Summer is almost over. I kind of hate to see it go, but the escalating heat makes you glad for the coming respite of fall – especially here in Texas. You could say the same thing about the markets; as the summer wears on volatility usually rises. This happens because trading volume diminishes and the markets begin to trade a little thin. People are on vacations or simply taking a break from the markets, preparing for a final push in the fall and winter months of the year. During this time, the slightest change in investor sentiment can have a surprisingly large effect on market direction, at least temporarily.

The June-to-July 35% rout in the China ‘A-share’ market has done its part to make this another volatile time of year. It has hit U.S. equities, which after tripling in price over the last six years are now barely up for 2015. And this year’s gains are attributable to just two sectors, health-care and retail. That is the tightest clustering for an advancing year since at least 2000, according to Bloomberg. In addition to uncertainty about China, it reflects erosion in U.S. corporate earnings as a result of a commodity sell-off, and the impact of a strong rise in the dollar. The good news is that prices should soon stabilize and the dollar’s ascent should slow. The biggest impact to earnings is likely behind us. And according to S&P Capital IQ, S&P 500 earnings should rebound 11% in 2016 after mostly flat performance this year.

I guess you could say the markets have also turned up the heat on the Chinese authorities! In recent days the Peoples Bank of China decided to allow the yuan to weaken about 3% versus the dollar in an effort to boost exports. This uncharacteristically large and abrupt currency adjustment took markets by surprise, sparking a global selloff in equities and emerging market currencies. Shortly after the devaluation, Chinese authorities were a little taken back by what they thought was an overreaction by the markets, and proceeded to assure everyone that it was simply a market-based fix for the yuan. They claimed the currency would be kept stable going forward.

In last month’s newsletter I wrote that developments in China should be observed carefully in the coming months because the aforementioned sell-off could portend signs of trouble in the economy. Subsequent data has only increased this concern. So far, Chinese authorities have proven themselves to be generally adept and proactive at managing their economy. We will continue to monitor their situation carefully. As the second largest economy in the world, it is important to global growth and financial markets that China avoids a hard landing.

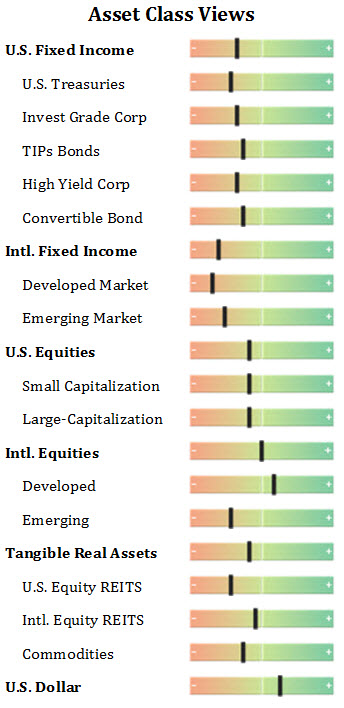

Fixed Income: An abrupt reversal in the second-quarter’s trend of rising interest rates happened in July. The weakness in China combined with last-minute maneuvering in the Euro-zone/Greece bailout discussions to rattle markets and encourage a flight-to-quality. While China remains a question mark, it does appear that Greece is now less of a concern (at least temporarily).

As I expected, the shake-out in the oil patch caused credit spreads to widen in recent months. I think this widening may have further to go, maybe into mid-autumn. And it could offer up some compelling entry points for increased exposure to corporate high yield and convertible bonds in the coming months.

My expectations for Treasury Inflation-Protected Securities (TIPS) to outperform their nominal Treasury counterparts has been delayed by a recent swoon in commodity prices (see below). However, a large part of these effects will be transitory, and a strong U.S. labor market will eventually lead to a firming in inflation expectations. When it does, TIPS will be an important asset to hold.

Commodities: A new wave of demand-driven weakness spread across much of the commodity markets as a number of developed and emerging economies appear to be struggling to maintain momentum. Oil prices have declined over 50% in the last year, while copper has lost almost 30%.

In Focus: The Law of Unintended Consequences

Since the Great Recession (2008-9) we have experienced a remarkable turn of events. The central bankers of Europe, Japan and the U.S. have all taken extraordinary steps to diminish the negative economic outcomes emanating from that devastating event. The end result for the U.S. has been a seven-year bull market that has carried stocks significantly higher, accompanied by weak but positive economic growth. It’s been a journey with many twists and turns, but it appears we are now approaching a transition point where the economy no longer needs the highly accommodative monetary stimulus the Fed has been dispensing for seven years. That doesn’t mean interest rates will rise significantly right away. They just need to return to a more normal environment and range, if for no other reason than to provide ammunition for the future. The longer the Fed keeps short-term rates near zero, the greater the chances of unintended consequences. Let’s consider that further.

