We are the Dead. Short days ago, we lived, felt dawn, saw sunset glow, loved and were loved, and now we lie in Flanders fields. -John McCrae.

In Flanders Fields is a poem written by Lt. Col. John McCrae. He was inspired to write it after presiding over the funeral of a friend and fellow soldier in World War I. The attacks last weekend in Paris made me think of the poem—not because the dead were soldiers. On the contrary, they were civilians attempting to enjoy simple pleasures like a concert, a soccer game or a meal out. As we learn more about the victims, we see they were mostly young and well educated—France’s best hopes for the future. At the same time, they were ordinary people with dreams about where their lives would lead them. Now their hearts are still, but life goes on for the mothers and fathers, sisters and brothers and friends who will feel a void for the rest of their lives. A new unease has settled over the western world as fears that our simple pleasures, as well, may become increasingly burdened by concerns of attack from an almost invisible enemy. In Flanders Fields charges the living to press on against the foe. France’s air force and police have already done that. And I suspect we will see other countries, including our own, take the fight against terror more seriously. I pray for success and for those who mourn their dead.

I raise these points because they are important to us not just personally, but as investors as well. What does the Paris assault mean for the markets that hold our savings, which represent our own dreams for the future? It is probably a little too early to tell. But risk assets such as stocks certainly do not thrive on uncertainty, and that abounds currently with respect to Syria and the Middle East. On the other hand, negative market reactions to events like terrorism tend to be short-lived. As time passes, factors such as economic growth, earnings, relative valuations, inflation and interest rates take over as the long-term determinants of performance. So far the markets have shrugged off any large impact from the attacks. But the developments will bear close watching in the months ahead, especially as a number of countries begin to step-up their fight against ISIS.

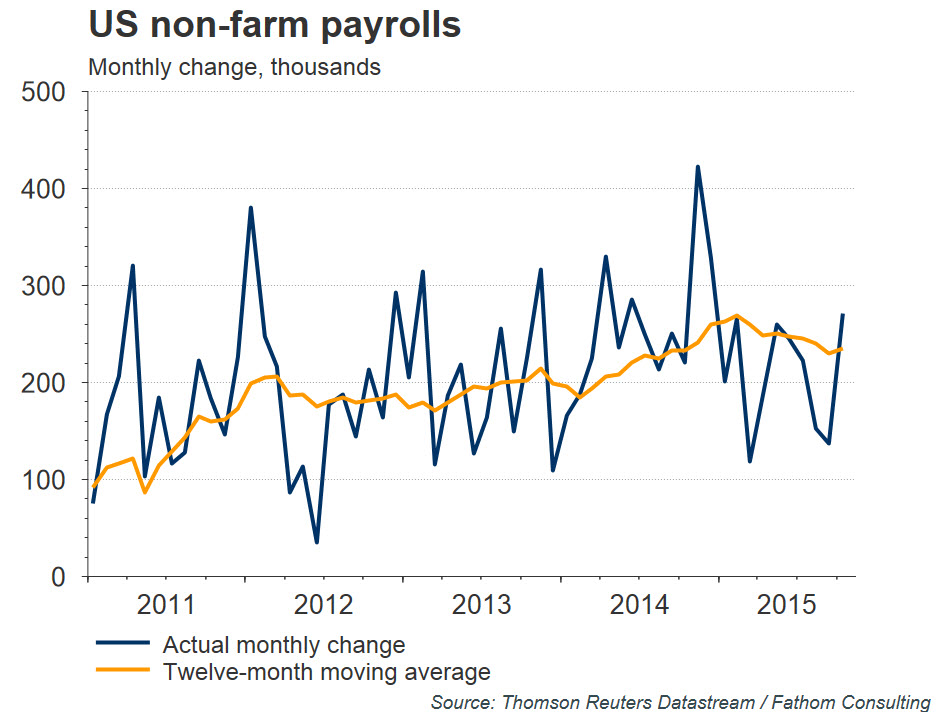

In the meantime we still need to watch the more traditional drivers of growth and market performance. U.S. jobs data continues to come in strong. The October payrolls report reflected a 272,000 increase in employed workers for the month. Over a million unemployed persons have found work in the last 12 months, dropping the unemployment rate to 5%. Further declines to levels often associated with full employment should begin to put upward pressure on wages in the year ahead and help drive inflation toward the Fed’s 2% target. The headline consumer price index (CPI) increase of 0.2% reinforces this probability. It marks a stabilization from recent weakness, suggesting that the drag from lower oil prices and a stronger dollar may be beginning to dissipate. ‘Core’ CPI removes the effect of the more volatile food and energy components, and it is up 1.9% over the last 12 months. Between strong labor markets and a firming inflation outlook, it appears likely that the first Fed interest rate increase in a decade will occur at the December 15-16th FOMC meeting. In my opinion, it would take some pretty disappointing economic news between now and then to avert this.

