In the spirit of the season, we are bringing you this month’s commentary in the form of a Christmas story. All opinions expressed are those of Byron D. Green, Jr. and Green Investment Management. We hope you enjoy it and wish you and yours a happy and healthy holiday season, and a prosperous 2016!

Scrooge—or whoever served as the inspiration for him—is dead, of course. There is no doubt whatever about that. After all, Charles Dickens wrote the novel A Christmas Carol way back in 1843. But like all great characters of fiction, Scrooge has achieved a kind of immortality, making it easy to imagine the old miser reacting to the most important economic news of today—such as the Federal Reserve’s announcement of a ¼% interest rate hike at the December meeting.

“Bah Humbug,” he might have intoned.

Scrooge was a saver, yes, but he was also a pessimist of the first degree. And his pessimism won out. Convinced in his mind the economy needed every bit of quantitative easing it could get, he went to bed angry about what he called the Fed’s ‘rash action.’ He dreamt of Janet Yellen reduced to abject poverty, begging him for a job as Bob Cratchit’s assistant. The image made him chuckle as he slept. But then Scrooge awoke to a great noise in his chamber. Standing before him, attired in a business suit with heavy chains about his neck, stood past Federal Reserve Chairman Ben Bernanke.

“I am the Ghost of Economic Past!” Bernanke said.

He grabbed Scrooge by his nightshirt, and suddenly the two were on the floor of the New York Stock Exchange. A nearby calendar said it was October 2008. Traders clenched their fists and yelled. Some hung their heads in misery.

“Remember this?“ Bernanke asked.

“The Great Recession,” Scrooge said. “How could any investor forget? I was so tense I could barely eat my gruel—lost thirteen pounds that month. Now I feel that tension anew, thanks to your unholy conjuring. Please, spirit, show me no more!”

But the vision continued to fill Scrooge’s eyes, as Bernanke’s punditry did his ears. “Zero and near zero interest rates were designed to discourage hoarding of cash by risk-averse investors in the aftermath of the very stock market crash you see before you, and to drive credit-based spending to get the economy back on track and people back to work.”

“It was just what we needed,” Scrooge said. “And it still is. So you agree that I am right, Spirit? Yellen’s tightening was a mistake!”

“That is not for me to say. But ere this night is o’er, you will be visited by two more spirits. Heed them well. They will show you the way.”

With that Bernanke waved his arms and vanished along with the trading floor. Scrooge found himself standing in his bedroom, so drowsy it was all he could do to make it to the bed before collapsing into a deep sleep.

Sometime later, he awoke again, to a loud banging upon his chamber door. Scrooge opened his eyes in time to see Janet Yellen walking through the door, wearing a crown and a sash pronouncing her ‘Ghost of Economic Present.’

“Stubborn miser!” she cried. “The rate hike is done. Why do you persist in your disapproval?”

“New spirit, I only wish for rates to be kept as they were! Have you forgotten what happened in the ‘taper tantrum’ of 2013, when the Fed merely hinted at raising rates? Bond prices were sent reeling! U.S. Treasury and global yields surged!”

“This is not 2013! You cannot expect markets to carry around quantitative easing for an eternity, the way your greedy partner Jacob Marley wanders the earth.”

