Some of you may recall a popular English crooner named Engelbert Humperdinck. He hit it big in the late 60’s and early 70’s with several songs, including one titled, “After the Lovin”. The lyrics to the song went something like this,

“Thanks for taking me on a one way trip to the sun

And thanks for turning me into a someone

… So I sing you to sleep, After the lovin’

…Oh, but after the lovin’, I’m still in love with you”

-Engelbert Humperdinck

I recalled these lyrics when thinking about how the Federal Reserve has taken the U.S. economy on a “one way trip” from the Great Recession of 2008-09. Say what you will of the Fed’s policy-making, one thing we can all agree on is there has been no “double-dip” recession (remember how often we heard that term in 2010-2012?) and the U.S. economy clearly remains the world’s leader. All this was achieved (at least in part) through the Fed’s zero-interest-rate policy and large-scale QE bond-buying activities.

To be sure, the recovery has not been as robust as we’d like. But after another soft patch in the data in the first quarter, recent economic readings appear to show that the U.S. expansion is back on track. The first quarter lull appears to have been little more than a combination of one-off events—weather, currency effects and port strikes.

In fact, the evidence continues to mount that the U.S. economy is gaining momentum. On June 5th, a payroll report showed 280,000 jobs were created in the U.S. in May – the largest increase since December. And revisions added 32,000 additional jobs to the prior two months’ reports. This was followed by a 1.2% surge in reported retail sales in May, after an upwardly-revised 0.2 percent gain in April. Consumers also boosted purchases of automobiles and other goods, providing still further evidence that economic growth is finally gathering steam.

This reinforces the likelihood that the Federal Reserve will feel comfortable enough to begin normalizing rates sooner rather than later. Barring unexpected developments, it will be hard to argue (though some will try) that the U.S. economy is too fragile to handle an increase of a fraction of a percent in short-term borrowing costs.

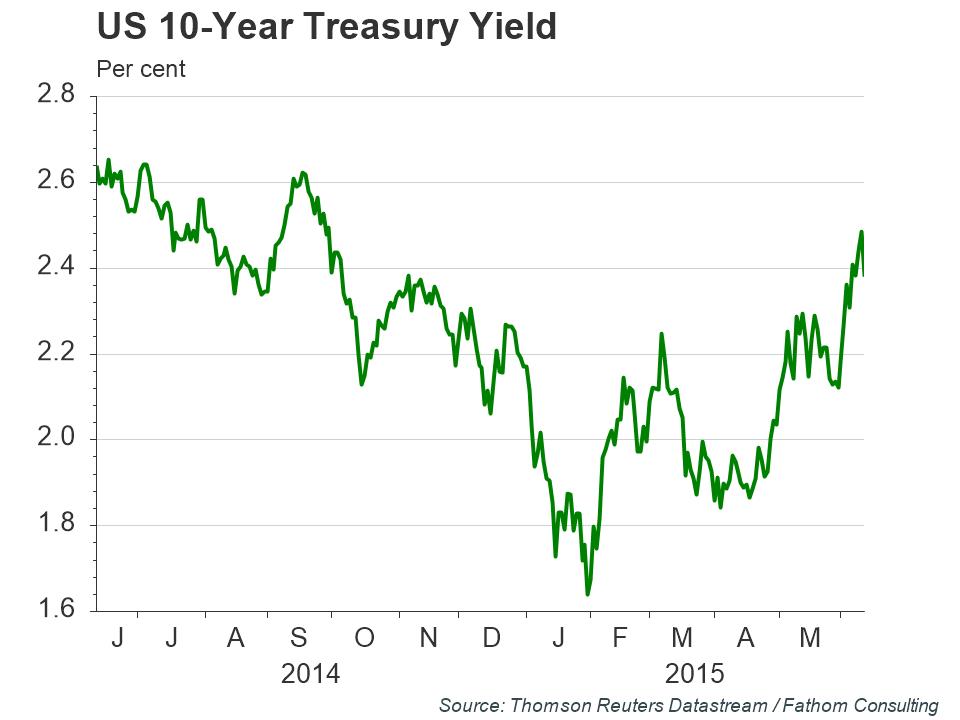

My best guess is that the Fed will make its first rate increase in September. But the upcoming June 16-17 meeting of the Federal Open Market Committee may give a better indication as to whether they might delay action. Recent bond market moves may have already begun to force the Fed’s hand, as 10-year yields have begun to rise, reflecting both stronger growth and rising inflation expectations (see chart below).

When the Fed does finally pull the trigger, will everything be okay? In other words, after the “lovin” of QE is over, will we be able to find anything in the markets to love? It’s a question we now need to consider.

First of all, expect the pace of tightening by the Fed to be very slow. Despite this gradualist approach, volatility in the markets will most likely increase. After all, it will be the first interest rate increase in nine years, and from historically low levels. Expect more upward pressure on yields to strengthen the dollar and flatten the yield curve. But while the stock market may pause or correct, as long as the underlying economy remains strong the turbulence should be temporary.

