Risk assets have been in the midst of a pullback recently, the inevitable correction that comes at some point after a long, low volatility advance. The markets have a way of reminding us every now and then that there is still risk in investing. The decline comes in October, a time notoriously associated with previous notable market breaks.

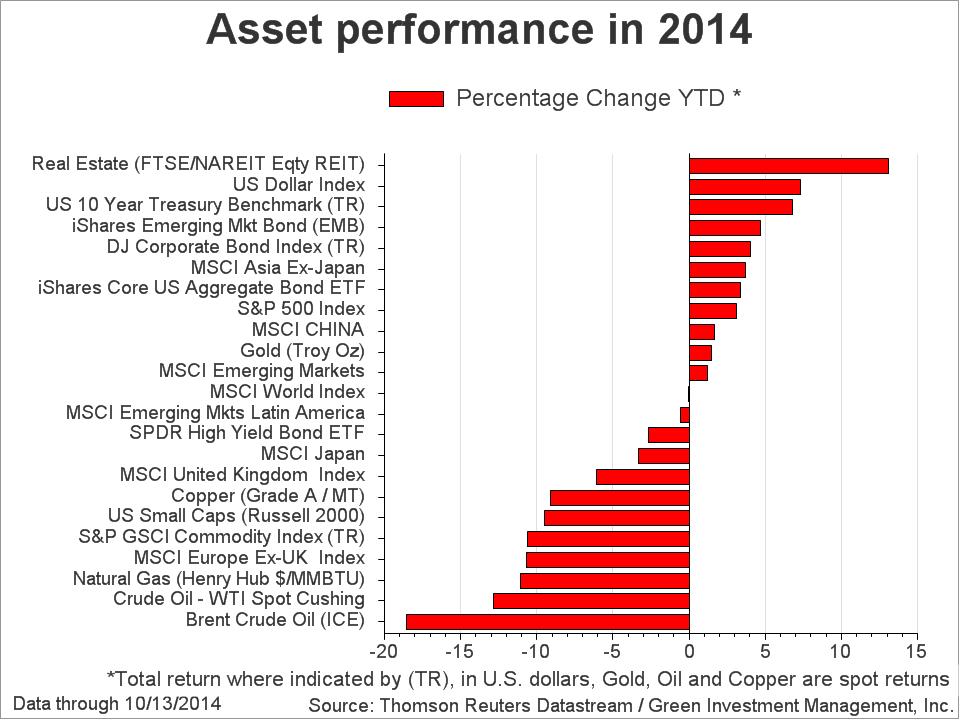

In this downturn, small cap stocks and emerging market equities have experienced outsized declines, but still within normal ranges for moderate corrections. High yield bonds, convertible bonds and non-dollar denominated emerging market bonds have also felt downward pressures over this period, while quality bonds and Treasuries have been boosted by declining interest rates.