The phrase “Law of Unintended Consequences,” originated in the mid-1800s, in the writings of the French economist, author and statesman, Frédéric Bastiat. He was attempting to dissuade the French people from an increasingly socialist leaning. He wrote about the difference between the “seen,” the obvious outcomes of a policy or political decision, and the “unseen,” outcomes that were unintended, less obvious but just as real.

“There is only one difference between a bad economist and a good one,” he wrote. “The bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.”

I can’t help but observe how many negative economic outcomes there have been in recent times that fit the definition of unintended consequences. When some small present good is sought without regard to longer-term ramifications, it often ends badly. For example, China’s attempt to bolster foreign trade by pegging its currency to the U.S. dollar helped for awhile, providing a relatively stable currency with which to trade. They established the peg at a low value to make Chinese products more competitive. But over the last year that has all changed as the dollar has gone on a 20% surge relative to its other trading partner’s currencies – leaving the yuan no longer such a great value. You might say the Law of Unintended Consequences kicked in. Left to free market forces, i.e., unpegged, the yuan’s value would have been based on its own economy’s merits. Instead, a weakening Chinese economy has been burdened by an artificially strong currency. As most of China’s competitor’s currencies have weakened against the dollar, China’s goods have become less competitive on world markets.

Last week’s decision to lower the value of the yuan relative to its previous dollar-peg does reveal several important things about China’s current situation. The central government is becoming increasingly concerned about economic growth. China’s prime interest rate has been lowered four times since last November in an effort to spur domestic demand. But the economy is still showing signs of weakness. The central bank needed the flexibility to be more accommodative, but would have had to spend significant amounts of its foreign currency reserves to support the old peg. Since the U.S. Federal Reserve is widely expected to begin the process of normalizing interest rates in the months ahead, the costs to maintain the previous peg against a stronger dollar would only grow.

The central government’s goal for China to be transformed into a consumer-driven economy rather than an export-driven one is clearly progressing more slowly than expected. Recent reports show that China’s export growth is slowing (-8.3% over the last 12 months) and domestic demand is not taking up the slack. Since China’s official data is often considered questionable, the chart below reflects a composite momentum measure of electricity consumption, rail freight volumes and credit growth as a potentially more reliable proxy for economic growth.

From the chart, it appears that growth in China may be slowing even faster than reflected in the official data. Hopefully, lowering the peg to the dollar will help China enhance the competitiveness of its exports while providing more flexibility to lower rates and spur domestic demand. We will see. But it also amplifies the global growth risks we are currently facing. Investors’ confidence in China’s ability to avert a financial crisis appears to be waning. This has been reflected in the markets by a flight to higher quality, lower risk investments –in other words, “risk-off” trading.

Fortunately, global risks ebb and flow. And one risk that has diminished since our last newsletter is that of Greece. They finally reached an accord last week with creditors on the terms of a third bailout. It was subsequently approved by the parliament and euro zone ministers. Assuming final approval this week by some of the national parliaments, including Germany’s, an initial tranche of 26 billion euros will be approved by the European Stability Mechanism (ESM) this Wednesday. This will be used for Greek debt payment obligations and to recapitalize their banks. There is still much work to be done in Greece to make their debt sustainable, but for now their financial system is looking much more stable for the near future.

Conclusion: There are always risks out there. The global economy has proven resilient to a number of shocks in recent years. Greece has been a repeat offender, but even it has failed to be more than a temporary distraction to the markets. The strength of the underlying economy is the biggest factor in determining the resilience of the markets. In the U.S., signs seem to be pointing toward a modest acceleration in economic growth. Europe, while uneven, also seems to be improving. Japan’s economy, on the other hand, shrank at an annualized rate of 1.6% in the April-to-June period. Both exports and consumer spending slumped, heightening pressure on policymakers to offer more monetary and fiscal stimulus. All-in-all, the global economy presents a mixed picture at the moment.

Collectively, we remain optimistic about the global outlook. At this point in the economic cycle we shouldn’t expect domestic equity gains to match those we have seen in recent years. But I think they may put in a reasonably good performance. Let’s just hope the coming fall will not only bring a welcome cool down, but a respite from the summer market volatility! All of us at Green Investment Management thank you for reading, and thank you especially for your business.

Disclosures: The views expressed are those of Byron Green as of August 18, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 08-18-2015

Click here to download printable PDF of GIM Market Commentary 08-18-2015