Deflationary pressures have dogged the global economy since the Great Recession ended in February of 2010. The economic downturn left the world with overcapacity and indebtedness that is slowly being worked off. Among the developed nations, the U.S. has probably made the most progress in that direction. Progress has been tougher for Europe and Japan. The rewards of a more pronounced, albeit slow, U.S. recovery have included a vibrant stock market, one of the strongest in the world over recent years.

In addition to aggressive quantitative easing (QE), efforts to strengthen the banking system have helped mitigate some of the adverse effects of the U.S. crisis. Europe and Japan were less aggressive in tackling their problems while the recession was still in the early going. But with U.S. success increasingly clear, Europe and Japan have redoubled efforts to invigorate their own economies.

Now, having been the first to turn to QE during the crisis, the U.S. is the first to begin exiting with its October, 2014 wind down of bond purchases. Meanwhile, the European Central Bank (ECB) and the Bank of Japan (BOJ) are still in full QE mode. The ECB began its latest round of easing on March 9th, with a very substantial commitment to buy bonds worth €1.14 trillion over the next 18 months. Buying this year alone will equal 6% of the euro zone GDP, and soak up almost double the net issuance of bonds forecasted for the period. This will lead to a net contraction of outstanding bonds and may force yields even lower. Yields are already at all-time lows for many euro zone nations, and rates have gone negative in some cases. In other words, bond issuers are charging interest rather than paying it! To some extent, they can get away with this because of the security of their issues and the inconvenience/expense of investors holding large amounts of currency. But with U.S. rates appreciably higher, money is leaving Europe and flowing to Treasuries and other higher yielding assets in the U.S. and other countries.

One of the most important dynamics of the ECB’s QE program is the resulting devaluation of the currency. Since last July, when the divergent policies of the Fed and ECB became clear, the euro has fallen from $1.37 USD to $1.06 today. This is a roughly 23% fall in less than a year, with the Euro now at its lowest level versus the greenback in more than 12 years.

QE is likely to continue in Europe until September 2016. Lower relative interest rates and further euro declines should enhance the competitiveness of the European economy by making goods and services from the region cheaper to the rest of the world. At the same time, foreign goods will be more expensive to Europeans, which should help offset persistent deflationary pressure. The BOJ appears to have Japan on a similar path with a similar goal.

Meanwhile, the US economy continues to grow. West Coast port strikes and a storm-filled winter are dampening expectations of first quarter data. And the sharp rise in the dollar and drop in oil prices may negatively impact earnings. But we anticipate that longer-term conditions will continue to improve. Jobs growth remains impressive, with 295,000 new jobs created in February, dropping the unemployment rate to 5.5%. Payroll gains over the last six months are the strongest in over 15 years. Corporate deal activity is supportive and oil prices seem to be etching out a bottom.

The U.S. Federal Reserve appears to be leaning toward a rate hike sometime around the middle of the year, or at least by September. The first rise is likely to be 25 basis points (1/4%), and could lead to further appreciation in the dollar. Overall, we view the move as having positive potential. It will show that the Federal Reserve has confidence in the U.S. economic expansion. This should buoy investor sentiment and support a rising stock market. But it may also cause increased volatility as the transition takes place.

Despite overall monetary conditions that remain favorable to the U.S. economy and domestic equities, a strong dollar and higher interest rates could create a drag on U.S. earnings. Some investors may look for returns elsewhere. Increased confidence in the sustainability of the global recovery could thereby steal performance leadership away from the U.S. on the strength of enhanced competitiveness and liquidity overseas.

According to FactSet Research Systems, S&P 500 earnings are projected to grow by 2.2% in 2015, while revenues decline by 0.7%. Real U.S. GDP growth is projected to be 3.1%. This would be an improvement over the tepid, 2%-type growth of the past few years. In terms of equity valuation, the current 12-month forward P/E ratio of the S&P 500 index is 16.6, above both the 5-year average of 13.6 and the 10-year average of 14.1.

What does it all mean?