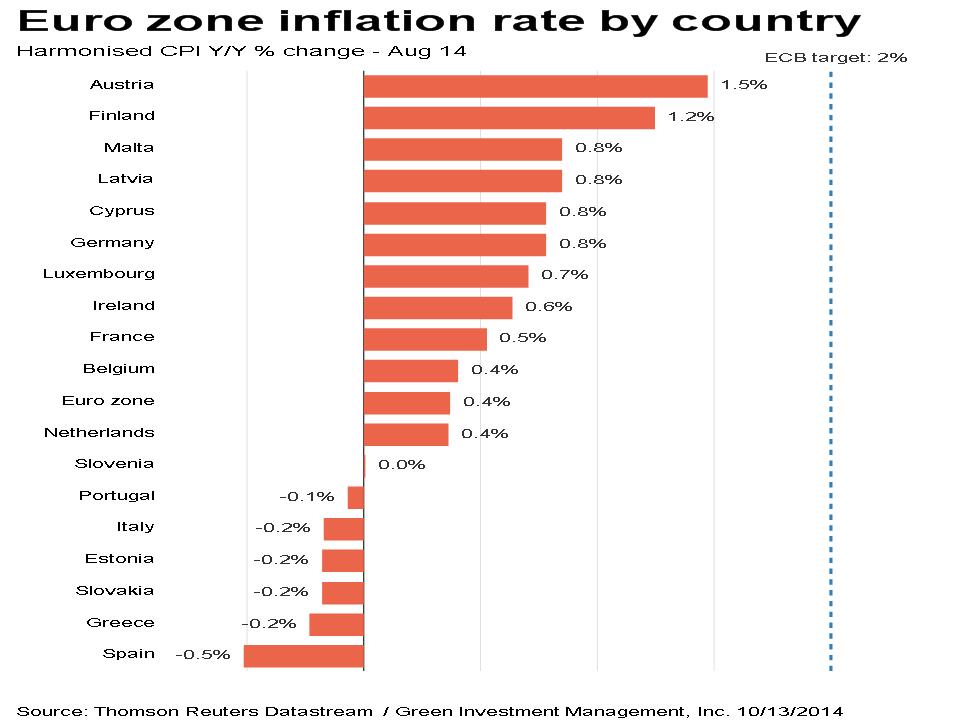

So what factors have led to the correction? There are multiple drivers of the market’s current weakness. With the U.S. economy showing signs of acceleration and an increasing expectation of reduced Fed accommodation in the months ahead, there are fears that future rate hikes may have a negative impact on bond returns and possibly spill over into equities. At the same time, deflationary pressures from a fading European economy are driving global interest rates down and creating a strong contrast with our improving domestic fundamentals. The Fed is very aware of these global deflationary forces and will proceed with any rate hikes cautiously.

One of the current challenges in this environment is determining how much more disappointing European economic data it will take to initiate greater monetary support from the European Central Bank (ECB) or fiscal leniency from Germany. In the meantime, there is concern that U.S. quarterly earnings reports may disappoint, due to the effect of a stronger dollar and a weaker European economy on the international component of corporate earnings.

Geopolitical concerns have also morphed this year from one focal point to another, adding to investor anxiety. For awhile, Russia’s annexation of Crimea and military campaigns into Ukraine captured the most attention, not to mention reaction in the form of sanctions. Now the focus has moved to ISIL’s violent advance through wide swaths of Syria and Iraq. Both of these situations have the potential to regress into more economically impactful armed conflicts, though for now they seem to be limited in their direct significance to the global economy. And if these crises were not enough to raise anxiety levels, now the spread of Ebola has elevated concerns further. Not only is the global community fearful for those that have contracted the deadly virus, but there is increasing concern that widespread travel restrictions could hamper international business. For now, though, the financial impact of the crisis appears to be small.

So what does all this mean for equity markets in the days ahead? It most likely means that global stocks may continue to struggle in the near term, especially given amplified deflationary pressures from the Euro area. Fortunately, there do not appear to be any meaningful signs of financial distress. Ultimately, we believe the ECB will respond more aggressively, if in their characteristically late fashion. The central banks of both the Euro area and Japan should be an ally to investors in the months ahead. Coupled with an improving U.S. economy and relative economic stability in China as policymakers there inject more liquidity, these dynamics should allow the current global slowdown to become merely a pause in a longer expansionary period. Stocks will most likely resume their climb in the months ahead.

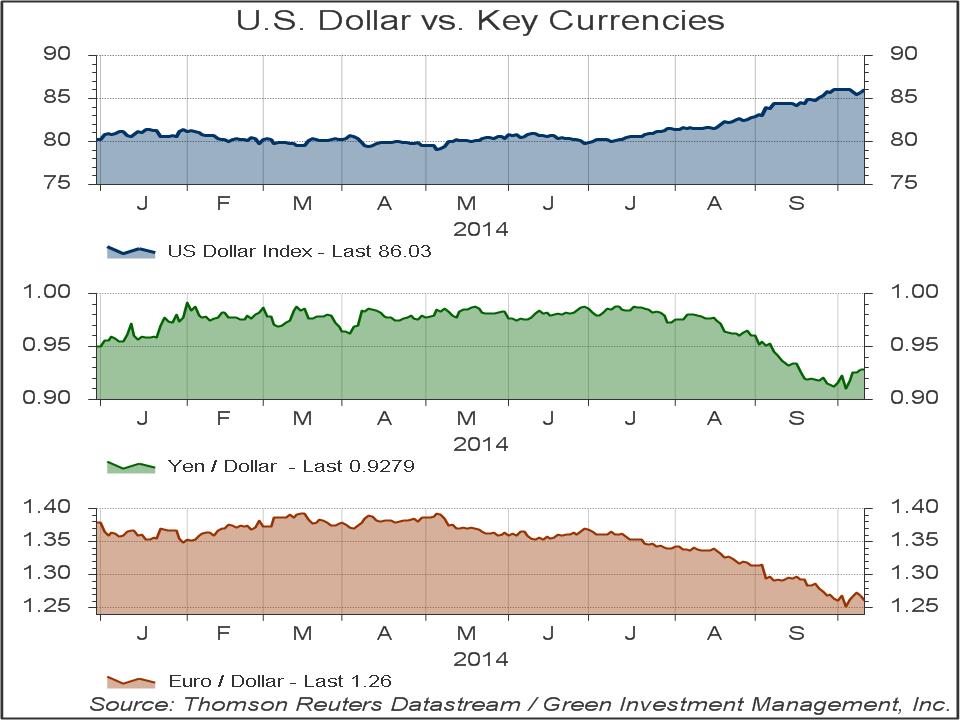

The U.S. dollar plays a significant role in the current environment. It has climbed more strongly than most expected this year, rising 7.3% against a basket of our trading partners. It has risen even more against the Euro, up 8.6%. Most of the rise has come in the last three months.

