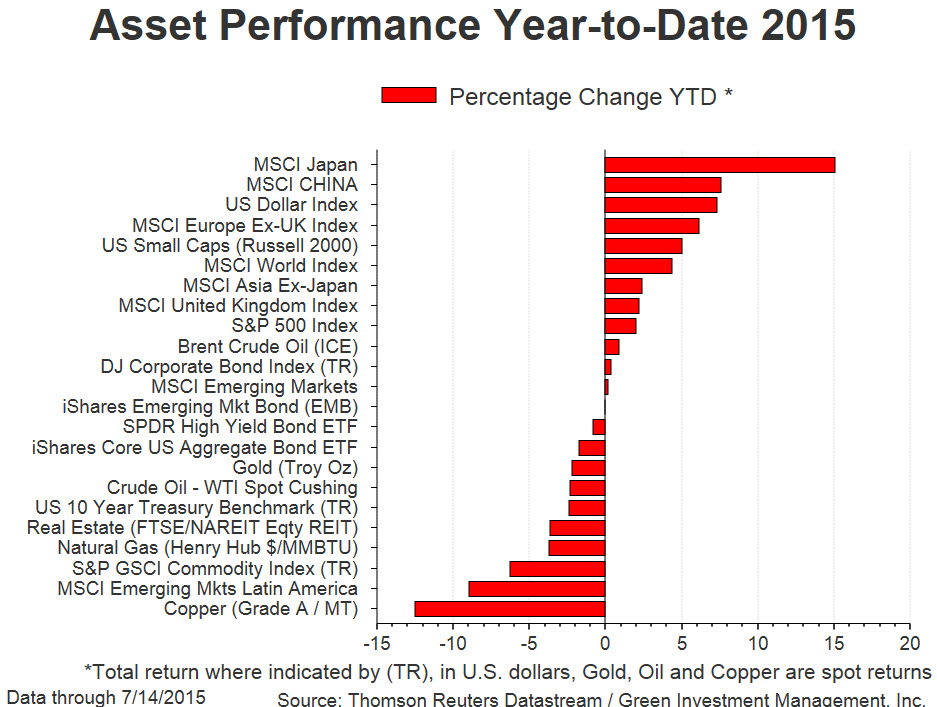

Emerging Markets: In the last couple of months, broad emerging markets indices have seen their year-to-date capital gains completely erode. Concerns over slowing growth in China along with continued strong shale oil production from the U.S. has led to further commodity weakness. This has negatively impacted commodity exporting nations and put further economic pressure on countries like Brazil and Russia that are already mired in significant recessions. In a more aggressive effort to bolster its slowing economy, China has responded with pro-growth policies such as rate cuts, local debt reform and renewed focus on infrastructure spending called their “One Belt One Road Strategy.” This program is clearly designed to buy time until domestic consumption can increase to balance out the excess capacity that exists in its export-related industries. This controlled experiment may serve to maintain growth at a reasonable pace until demand from consumers expands and demand from Europe and Japan increases. At the same time, China’s aggressive efforts to reaccelerate their economy raises warning flags that the apparent slowdown is very real and should be taken seriously. I will watch all of these situations carefully. In the long-term I continue to expect that emerging countries will offer some of the best growth opportunities available.

Fixed Income: Uncertainty over the crisis in Greece and concerns about weaker growth in China has kept U.S. rates in check recently. But the trend may be reversing as optimism about a Greek deal has grown and Federal Reserve Chair Janet Yellen indicated that the Fed is on track to raise rates later this year. I expect that low rates emanating from Europe and Japan should help keep global rates from rising so fast as to be damaging to the recovery. The Federal Reserve is also mindful of the impact it could have on the dollar if it raised rates too quickly. With a slow, controlled normalization of rates, this should continue to be a favorable environment for the credit sectors of the market and increasingly less favorable to long-dated treasuries. I continue to like the high-yield segment of the market but have pared back our exposure as oil prices have continued to weaken of late, signaling potential difficulties for energy-related debt.

I expect the advance in global bond yields to persist as the expansion continues to gain traction. A gradual re-appraisal of the outlook for inflation should drive nominal yields higher across the major markets. For this reason, I continue to recommend exposure to Treasury Inflation-Protected Securities (TIPS) in many of our strategies, along with an underweight to longer-maturity Treasuries. I recommend a modestly underweight position to bonds overall in our balanced allocations, while also recognizing that bonds play a critical diversification role versus stocks in a multi-asset portfolio.

Conclusion:

“Someplace where there isn’t any trouble…do you suppose there is such a place, Toto?

-Dorothy

The recent market anxiety caused by the trifecta of Lions, Tigers and Bears reminds me that global markets are much more interconnected than they have ever been before. If Dorothy were here I think she would say, “I’ve a feeling we’re not in Kansas anymore.” Risk management is an increasingly critical element of portfolio design and the importance of maintaining a well-diversified portfolio is extremely important. Every part of your portfolio should play its role and work to complement the other parts. It would be nice if there wasn’t anything to worry about at all, but then, like Dorothy, we would probably find ourselves stuck inside a dream.

In the meantime, I will keep my head out of the clouds and abreast of market, economic and other relevant developments and report back to you through this newsletter. All of us at Green Investment Management thank you for reading, and thank you especially for your business!

Disclosures: The views expressed are those of Byron Green as of July 14, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 07-14-2015

Click here to download printable PDF of GIM Market Commentary 07-14-2015