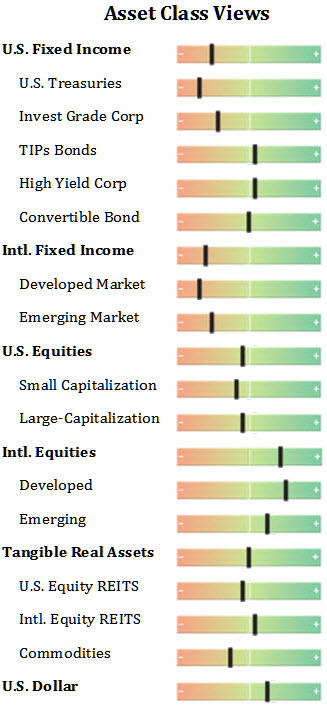

- A global recovery warrants a pro-growth bias in portfolios, and we continue to overweight stocks vs. bonds. Globally speaking, the bull market in equities should continue to run, although the “returns baton” may be on the verge of passing from the U.S. to nations more flush with central bank liquidity. We increasingly favor the relative value of Europe and Japan.

- While deflation remains the concern for much of the globe, we expect to see wage increases finally make their way into the U.S. economic data in the year ahead. We have yet to see wage inflation of any significance, but considering the number of new jobs being created and the tightening labor market, we believe it will happen soon enough.

- Interestingly, wage inflation could also appear in Germany later this year, the result of a tightening job market. This could pose headaches for the ECB. But with European fears of deflation still strong, any wage growth could also have an outsized positive impact on investor psychology, potentially raising interest rates on bonds, moving money into equities and firming up the euro.

To speak a little to the plunge in commodity prices, especially oil, over the last six to nine months, it has been driven more by strong supply than weak demand. It has also created a sharp drop in headline CPI inflation across the world. For most net commodity importers, (including China, the euro area, Japan and the U.S.), this provides a windfall similar to a tax cut for both consumers and businesses. For the nations that are net commodity exporters (about 20% of the globe), it acts as a deflationary shock, and we are underweighting those nations in our international holdings.

Speaking of which, rising confidence in the global recovery should drive more investors to look overseas in the coming months. This will benefit multi-asset global portfolios. We are increasing our investments in Europe, Japan and emerging market equities (especially those of commodity importers). The search for yield should also be supportive of risk/pro-cyclical assets.

We do not view potential U.S. rate hikes later in the year as an obstacle to more U.S. equity gains. As things stand, we would view rate-driven corrections as an opportunity to accumulate more stocks.

In fixed income, the current strength in the dollar tends to work against the performance of foreign bonds, especially those of developed markets with low rates. For this reason, we presently have an underweight allocation to foreign issues.

We retain a bias toward high-yield corporate bonds, which have enjoyed something of a recovery as credit spreads have narrowed since the first of the year. Our holdings of Treasuries and investment-grade corporate bonds are in short-to-intermediate-term issues, as we wait for more appealing longer rates. We have also begun to accumulate TIPs to be positioned for what we believe will be a modest upturn in inflation expectations later in the year. TIPs are driven by changes in both real rates and inflation expectations. We believe inflation expectations may be underestimated currently, and may trend higher in the months ahead. TIPs make a good defense against up-side inflationary surprises, especially if oil prices rise again later in the year (see below). We see this as a real possibility since excess supply should disappear as the global economy speeds up, even incrementally. In such an environment, commodities could once again offer investors diversification benefits.

In summary, we see the performance of the markets in the year ahead as being largely driven by a struggle between deflationary forces and reflationary expectations. This is the key dynamic affecting our positioning across asset classes. Deflation fears have been enhanced recently by the decline in oil prices. But central bank easing has accelerated globally, with the aim of reigniting growth and hitting desired inflation targets. We believe these steps will serve to alleviate foreign growth concerns and inflate asset prices. In the meantime, we continue to be constructive on both U.S. and foreign equities.

That’s our current take on the markets. Needless to say, there may be bumps in the road ahead, but we will stay abreast of the situation and update you monthly with this newsletter. If you are a client, we thank you for your business. If you are not, we would love to have the opportunity to work with you. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of March 17, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 03-17-2015

Click here to download printable PDF of GIM Market Commentary 03-17-2015