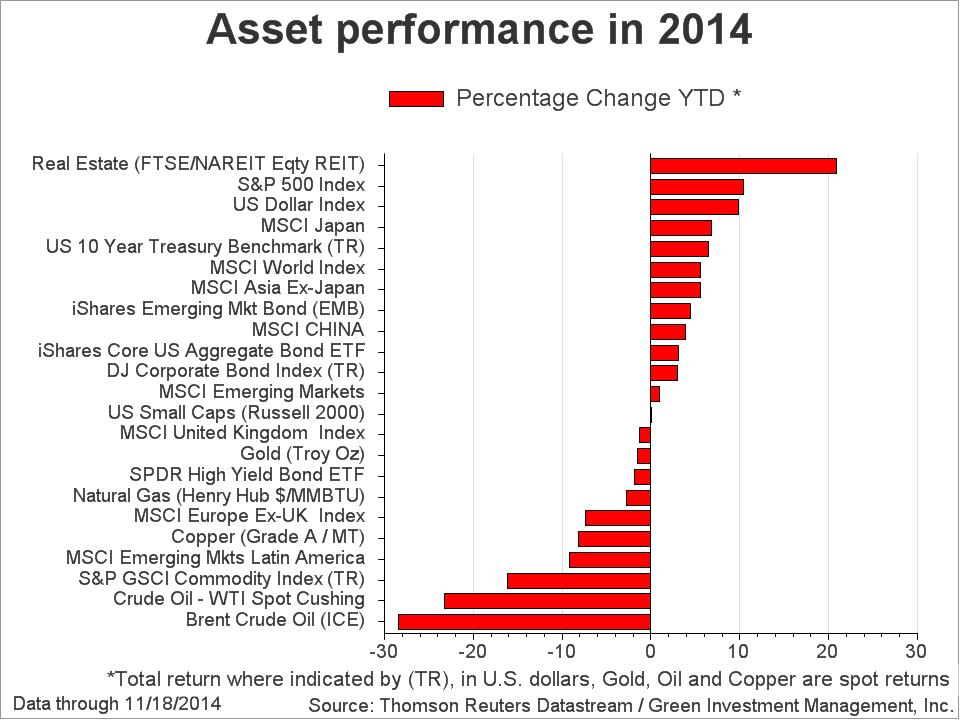

Globally, risk assets have enjoyed a solid rebound from last month’s sell-off. While this reflects improved market sentiment since mid-October, viewed from a broader perspective it also reflects increased volatility, which is tied to: (1) anxiety surrounding the long-anticipated end of quantitative easing in the U.S., (2) the uncertain timing of Federal Reserve interest rate increases and (3) concerns of renewed recession in the euro area that could undermine the global recovery. So far, these factors have contributed to constrained global equity performance for the year as a whole. But regardless of the worries and the corresponding gyrations, we are upbeat about the economic prospects for the U.S. and global economy as we near 2015.