This strength is at least partly responsible for the recent sell-off in many commodities—especially oil—which trade primarily in U.S. dollars. The dollar is somewhat overbought currently, and while this may cause a temporary counter-rally, we expect it will continue to trend higher in the months ahead as the U.S. economy grows at a faster rate than most of our trading partners and a Fed rate hike nears. A strong dollar will be a mild headwind for domestic manufacturing & exports, with exceptions in some industries like semiconductors which will be affected more significantly. But overall, improving domestic demand from both increased capital and consumer spending should offset many of the negative effects.

Globally, a strong dollar is more impactful, especially to economies such as Germany and Japan that depend heavily on exports. Combined with improving U.S. fundamentals, it creates a badly needed boost in demand for goods from these countries (and others), which are suddenly less expensive. In effect, a stronger dollar can export growth to Europe and Japan. A stronger dollar also serves to moderate inflationary pressures here at home. Both of these effects may lessen the upside to be expected in U.S. rates. Combined, they may serve to extend the length of the current economic cycle well beyond the average.

So what does this mean for bonds? Our base case is for the underlying economic up-trend to remain intact, with U.S. growth accelerating moderately and global growth picking back up in the coming months. Improving growth will push interest rates up, with the Fed instituting their first rate hike sometime in the middle of 2015. Since government bond yields are so compressed and offer little compensation for this risk, it raises the need for maintaining shorter durations than normal. Even if the Fed Funds Rate rises less than previously expected, the Treasury market could still become jittery as the time draws near. Because we do not expect rates to rise dramatically, the impact should be manageable.

In the high-yield sector, credit spreads remain well above the lows of 1997 and 2007, and there is potential for spread compression as the economy improves. The U.S. corporate speculative grade default rate was estimated to have increased to 1.6% in September after reaching its lowest level since the financial crisis in July. Standard & Poor’s Global Fixed Income Research expects the trailing 12-month default rate to rise to 2.7% in the year ahead. This modest initial upturn may inhibit further spread compression. And beyond the spread itself, just the low absolute level of yields in the “high” yield space tempers our expectations for returns at this stage of the business cycle. Once the stock correction has run its course, we do expect some rebound in high yields as well as in convertibles.

Commodity indexes have underperformed recently, particularly when compared to U.S. equities. They are being affected by the rising dollar and the softening economy in Europe. This is especially true for oil that is priced in U.S. dollars in international trade and is being negatively affected by a convergence of improving supplies (especially from U.S. shale) and softer demand. Brent crude and West Texas Intermediate Crude are down 18.6% and 12.9% year-to-date, respectively. Commodities continue to adjust to the end of the secular cycle that took place from the late 1990s until the 2008 financial crisis. An infrastructure spending spree created overcapacity that has gradually been worked off or removed. We believe commodity prices are at reasonable levels from a long-term valuation perspective, but they may continue to underperform in the short run due to U.S. dollar strength and disinflationary pressures. In the intermediate term, we expect an improving global economy to provide an environment for favorable performance. Commodities remain an important tool for hedging against unexpected changes in inflation, and provide diversification against stocks and bonds. Should there be an improvement in emerging market demand and an upturn in inflation expectations, commodity returns could improve. In the meantime, weak commodity prices are a major stimulant to the major net commodity importing economies.

Going forward, we recognize the probability of further short-term market volatility. We continue to recommend that investors be overweight in stocks relative to bonds for a properly balanced allocation. Stocks should benefit as global growth gradually improves. Deflationary pressures are putting key central banks around the world in a reflationary posture, essentially making them an ally of risk assets. The recent decline in the Euro should help to mitigate deflation risk in Europe, but the ECB needs to act soon.

Those are the most prominent and pressing issues on our radar right now. Going forward, we can always be certain of uncertainty, so we will be monitoring the situation closely and getting back to you as the situation warrants. We send thanks to those of you who are our clients. We value the trust you have placed in our firm and we sincerely appreciate your business. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of October 14, 2014 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 10-14-2014

Click here to download printable PDF of GIM Market Commentary 10-14-2014