I was blessed with a great mom. I bet, and hope, that many of you can make the same claim. Over the years I can remember my mother giving me advice on all sorts of things: ‘Eat your vegetables,’ ‘take care of yourself,’ ‘get plenty of rest,’ ‘stand up straight,’ ‘everything happens for a reason,’ ‘be polite’ and a host of other motherly one-liners. Probably one of the most important lessons she taught me was that ‘honesty is the best policy.’ Like George Washington, I can’t claim to have perfectly carried out my mom’s request to always be honest, but I can say it has been a guiding principle that has served me very well over the years. Collectively, all these lessons have formed a roadmap for me as I have progressed through life. I am not sure how mothers know all of this stuff, but I am glad they do.

Too bad countries don’t have mothers to teach them right from wrong. It is quite clear that honesty on the global scene is the best policy. It leads to relationships that are built on trust and reliability. And it leads to data the markets can trust. Recently, the trustworthiness of China’s economic data has been brought into question. This has wreaked havoc not only on China’s own markets but on the stability of markets across the globe. While I certainly don’t blame all of the recent volatility on China alone, concerns about China’s true situation has comingled with uncertainty over when the U.S. Federal Reserve will begin to normalize rates. And that union has produced great unease in the markets.

This is not the first time market watchers have questioned the veracity of China’s data. For some time now, economists have marveled at how China can provide its gross domestic product (GDP) numbers to the world weeks ahead of that of developed economies such as the U.S. and the euro zone – and then hardly ever need to revise. In the U.S. we often revise our data significantly on subsequent, multiple updates.

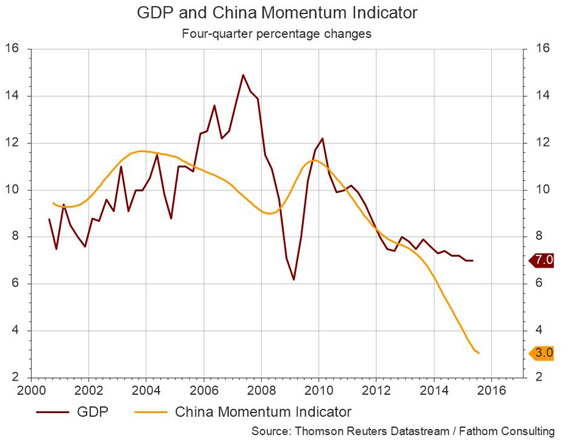

China has continued to report a relatively steady 7% annual growth rate in GDP in the first half of the year. This is in the face of significant sell-offs in global commodities—often a sign of global economic weakness. And it is especially perplexing given that China has been the primary driver of global commodity demand for several years. Furthermore, it doesn’t seem to sync with data from Fathom Consulting, a London-based independent research firm. Fathom composes and monitors a simple indicator that is designed as a proxy for the Chinese economy. It is comprised of three variables: electricity consumption, rail cargo volume, and bank lending. While the indicator is not intended to be an exact measure of the rate of growth of the Chinese economy, it does provide a second opinion, of sorts, to official numbers that may be less than reliable. Based on past experience, this indicator implies a current growth rate closer to 3% for the Chinese economy, rather than the official line of 7%. Needless to say, this is confusing investors. If China is slowing more rapidly than publicly reported, that fact could have significant global implications. In the meantime, policy uncertainty has taken its own toll.

Just a few years ago, the dependability of China’s data was not as important as it is today. But the nation has now emerged as an economic power that represents over 16.7% of the global economy, or $10.3 trillion, slightly more than that of the U.S. This helps explain why global equities have experienced such volatility since China devalued the yuan on August 11. The markets interpreted that as one more piece of tangible evidence that Chinese authorities may be getting concerned about growth, and may be willing to do anything to spur it forward.