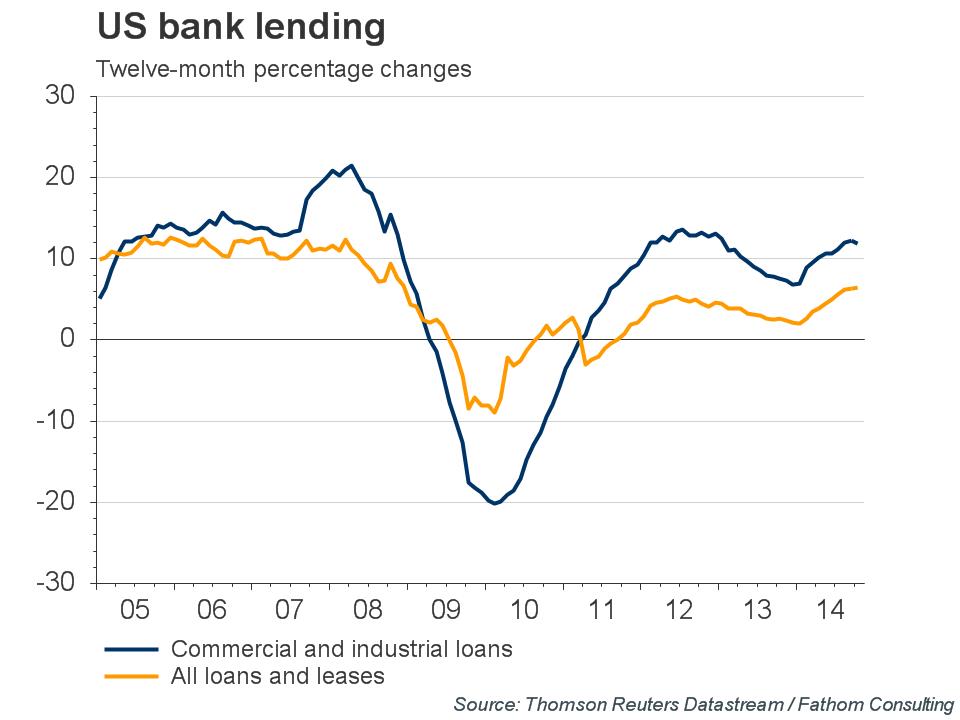

In the U.S., employment continues to grow at a sustainable rate. The budget deficit has narrowed markedly and credit demand continues to improve (see “Bank Lending” chart). Soon the third quarter earnings season will come to an end and, on-the-whole, reports have quelled concerns about the negative effects of a stronger dollar on earnings and the fear that growth is slowing – both of which have held back U.S. equities recently. As reported in the November 14 issue of Factset Earnings Insight, average earnings growth reported for the S&P 500 was 7.9%. Over time, we expect these favorable trends in the U.S. economy to help push the world economy onto a healthier growth path in 2015. This should spur another global advance in stocks.

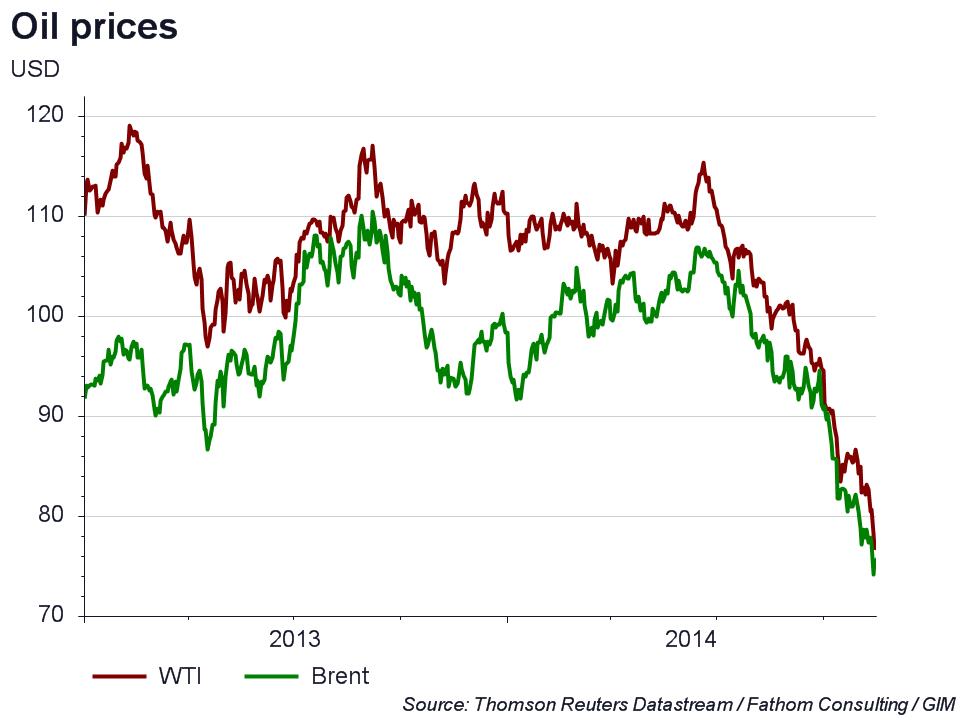

It’s worth noting that oil prices have declined between 25-30% this year (See “Oil prices” chart on next page). While the scale of the drop seems severe, it represents a break from price levels that were elevated due to geopolitical concerns and fundamentally out-of-sync with the supply-and-demand balance. Prices are now searching for a new equilibrium, in the face of opposing influences that include softening global growth rates, improving U.S. shale supply and a suspected price war among suppliers. As this process sorts out, we see the decline as decidedly pro-growth for the U.S. and other economies that depend on oil imports. It represents a windfall to consumers and a new tailwind to their spending.

Like we anticipated last month, the European Central Bank has finally reacted to the eurozone’s lackluster economic growth (0.6% annualized in third quarter) with promises of new stimulus, to potentially include sovereign bond purchases as needed. We are encouraged that this has minimized contagion to the financial system this year such as we saw in both 2011 and 2012. In very recent comments (11/17/2014), Draghi has sounded somewhat upbeat, noting that the region’s credit cycle appeared to be turning favorably. Nonetheless, the region’s economy may continue to struggle until policymakers allow more fiscal flexibility to revive aggregate demand, Russian sanctions are reduced and/or the global economy strengthens enough to pull the region out of its fragile state. Until clear improvement comes, the ECB may be compelled to increasing quantitative easing measures. It is one of the last options the central bank has left, and there is a rising chance they’ll announce a new easing program at their next meeting on December 4th.

