U.S. large cap stocks were a stand out performer in 2014. A relatively strong U.S. economy juxtaposed against generally weak global growth and heightened deflationary pressures made the U.S. look like the safest place to invest in the world. A plunge in oil prices beginning around midyear only served to intensify global deflationary concerns still further. The rapid fall raised the specter that oil prices were dropping not only because of enhanced U.S. production, but also because the global economy was entering into a slower growth trajectory. The amplified anxiety caused correlations to rise, as it will sometimes when there is stress in the markets. The unfortunate upshot is that it clouded the benefits of diversification in 2014. And as we move forward in 2015, we are already seeing some of these factors start to change.

It is becoming increasingly evident that a broader, more durable expansion is taking hold in the U.S., and that the slide in oil prices was driven more by supply than a waning global economy. The U.S. labor market created more than one million jobs over the past three months. Job growth for the past twelve months was the strongest in 15 years. To top this off, consumers are just beginning to reap the full benefits of lower oil prices. Strength in the U.S. economy gives power to the U.S. dollar, and non-oil import growth is accelerating as the dollar strengthens. These factors alone should provide considerable stimulus to the global economy. But in addition the European Central Bank (ECB) will begin its recently announced quantitative easing (QE) program this March, and carry it through at least September of 2016. The size is substantial, equal to 6% of Eurozone GDP this year alone. It should help cure fears of economic contraction emanating from Europe, and help bolster economic activity in other parts of the world. As the year wears on, persistent investor pessimism for foreign equities should begin to diminish.

In the U.S., the consumer is a critical part of the ongoing recovery, representing almost 70% of the economy. And the consumer is looking pretty good, as reflected in the February consumer sentiment index. It stands at 93.6, just off an 11-year high. There has been some recent softness in the industrial sector of the U.S. economy, as reflected in a weaker Purchasing Managers’ Index (PMI) which peaked last August. But the consumer dominates the economic story here and consumer confidence is strong. This appears to be more than just a domestic phenomenon. There is a trend of rising global consumer confidence in recent months in many of the developed economies—a very favorable indicator.

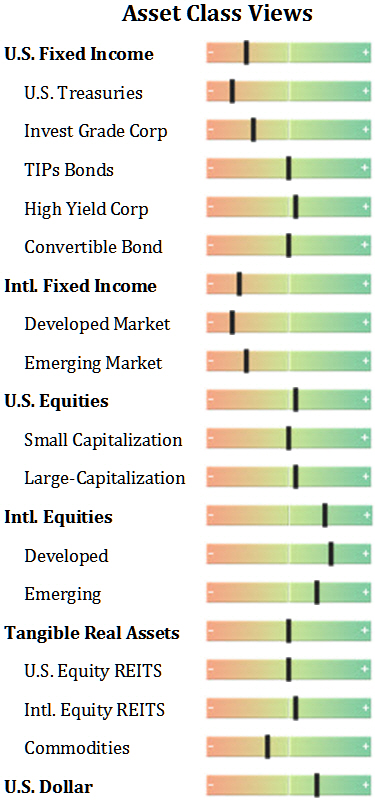

For a complete view of our positions on different asset classes, the graphic below shows exactly where we stand on an underweight/overweight spectrum.

Note: “-” equals maximum underweight, “+” equals maximum overweight. These are our current views for the 6 – 12 month horizon and are subject to change at any time. Tactical qualitative investment strategy weightings are relative to the strategic weightings for a fully diversified portfolio. See additional disclosures below.

Improving consumer confidence, along with solid U.S. jobs growth, will likely push the Federal Reserve to raise interest rates towards the middle of the year. Trading based on deflationary concerns (buying Treasuries, shorting commodities, etc.), which have persistently dogged the global economy, should begin to unwind as the year unfolds, driven by improving global growth and stable-to-strengthening oil prices. There may be bumps along the way, as with the “taper tantrum” that occurred in 2013, when interest rates on bonds rose rapidly and threatened equity markets. But we expect such “tantrums,” if there are any, to be short lived.