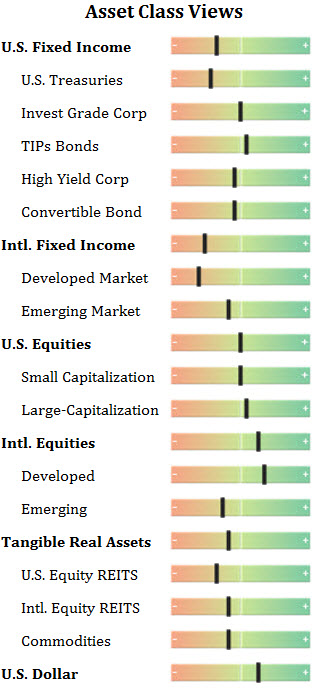

On the earnings front, 2015 has been a difficult year. According to FactSet Earnings Insight, full year revenues and earnings for the S&P 500 will likely decline by 3.4% and 0.3%, respectively. This is largely due to the impact of falling oil prices on oil company earnings. FactSet estimates that if the energy sector was excluded from the calculations, earnings would be up 6.9% and revenues up 1.9% for the year. Fortunately, a drop in energy prices of similar proportions in 2016 is unlikely, diminishing the chances of a repeat performance in earnings. FactSet expects 2016 earnings and revenues for the broad index to rise 8.2% and 4.5%, respectively. That places the 12-month forward P/E ratio of the S&P 500 at 16.1, above its five and 10-year averages of 14.2 and 14.1, respectively. These valuations are not particularly captivating, given the environment of rising rates we appear to be moving toward. But compared to bonds, U.S. stocks should still offer some value in 2016.

With stocks no longer underpinned by low absolute valuations, we should not be surprised by an increase in volatility going forward. This is normal as we transition to a more mature phase of the business cycle. The recent 8% decline in the S&P 500 during August and September followed by a 8% rebound since then illustrates the point well. A mixture of concerns about global growth, commodity price declines and the on-again, off-again expectation of the Fed’s first interest rate increase were responsible for the whiplash. Aware of potential anxiety around the first rate increase in over a decade, Fed officials have been trying to psychologically prepare the markets, emphasizing that the upward path will be gradual.

On the plus side, rising employment and wages are favorable for consumption growth, which bodes well for U.S. domestic demand in the year ahead.