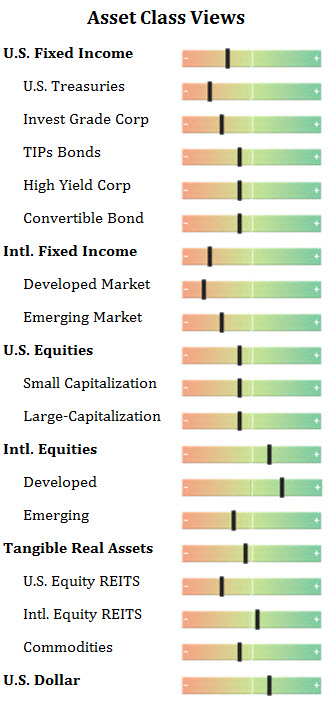

It’s important to keep a global perspective on this. In spite of the Fed’s change in direction, QE programs in Europe and Japan will still be pouring a US dollar equivalent of $130 billion into bonds and to a lesser extent stocks (Japan) monthly. This will serve to dampen any rise in global rates, especially when combined with subdued-but-improving world growth. That should help carry U.S. and many foreign equity markets higher, in spite of price levels that are no longer cheap.

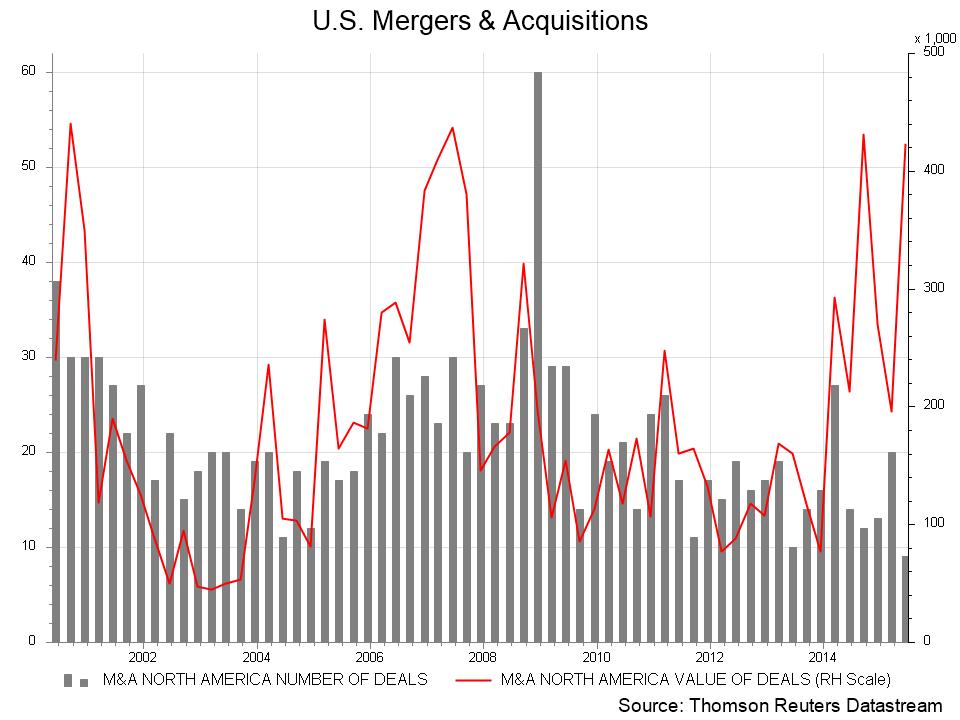

According to FactSet, the forward 12-month P/E ratio of the S&P 500 index now stands at 16.8. This is above the 5-year (13.8) and 10-year (14.1) averages. While a little on the high side, in bull markets earnings multiples can stay well above historical averages for extended periods. But when coupled with rising interest rates, these high multiples may limit the extent of additional expansion, or even bring some multiple-contraction in U.S. stocks. I expect increases in the value of U.S. stocks from here to come primarily from rising earnings. While these may be in scarce supply in the short term (+2.2% earnings growth estimated for the remainder of 2015), the outlook for earnings in 2016 appears much better (+12% estimated) as the impact of falling oil prices on oil company profits fade. In the meantime, additional demand for stocks is coming from rapidly rising mergers and acquisitions (M&A) activity (see chart below) and more overseas demand. Impending rate increases could hasten this activity even more in the coming months.

As the U.S. economy continues to accelerate from the anemic first quarter levels to what I expect will be an above-trend pace of around 2.7% – 3%, I’ll be looking for cyclical stock sectors to outperform defensive ones and value sectors to outperform growth.

Europe & Japan: The Euro area economy has begun the year on an upward path, with annualized GDP growth of 1.6%. Loan growth also appears to be rebounding, a good sign for continued expansion. I continue to like Europe and Japan. Their valuations, while not cheap, are appealing because the profit cycle in those countries still has significant room to run.