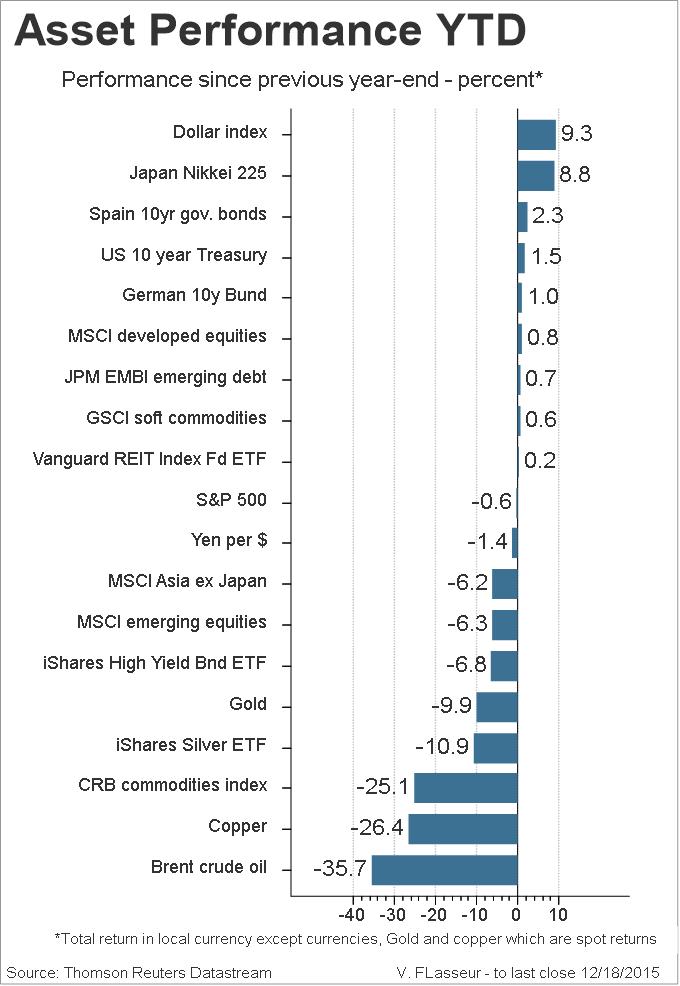

Scrooge wrung his hands. “But even in the present, Spirit, trouble nips at our heels. Look at the meager returns to many asset classes. Look at the collapse in oil prices, how S&P 500 earnings remain almost flat for the year. And with the U.S. dollar surging, manufacturing and exports weaken even as we speak!”

“Enough, Scrooge,” Yellen bellowed. “Additional easing is not what is needed. Take a look at these people,” she said with a sweep of her arm. Visions of older retirees and children saving their quarters filled Scrooge’s vision. “It’s time to give these people a little reward, rather than just risk barons and leveraged-carry traders. By raising rates, we removed a major source of uncertainty that blocked the markets’ progress. The rate hike has already brought a significant bond market rally, and that may imply a much lower trajectory for rates going forward than some had feared. As often is the case, markets have anguished more over the uncertainty of an increase than they have over the increase itself.”

“I will hear no more, Spirit. Leave me!” Saying that, Scrooge lunged at the Ghost of Economic Present, but suddenly found himself alone in his bed clutching his sheets. Once again he was exhausted and slept, until awakened again later by the deafening sound of his own snoring. The hair on the back of Scrooge’s neck stood as he saw a laughing, crimson-cheeked Warren Buffet, the oracle of Omaha himself, float into the chamber right through a wall. He held a silver goblet of wine and saluted Scrooge with it.

“I am the Ghost of Economic Future,” he said. “I see all and know all.”

“Fearful spirit! You of all people must realize the danger we are in from the interest rate hike.”

“Danger? Pshaw! Look at this, Scrooge!” Buffett said as he produced a crystal ball and held it up. In it Scrooge could make out a scene similar to the first one he’d seen, a trading floor full of anguished investors. But it was different in one way. A calendar in the scene said it was October 2018.

“I knew it,” Scrooge said. “The rate hike will destroy us. You have proven me right, Great Oracle!”

“I have not! This ball shows not only what is to come, but what could have been. This vision is what may have come to pass if rates had been left near zero. Imprudent risk taking, dangerous debt levels and asset bubbles could have followed, resulting ultimately in a new crash. And the Federal Reserve would have been hamstrung reacting to it, since rates could hardly be lowered from zero.”

Buffett waved his hand over the ball and the scene changed. In place of the scene of woe, Scrooge now saw a well-functioning economy of producers and consumers, investors and savers happily going about their daily business.

“There are always risks to an economy, from many sectors,” Buffett said. “But small, gradual rate increases need not wreck things. Consider a few points.”

An astonished Scrooge looked on as a set of bullet points materialized and floated in thin air above his bed:

- Current Federal Reserve monetary policy is not tightening so much as it is dialing down the looseness. The monetary environment remains equity-friendly, especially at the global level. And easy monetary conditions in both Europe and Japan should serve to moderate the impact of the U.S. rate increase.

- A merger-and-acquisition boom and corporate share buybacks are providing demand for equities. This trend may accelerate into 2016 as companies try to lock in attractive funding costs while they are still available.

- Improving labor markets, low gasoline prices and a rise in wages and should aid consumer spending in the U.S. and offset weakness in industrial demand.

- With some stabilization in oil prices in months ahead, earnings should improve for energy-related companies as we move deeper into 2016. Energy companies across the globe are cutting both expenses and drilling budgets. This will eventually help bring supply and demand back into balance.