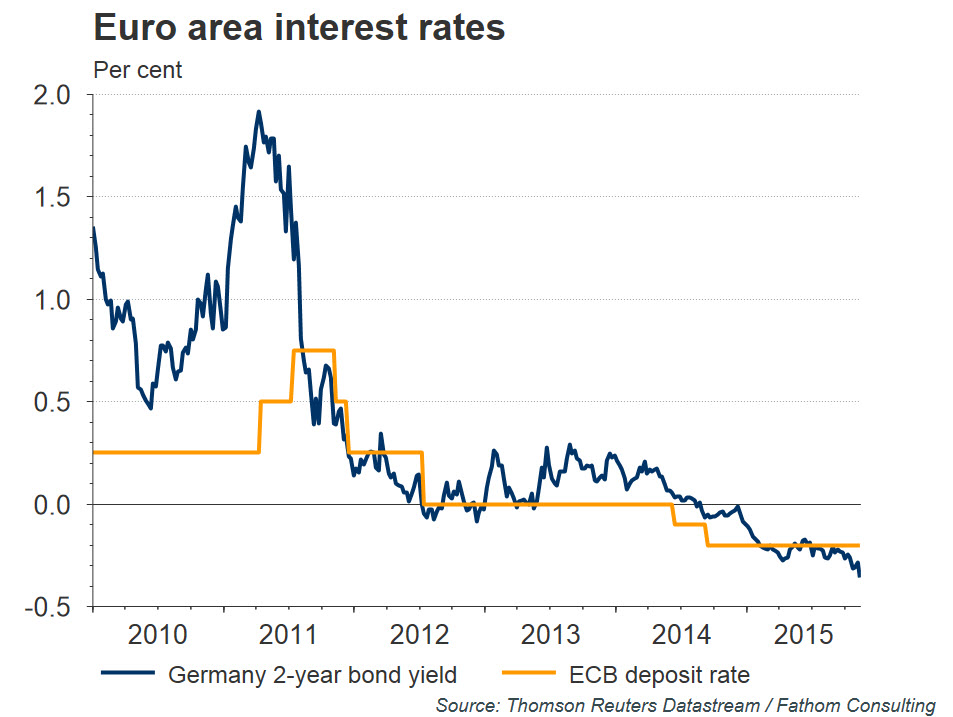

In Europe, improving employment has been a source of stability, as has lower oil prices, a weaker euro and easy monetary conditions. But exports play a more significant role in the economies of Europe than they do in the U.S., and Europe has been hit harder by weak industrial demand from China and other emerging markets. As a result, growth in the eurozone slowed unexpectedly in the third quarter. European Central Bank (ECB) President Mario Draghi suggested that downside risks and stubbornly low inflation may justify the need to ease further at its upcoming meeting on December 3rd. If this happens, it could provide a nice boost to the region, as the euro would likely fall further relative to the dollar. It would also drive further divergence in monetary policies between the Fed and the ECB, and further suppress eurozone government bond yields.

In the U.S. we are well ahead of Europe in our expansion, and the impact of factors discussed above (rising employment and consumer spending) could even become negative if they accelerate too rapidly and bring high inflation. But my money is on growth remaining steady not rapid. That should enable the U.S. stock market to grow earnings and gains in 2016. But a strong dollar will likely create headwinds for earnings of U.S. exporters. Investors must be more selective at this stage of the business cycle. Quality becomes increasingly important.

Since I expect growth to be reinforced by euro weakness and more monetary easing, I continue to like the value of European stocks. The same goes for Japan, despite the fact that their economy is technically back in recession. The Japanese government has been actively involved in an effort to rejuvenate its domestic economy since Abe’s election in 2012. And there has been progress on improving profitability and bringing positive, albeit modest, inflation. It is very likely there will be additional measures taken to stimulate the economy in the months ahead. So despite ongoing issues, relative to other developed markets I believe Japanese stocks have value on their side.

Emerging Markets

Following an extended period of rapid growth, emerging economies have slowed in recent years. In the months ahead I expect continued headwinds from rising U.S. interest rates and broad-based currency weakness against the dollar. These pressures may lead to disappointing growth. In spite of this, we are beginning to see attractive entry points based upon valuations that are the best they have been relative to developed markets in over a decade. The key is to avoid lumping all emerging markets together in a media-friendly acronym. They are a diverse set of countries and economies. While resource dependent Brazil and Russia struggle with recession, countries like Mexico and India are experiencing very favorable growth dynamics.

Bonds

As with U.S. equity, it’s important in this stage of the business cycle to be selective with credit. Recently the high yield sector, always economically sensitive, has been vulnerable to short-term swings in oil prices. And Moody’s reported on November 2nd that it expects the U.S. speculative-grade default rate to climb to a four-year high of 3.8% by October 2016. That is not excessive by historical standards, but additional defaults could happen if oil prices fell further. There could even be knock-on effects to other sectors. With all that said, yields remain attractive in the high yield space. Inflation protected TIPS are another good option (especially over nominal Treasuries), as we anticipate a gradually increasing domestic price level.

Altogether, rising rates may make for a more challenging environment for bonds in 2016. However, we believe that the demand for income from institutions and aging baby boomers will help contain the rise in long-term rates from being too harmful.

Commodities

Commodities are very sensitive to a strong dollar, and we expect the dollar to remain strong into early 2016. Overcapacity continues to be a problem in much of the commodity complex. But adjustments are taking place that should eventually bring attractive return opportunities. This will be especially true if inflation ticks up in the U.S. as expected.

There are always risks to our outlook. Though we may not expect them, we keep them on the radar screen all the more. Currently I am particularly monitoring: wage pressures that could cause general inflation to surprise on the upside; a further decline in oil prices; geopolitical risks from Syria and the Middle East. The ‘trouble list’ is, as always, fluid. We will add and discard from it as warranted, and keep you up-to-date in these commentaries. Stay tuned. And in the wake of the tragedy in Paris, let’s all take time to appreciate our lives and the lives of those around us.

Disclosures: The views expressed are those of Byron Green as of November 19, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 11-19-2015

Click here to download printable PDF of GIM Market Commentary 11-19-2015