The latest economic data on the U.S. economy seems to suggest that once again in this multi-year expansion we have hit a soft patch. For example, the March U.S. nonfarm payroll report was the weakest in over two years; only 126,000 non-farm jobs were created. This comes on the heels of 12 straight months of job creation in excess of 200,000 per month. As you might expect, this has led investors to question whether this is a another temporary soft patch in the data, or is the strong rise in the dollar taking a significant toll on foreign demand for U.S. goods and services? In other words, is it a bump in the road or is the U.S. economy losing momentum?

So far, the markets have responded surprisingly well to the disappointing batch of economic news since mid-March, the date of our last newsletter. Global stock markets are up, oil prices have rebounded somewhat and the yields on longer-dated U.S. Treasury bonds are slightly higher. The dollar has also rebounded a little after mid-March weakness. It seems that the lull is, for now, being interpreted as a bump in the road, with influences such as the winter weather and the west coast port strike being the main causes of the deviation.

We tend to agree with that reading. Leading indicators of spending and income are still trending higher, implying that surprises are more likely to come on the positive side. After all, we have begun to grow accustomed in this expansion to spurts of growth followed by periodic pauses. Overall, it has been an atypical recovery by historical standards. We attribute a lot of its seeming delicacy to the tremendous blow that the average person experienced from the Great Recession of 2008-2009, much like the Great Depression era participants who had their spending propensity permanently changed in the 1930’s. But while this has served to slow our economic advance, it also means that, even at this stage of the cycle, we should still have areas of pent-up demand to fuel new growth.

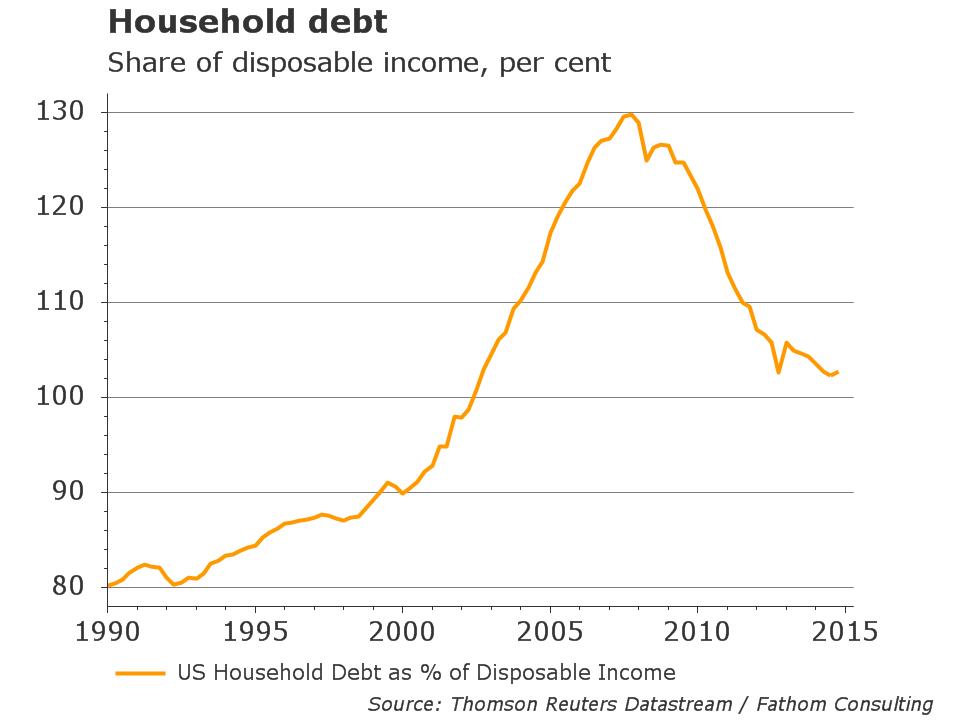

As reticence by consumers toward spending and credit continues to diminish, spending should gradually increase. The positive underlying trend in employment and recent gains in income from rising payrolls should help enable this—especially when we factor in the big bonus of a 50% plunge in oil prices since last year. Household debt as a share of disposable income has also dropped considerably from its peak in late 2007, and is the lowest in over 12 years (see chart bottom left). Record low borrowing rates are one reason. And these costs will be slow to rise since many homeowners have locked in low mortgage rates. In addition, the Fed is likely to be very cautious in raising rates. Collectively, the data points to an improving credit and earnings picture that should lead to consumer confidence and spending. We expect this to be a positive force in the months ahead for U.S. equities and the dollar.