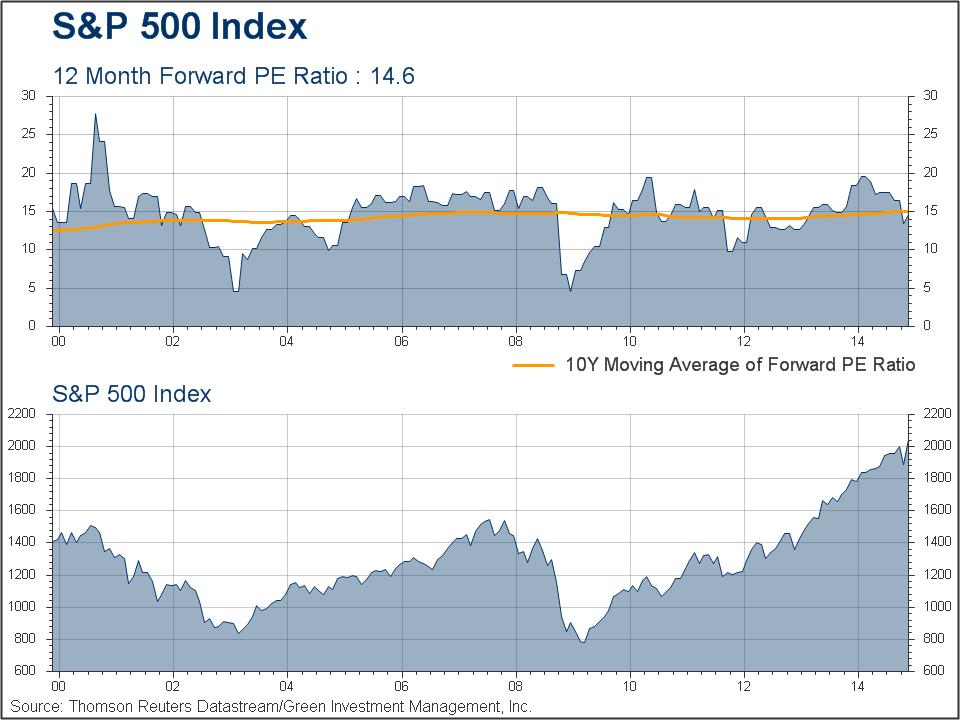

Despite the eurozone’s issues, we feel the U.S. and most global equity markets are positioned for continuing strength. Third quarter earnings have fared better than many expected, and forward earnings momentum should continue to improve as the economic recovery solidifies. In aggregate, industry analysts are calling for 8.5% earnings growth for the S&P 500 over the next four quarters (Q42014-Q32015, source: FactSet Research). From a valuation perspective, the forward P/E ratio for the S&P 500 (see “S&P 500 Index” chart below) reflects reasonable value at 14.6, slightly below the 10-year average of 15. If the multiple stays steady and projected earnings play out as anticipated, large cap U.S. equities should produce high-single-digit returns in the year ahead. We think upside surprises to returns outside the U.S. are most likely to come from Europe, Japan, India and other select emerging market equities that have either underperformed relative to the U.S., or that implement new policies to encourage better growth going forward.

A strengthening U.S. economy should eventually lead to rising interest rates by mid-to-late 2015. This will negatively impact U.S. bonds. The following recent quote from Mark Zandi, chief economist of Moody’s Analytics, emphasizes the risk-side of a rate increase environment: “The job market is steadily picking up pace. Job growth is strong and broad-based across industries and company sizes. At this pace of job growth, unemployment and underemployment is quickly declining. The job market will soon be tight enough to support a meaningful acceleration in wage growth.” Mark’s quote generally reflects our sentiments on the U.S. economy and the difficult environment that its improvement may produce for domestic bonds.

While domestic bonds in general may struggle against rising rates, there will likely still be pockets of opportunity in the months ahead. We currently like:

- Convertible bonds: They participate in a rising equity market while generally producing more income than equities.

- High yield bonds: Their higher yields can help buffer the negative effects of rising rates while benefiting from an improving economy.

- Dollar-denominated emerging market bonds: Many emerging economies will benefit from the recent decline in energy prices. These may reduce inflationary pressures and lead to lower rates or more accommodative central banks in those countries.

Following the recent spike in market volatility, we implemented a more “risk-on” view in our bond portfolio, as valuations were driven to levels that we find attractive given credit fundamentals. We increased our holdings in high yield, convertible and emerging market debt, while continuing to have our portfolios positioned for higher U.S. rates. In this environment, high quality bonds provide a counterweight—one of the few positive ones available—in case a “risk-off” scenario occurs.

Further observations on recent oil price declines:

A downside of continuing oil price drops is the risk they bring for destabilizing nations that depend on oil export revenues. This could negatively affect global economic activity and markets (as occurred when oil prices collapsed in 1985-86). Currently there are no clear signs of any breakdown in vulnerable countries, but we will watch for these. Ultimately, weaker prices should lead to increasing marginal demand and decreasing marginal supplies, which should help oil prices stabilize in the months ahead. This is especially true if the global economy begins to pick up steam. An important OPEC meeting will take place at the end of November when the organization may take action, such as cutting production to stabilize or even raise prices.

Those are the most prominent and pressing issues on our radar right now. Going forward, we can always be certain of uncertainty, so we will be monitoring the situation closely and getting back to you as the situation warrants. We send thanks to those of you who are our clients. We value the trust you have placed in our firm and we sincerely appreciate your business. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of November 18, 2014 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 11-18-2014

Click here to download printable PDF of GIM Market Commentary 11-18-2014