Greece: Greece was unable to reach any agreement with its creditors over the past weekend, so talks will continue into the Eurogroup meeting this coming Thursday. Compromise is being sought, which may come by way of a short extension of time to negotiate further without fear of default. The Greek government has been unwilling so far to agree to creditor demands, especially regarding pension reform. This impasse is leading to a severe liquidity shortage in the Greek economy. The hard choice of Greece exiting the Euro or remaining in it is at hand. If Greece doesn’t compromise on some level, they will be unable to pay the same group of pensioners that they are ostensibly trying to defend. It’s quite possible Greece may miss a debt payment in the coming weeks, but I expect that a compromise will eventually be found to keep the country in the Euro. In the meantime, it will be a source of volatility in the markets.

Emerging Markets: In the last few weeks, emerging markets have seen their year-to-date outperformance of developed markets completely erode. Currency has been the major cause of this, as some emerging market currencies have fallen significantly. This is an impact of rising interest rates in the U.S. and Europe, which is pressuring many emerging nations to either raise their own interest rates or face weaker domestic currency.

Aside from these currency effects, emerging market equity performance is driven more by a change in the rate of growth than the absolute level of growth (Goldman Sachs, EM Spotlight, June 10, 2015). China has certainly seen a rate-of-growth slowdown from recent years, and there have been sharp contractions

in Brazil and Russia as well. At the same time, other emerging countries are benefitting from lower oil prices – especially those such as India that have taken the opportunity to usher in fiscal and structural reforms designed to boost long-run growth and development.

I think many emerging countries will offer tremendous growth opportunities in the years ahead. But in the near-term, Federal Reserve rate increases will bring the risk of capital outflow from emerging nations. This will affect some countries more than others, likely presenting new opportunities as events unfold. In the meantime, emerging country currency markets need to stabilize before I would expect their stock markets to outperform developed markets once again. Hopefully this transition can take place in the coming months.

Fixed Income: Treasury yields have moved considerably off of their lows of the spring. The U.S. 10-year reached 2.48% on June 10th, well above its April low of 1.84%, which coincided with concerns of a slowdown in U.S. growth. Recent economic numbers have allayed fears and brought a strong snap-back in yields. And longer yields have risen faster than shorter ones, steepening the yield curve. Historically, this has been a sign of faster economic growth ahead. It also tends to put increasing pressure on the Fed to suppress rate rises on the long-end by raising short-term rates, another sign that rate increases are probably not far away. I suspect that if economic data remains strong, the Fed will likely raise rates as early as September. The good news is that low rates emanating from Europe and Japan should keep global rates from rising so fast as to be damaging to the recovery.

Credit has outperformed other fixed-income categories year-to-date, with high-yield bonds outpacing their investment-grade counterparts. I expect the advance in global bond yields to persist as the expansion continues to gain traction. A gradual re-appraisal of the outlook for inflation should drive nominal yields higher across the major markets. For this reason, I continue to recommend exposure to Treasury Inflation-Protected Securities (TIPS) in many of our strategies, along with an underweight to longer-maturity Treasuries. I recommend a modestly underweight position to bonds in our balanced allocations, while also recognizing that bonds play a critical diversification role versus stocks in a multi-asset portfolio.

Commodities: West Texas Intermediate Oil prices have rebounded since the first of the year but are still (at $59/barrel) well below the $100 levels of just a year ago. Saudi Arabia continues to raise its output to “meet demand,” or as I like to say – to try to run U.S. shale oil producers out of business. So far this is showing signs of working. Recent shale oil production shows significant declines. Unless global demand picks up meaningfully in the coming months (a reasonable possibility), we could see oil prices move a little lower in the near-term. For the overall commodity complex, almost every commodity is trading significantly below its five-year average as the market continues to adjust to overcapacity. A pick-up in global growth should begin to offer what I expect to be early entry points to better returns in the months ahead.

Currencies: Divergence in global growth and in central bank policy should continue to fuel the relative strength of the U.S. dollar against global currencies.

Conclusion: Over all, the U.S. economy is still in expansion mode while Europe, Japan and some of the emerging market economies show signs of improvement. Market volatility may increase around both the Greek impasse and the potential for the first Fed rate hike in years. But Greece has more to lose than gain by holding out much longer, and the stock market generally rises during early stages of rate-hike cycles. Let’s also not forget that Europe and Japan continue to pump $130 billion of dollar equivalent liquidity into the global economy monthly. So I expect the bull market to remain intact, and that after the lovin’ of QE is over, we’ll still find plenty to love in the stock markets.

In the meantime, I will keep abreast of market, economic and other relevant developments and report back to you through this newsletter. All of us at Green Investment Management thank you for reading, and thank you especially for your business!

Disclosures: The views expressed are those of Byron Green as of June 16, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 06-16-2015

Click here to download printable PDF of GIM Market Commentary 06-16-2015