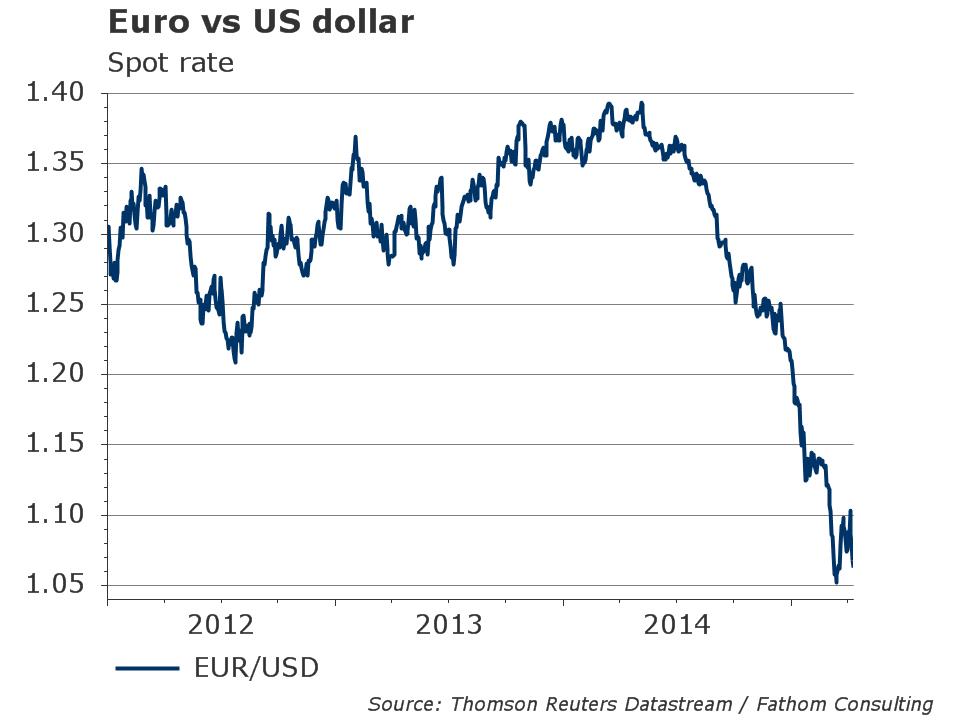

While the U.S. recovery has been hindered by both the memory and the “impact crater” of the Great Recession, Europe’s recovery has been even slower. But that may be changing. Europe could emerge from the first quarter with a more rapid rate of growth than the U.S. economy. The growth leader of recent years (the U.S.) may be on the verge of becoming the follower, with Europe now having all of the elements in place for robust growth ahead. Not only has the ECB’s aggressive efforts to invigorate the economy pushed rates below 0% in some cases, but it has devalued the Euro by 22% since the highs of 2014 (see Euro chart below). This makes goods and services from the Eurozone much more price competitive internationally. On top of this, the windfall drop in oil prices and ongoing structural reforms are making for a perfect elixir to put some health back into the European economy. And even if this does turn the U.S. into a “follower,” it’s a beneficial development for America and the rest of the world.

Putting all of this information together, we believe the Fed’s departure from a zero interest rate environment will still happen this year, though there could be a slight delay. We expect that the U.S. economy will bounce back from the first-quarter’s soft patch and return to a more normal growth trajectory. Corporate earnings are at risk of a modest decline in 2015 due to a stronger dollar and slashed expectations for oil companies, but these impacts should diminish as oil prices stabilize or rebound and the dollar’s secular advance slows.

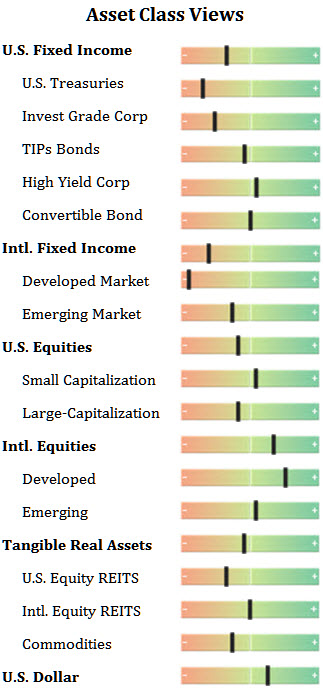

As we have expected, equities have been the best performer to date across asset classes, especially in Europe and Japan. Here in the U.S., stock valuations are more elevated and have struggled to small gains in the face of a surging dollar. The S&P 500 is up some 3% on the year. The broader market has fared a bit better, as reflected by the S&P 400 Mid-Cap and the S&P 600 Small-Cap Indices being up roughly 6% and 5%, respectively. Domestic markets are still digesting the softer earnings outlook and disappointing 1st quarter economic data, while also anticipating the Fed raising rates at some point.