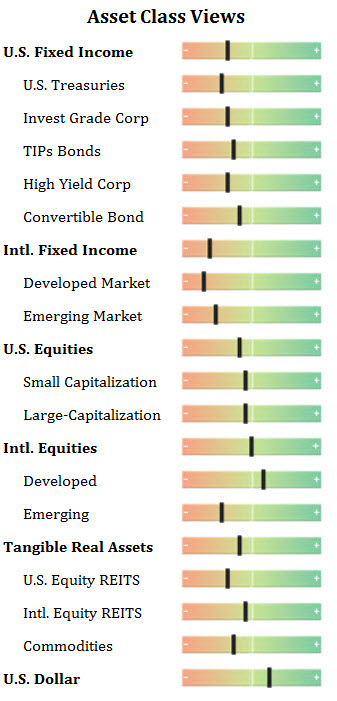

Chinese policy uncertainty combined with the pending start of a rate-hike cycle here in the U.S. has turned 2015 into a challenging year (so far) for most asset classes. The MSCI Emerging Markets index began the year with a 12.2% surge into late April, only to fall back since then to a 13.5% loss currently (as of the close September 15). The MSCI EAFE index of foreign developed markets has experienced similar fortunes, rising for a gain of around 12.5% as of May before falling back to a -.7% loss currently. Domestically, the S&P 500 index was a laggard on the upside earlier in the year, managing only a modest gain of about 4.1%. Since then, in the wake of the Chinese devaluation, it has fallen to -2.5%. Commodities take the gold medal so far this year for the worst performing asset class. The GSCI Commodity-Indexed Trust (GSG) consisting of a broad basket of energy, industrial and precious metals, agricultural and livestock markets, is down 20.5% YTD. For the somewhat risk-off environment we are in, bonds have put in a surprisingly disappointing performance of .1% for the Barclays Aggregate index of U.S. investment grade bonds.

Where do we go from here?

The evaporation of equity gains from earlier this year has damaged investor confidence, as has the pending U.S. rate hike cycle. The Fed has its next meeting on Wednesday, September 16, followed by announcements of any changes to policy rates on Thursday. It is still uncertain whether they will move at this meeting or defer to meetings in October or December. Strong U.S. employment data (jobless rate now 5.1%) and upwardly-revised 2nd quarter GDP growth of 3.7% both support an increase by the Fed. On the other hand, weak commodity prices and tame inflationary pressures could support the case for waiting. I am personally hoping for a small ¼% increase now, as uncertainty is causing more disruption than the actual increase itself in all likelihood would. By raising rates and beginning the road to normalization, the Fed will be affirming its confidence in the US economic recovery. It reminds me of something football coach John Madden once said, about the first points in a game often being the hardest to score. Likewise, the first rate hike is likely to be the toughest for the Fed to undertake. It will be best to go ahead and put that behind us so the markets can get used to the new environment.

Regarding China, I believe the evidence supports a growth rate that has slowed more than official numbers indicate. The uncertainty surrounding the degree of slowdown may have caused investors to react more harshly than if the true growth rate were known. Uncertainty often has that effect. As my mother would have said, ‘honesty would have been the best policy.’ We know the policy goals of China are to become a consumption-led rather than investment-led economy. The path to achieving that goal may be uneven. But will the growth in China just be irregular for a while, or might there be a true economic hard landing? That is the 64,000 yuan question right now. Consumer demand has not grown fast enough to offset the decline in the manufacturing sector. But that doesn’t mean they aren’t making progress in the right direction. For example, retail sales have increased 10.8% over the last year (through August). Fortunately, the services side of the economy represents 48% of the country’s GDP and the Non-Manufacturing purchasing managers index survey shows that growth is holding up well in that sector (+53.4 in August). And the central bank of China is one of the few major central banks that has ample room to provide additional monetary stimulus. Combine that with fiscal stimulus programs already in play, and potentially more to come, and these measures should help China avoid the kind of substantial decline in economic growth rates the markets seem to be afraid of now.

In the next few months (or days) when the Fed finally hikes rates, one element of uncertainty will be removed from the markets, yet monetary policy will still remain, on balance, very accommodating for months to come. We may also gain greater clarity on the economic trajectory of China. The markets appear oversold to me and any improvement in the outlook could spur a nice rebound in equities and other risk assets. I also remain constructive on U.S. and European economies, which appear to be in good cyclical shape. America’s economy, in particular, is well insulated from any Chinese slowdown with just 8% of our exports, and only 0.7% of our GDP, going to China. FactSet Research Systems reports that analysts are looking for a record level of earnings per share for the S&P 500 index to resume in the 4th quarter of 2015. This will be after two consecutive quarters of decline, and pave the way to a projected increase of 10.2% in 2016. Low oil and commodity prices should continue to provide a boost to consumers in the months ahead.

If my mother were here, I think she would say, ‘Be patient. Good things come to those who wait.’

Disclosures: The views expressed are those of Byron Green as of September 16, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 09-16-2015

Click here to download printable PDF of GIM Market Commentary 09-16-2015