- Credit woes within the energy sector are not likely to devolve into a broader credit crisis. Unlike during the mortgage crisis, the banking system is very well capitalized and much of the financing of the energy business has been achieved through capital markets. That said, we may see more fallout from weak energy and commodity prices in the immediate months ahead, and this may keep markets on edge.

- Inflation pressures should remain modest for a while as falling commodity prices continue to impact costs. However, the services side of the economy—which makes up more than 80% of Core CPI calculations—has risen 3% year-over-year. Expect inflationary pressures in services to accelerate as the unemployment rate drops further in the year ahead. This could lead to an upside surprise in inflation later in the year as deflationary pressure on the goods side begins to wane.

- The Federal Reserve may raise interest rates at least a couple of times in 2016, depending on the strength of the economy and absent events like a further slowdown in China. But this does not mean an automatic downturn in the business cycle. Consider this from an analysis of the last four business cycles in the Federal Reserve Bank of St. Louis Review: “Liftoff (the beginning of interest rate hikes) is not the end of the phase of improvement in the economy…Judging from past experience in a period when monetary policy is generally considered to have been successful, the economy continues to improve long after liftoff occurs.”

After Scrooge read these points, the Ghost of Christmas Future waved his arms and they vanished. He held up the crystal ball again. In it Scrooge saw a new image materialize—a freshly dug grave with a headstone.

“Oh no, Spirit, please! I am not ready to die!”

“Look closer, Scrooge. It’s only the grave of 0% interest rates.”

Scrooge’s relief was so profound that he fainted away, later awaking in his bed to the sunlight of a beautiful morning. Having now lost his fear of the interest rate hike, Scrooge felt a new man. He rushed to the office, gave his assistant Bob Cratchit the day off out of sheer good will, and asked Green Investment Management to send him their latest thoughts on asset classes via the steam-powered fax machine. Here is what he received.

- U.S. Equities: We believe it is too early in the business cycle for a bear market. But any gains in 2016 may be muted, with slightly more volatility than in recent years. According to FactSet, the 12-month forward PE is 16.1. With PE levels above both 5 and 10 year average levels, earnings will have to increase above the current projected rise of 7.7% in 2016 (as projected by FactSet) to expect much upside in the S&P 500 in the year ahead.

- European Stocks: The European Central Bank continues its easy money policy. Reinforced by oil and commodity price weakness, 2016 could be a good year for Europe.

- Japanese Stocks: The Japanese economy continues to struggle for stronger growth against structural headwinds, including an aging population and high debt. There are some positive signs, and highly accommodative QE policy continues, but fiscal policy will remain constrained by public debt. That said, prospects for the year ahead are reasonably encouraging, and we will be watching closely for signs of an enduring pickup.

- Emerging Markets: After years of underperformance, valuations are not particularly high. That should help prevent any 1998-style currency crises as the U.S. enters its tightening cycle. But the earnings outlook remains generally weak. China particularly may struggle in 2016 as it tries to shift from being export-driven to consumer and services-driven. This will continue to weigh on both commodity and trade data, keeping the world’s most populous nation on a gradual slowdown to GDP growth rates below 7%. By comparison, India has seen its growth rate accelerate to 7.4% for the third quarter of 2015.

- Fixed Income: Yields should pick up as rates normalize. With inflation likely to rise from current depressed levels, we favor TIPS over nominal Treasuries in 2016. Wider credit spreads offer reward for credit risk, but diversification and good judgment, as always, are critical. Negative outflows are raising liquidity concerns in high yields. Much of the high-yield space offers attractive valuations, but technical factors may weigh on the market in the months ahead and cause traders to price in additional risk. Sentiment sometimes proves to be more potent than fundamentals in the short term. While these factors could prove challenging, we believe this may also lead to some exceptional opportunities. We are underweight high yield at the moment. Given the ongoing strength of the U.S. dollar, we are avoiding non‐dollar sovereign bonds.

With this advice and his newfound confidence in the markets, Scrooge vowed to ready his portfolio for gains around the world in 2016, from strengthening advanced economies to select emerging nations, and especially the credit markets. Ever afterward it was said of him that he knew not only how to save, but to invest as well. May that be truly said of us, and all of us! And so, as Tiny Tim observed, God Bless Us, Every One!

Disclosures: The views expressed are those of Byron Green as of December 21, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 12-21-2015

Click here to download printable PDF of GIM Market Commentary 12-21-2015