Since the Great Recession, both stocks and bonds have rallied considerably, leaving neither one as attractively priced as they once were. According to FactSet Research, the P/E ratio for the S&P 500, based on estimated 12-months-forward earnings, is now 16.8 (2091.18/$124.30). This is above the 10-year average of 14.1. But if the economy can continue to expand as we approach Fed rate hikes, we believe that earnings will strengthen support under current valuations as we move through the year. In the meantime, continued easy monetary policy here and reflationary policies from the ECB and the BOJ should help fuel global growth.

The expanding global recovery should also drive increasing numbers of investors to look overseas in the coming months. Improving confidence in Europe should lead to more M&A activity, debt-funded repurchases of shares and distributions from cash-rich European companies. So far, they have lagged their U.S. and Japanese counterparts in this recovery. We continue to like Europe, Japan and emerging nations such as India, Korea, China and others favorably affected by lower oil prices. Emerging market policy makers are generally biased toward easy-money policy in commodity-importing nations, which are reaping the benefits of lower inflation as a result of soft commodity prices (especially oil). Conversely, several commodity-exporting nations that have been negatively affected by falling commodity prices have been forced to keep interest rates elevated to support their currencies and/or fight inflation. Examples of this are Brazil and Russia.

We do not view potential U.S. rate hikes later in the year as an obstacle to more U.S. equity gains. As things stand, we would view rate-driven corrections as an opportunity to accumulate more stocks. In the case of emerging market stocks, the impact may be much more varied and will have to be evaluated on an ongoing case-by-case basis.

Long-dated Treasuries are comparatively unattractive relative to domestic stocks, because of our expectations for better growth, slowly rising interest rates and an unwinding of deflation fears. But the end to the Fed’s zero interest rate policy does not spell misfortune for bonds in general. Our holdings of Treasuries and investment-grade corporate bonds are in short-to-intermediate-term issues as we wait for more appealing longer rates. We have begun to accumulate TIPs in some of our portfolios, to be positioned for what we believe will be a modest upturn in inflation expectations later in the year. TIPs are driven by changes in both real rates and inflation expectations. We believe inflation expectations may be underestimated currently, and may trend higher in the months ahead.

The outlook for corporate credit remains fairly constructive, with a strong probability that credit spreads will narrow over the course of the year, especially in the high-yield sector. Spreads are still elevated relative to previous credit cycles, and this could help offset the negative impact of rising rates on bond returns. Our baseline expectation is for corporate earnings to remain relatively stable but gradually improve later in the year on the back of better U.S. and global growth. We think the appetite for corporate debt will continue to be strong, with investors seeking income and encouraged by the prospects of stable growth, low global yields and relatively modest returns in equities.

Globally, the current strength in the dollar tends to work against the performance of foreign bonds, especially those of developed markets with low interest rates. For this reason, we presently have an underweight allocation to foreign issues.

Oil has become a real focal point to the economies of the world over the last year. After falling by 60% from its peak of $115.43 on June 19, 2014 to a low of $45.25 in mid-January, Brent crude seems to have stabilized over the last couple of months between about $50 and $60 dollars a barrel. Prices are likely to remain volatile for at least a few more months as oil companies adjust to excess inventories by cutting back on drilling activity. And a successful conclusion to the nuclear talks with Iran could potentially worsen the oil glut further over the coming year. Iran could potentially sell 30 million stored barrels of oil into the market as well as 3.5 million additional barrels per day by the end of 2016. This bears watching closely as significant new weakness in oil prices could have negative economic repercussions.

To summarize our outlook, improving global economic growth and favorable monetary policies warrant an overweight on stocks versus bonds for the coming months. We expect the recent change in market leadership away from U.S. stocks to continue, given relative earnings trends and growing policy differentials between the U.S. and Europe. We continue to recommend that investors underweight long duration Treasuries and suggest an overweight to corporate high yield bonds mixed with exposure to TIPS and convertible bonds.

Disclosures: The views expressed are those of Byron Green as of April 15, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 04-15-2015

Click here to download printable PDF of GIM Market Commentary 04-15-2015