Since we believe “the Fed is coming” and that interest rates will rise, we consider the return prospects more favorable for equities in general than for bonds. Rising rates should pressure bond returns, and we remain overweight equities. But valuations are no longer cheap in domestic stocks. And volatility and the risk of drawdowns may rise as the year progresses. According to FactSet Research, the 12-month forward P/E ratio for the S&P 500 is now 17.1, well above the 5-year (13.6) and 10-year (14.1) averages. When the Fed hikes rates, it would be reasonable to expect some P/E compression in domestic equities. But rising earnings in the second half of the year should also provide some support for domestic stock prices, and create the opportunity for further gains over the course of 2015.

Overall, rising interest rates need not be a negative for domestic stocks, as long as the rise is due to an improving economy and not an upturn in inflation. But we have been seeing impressive results from European markets in recent weeks, and we believe this may be the beginning of a period of outperformance by foreign equities relative to the U.S.—a catch-up in regards to both earnings and valuations. A strong dollar may also prove to be a headwind for foreign sales and earnings of large U.S. companies, while providing a boost to the revenues and earnings of companies operating in countries with weak currencies, such as Japan and the Euro Zone.

The recent rebound in oil prices is already alleviating some of the concerns about deflationary pressure in the global economy. Moving ahead, we are expecting domestic bond yields to trend higher in reaction to (1) the improving global environment, (2) an uptick in inflation expectations and (3) the beginning of the Fed’s rate tightening cycle. The risk-reward outlook for Treasuries here is poor—unless global economic conditions have a reversal, which we don’t expect. The same poor outlook holds true for high-grade corporate bonds.

We do continue to like high-yield corporate bonds, which we believe offer higher starting yields to help cushion against price declines, especially in an improving economic environment. This category should outperform in 2015. Convertible bonds may also be attractive, as they offer some participation in the potential outperformance of equities, while still providing income.

Treasury inflation participation securities (TIPS) are an attractive diversifier in this environment. TIPs are driven by changes in both real rates and in inflation expectations. We believe inflation expectations may be underestimated currently, and may trend higher in the months ahead. TIPs make a good defense against up-side inflationary surprises, especially if oil prices rise again later in the year.

Domestic Equity REITS had a very strong year in 2014, up 28% as measured by the FTSE NAREIT All-Equity REITs index. This was the result of very strong fundamentals, robust investment flows and some catch-up from the prior year’s flat performance. Valuations are no longer cheap, at an estimated 25 times projected adjusted funds from operations (AFFO). The long-term average is around 16, and REIT prices could also be negatively impacted when the Fed begins to raise rates. With all that said, we think the overall outlook for REITs continues to be favorable. Funds from operations are expected to rise by a median of 7.4% in 2015, according to SNL Financial. And the average yield stands at 3.3%. Furthermore, studies show that REIT returns are more affected by economic growth rates and credit spreads than by the direction of interest rates.

As mentioned above, regional returns leadership is likely to shift away from the U.S. as growth in the rest of the world begins to strengthen. We favor an overweight to international equities, with emphasis toward the euro area, Japan and emerging market, commodity-importing countries such as China, Korea and Taiwan. Ongoing QE (i.e. from Europe and Japan) is likely to moderate deflationary pressures and raise the P/E multiple that investors are willing to pay, because of reduced risk. Any upgrades to European growth prospects due to lower currency exchange rates and lower oil prices would further support this trend. It’s important to remember that when investing in foreign countries, it may be advisable to invest through vehicles that hedge out the currency risk a strong U.S. dollar poses.

In summary, our overall outlook is positive this year. The stock market will be susceptible to corrections as we move closer to a Fed tightening cycle, and we expect that volatility may increase at times. We recommend an overweight to equities relative to bonds, but caution that gains in domestic equities may be more selective this year than in recent years. Bonds should still play an important part of most investors’ portfolios. We like the prospects for many foreign equity markets as the global expansion spreads, oil prices stabilize and the QE programs of the European Central Bank and the Bank of Japan begin to stabilize deflationary threats.

As always, geopolitical risk spots remain, such as in Ukraine and the Middle East and now even Greece. Our outlook is built on these situations remaining manageable in the long run, which we think is the most likely scenario.

That’s our current take on the markets. Needless to say, there may be bumps in the road ahead, but we will stay abreast of the situation and update you monthly through this newsletter. If you are a client, we thank you for your business. If you are not, we would love to have the opportunity to work with you. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of February 18, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 02-18-2015

Click here to download printable PDF of GIM Market Commentary 02-18-2015