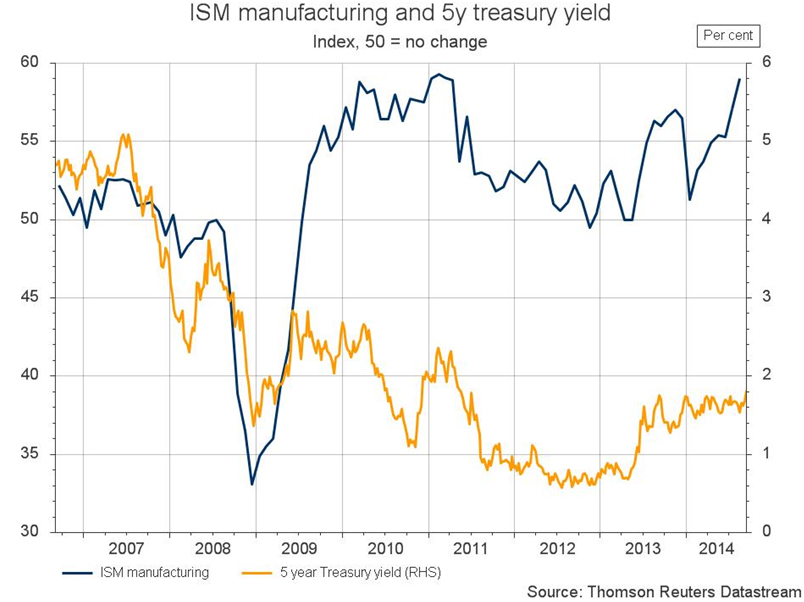

The U.S. economy continues to build on the strength we reported in last month’s commentary. The ISM manufacturing index is near a 10-year high. Car sales are the strongest in over eight years. Job creation continues to be solid and last Friday’s data on domestic retail sales revealed a 0.6 percent increase for August. Falling energy prices (gasoline prices are down 19% from highs in June), a shrinking budget deficit (more than 20% below a year ago), strong equity returns and low mortgage rates should boost consumer confidence, which is already near multi-year highs, even further. According to FactSet Research Systems, for all of 2014 and 2015 the projected earnings growth rate of the S&P 500 is 7.3% and 11.5% respectively.

All of this data points to an accelerating economy that appears to have very broad-based support. The favorable data also seems to point to a self-sustaining jobs expansion. This happens when the growth of new jobs drives growth in aggregate income, which in turn drives consumer spending and ultimately even more new jobs. This is great for the economy, but also means the Federal Reserve’s accommodative monetary policy will no longer be required to sustain growth and will most likely come to an end sooner rather than later. Last week’s bond market weakness indicates these concerns may already be reaching a tipping point as rates surged on anxiety about the upcoming Federal Open Market Committee meeting later this week. The forward-looking language the Fed provides at that meeting may accelerate market expectations of a rate hike earlier in 2015 than previously expected.

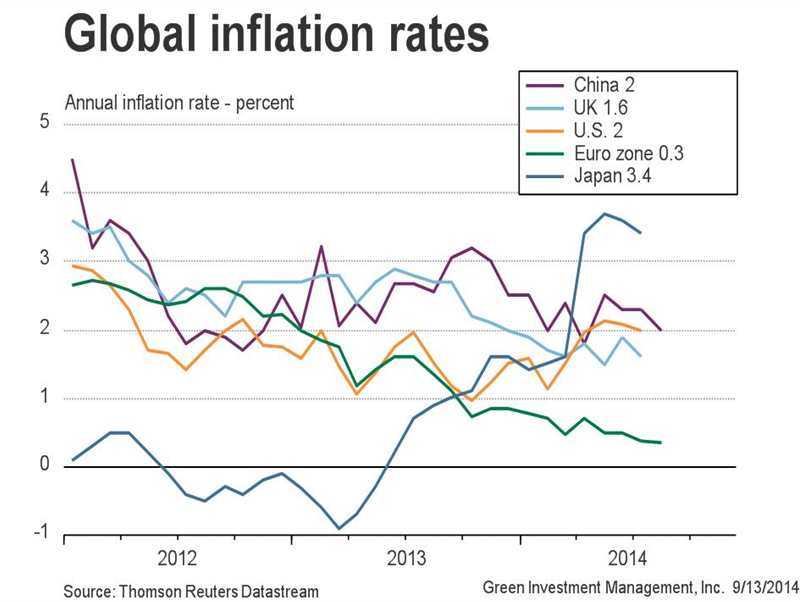

This contrasts markedly from other key central banks around the world. Less than two weeks ago, the European Central Bank cut interest rates and indicated it will soon begin new quantitative easing to help bolster the soft Euro-zone economy. China and Japan are also expected to continue to stimulate their economies in the face of sluggish growth. These efforts should help keep global monetary conditions from becoming too tight and maintain real gross domestic product (GDP) growth at a 3.1% global rate for 2014 (versus 3% for 2013). Growth for 2015 is projected to rise to 3.7% (by Goldman Sachs Global Investment Research).

Amidst this strong overall outlook, there are important geopolitical risks that have the potential to increase market volatility and damage returns. The conflict in Ukraine seems to be the worst of these right now. But the extremely violent Islamic State militants in Iraq and Syria (a.k.a. ISIS or ISIL) might have the most long term destructive potential. Either conflict could deteriorate quickly, but we believe the odds of a broad-based and lasting market impact from them are relatively low. Here’s why:

- In the Ukraine, we believe Russia may have accomplished its short term objectives, and therefore attempt to de-escalate the conflict in the weeks ahead in an effort to lessen economic sanctions. The sanctions are starting to have a significant impact on Russia’s economy, but relatively less on Europe. Cutting off Europe’s access to natural gas remains the most deadly arrow in Russia’s quiver, but we believe the risk of it being used is low. Russian gas may supply 45% of Europe’s demand, but European purchases also account for 72% of Russia’s total gas sales. In other words, if Russia shut off the spigot it would probably hurt itself at least as much as Europe. Our expectations are for instability in the region to persist. As long as Ukraine is pro-western, Russia will seek to keep it weak and unstable, and a complete resolution to this is not likely any time soon. But we do not anticipate the situation deteriorating to the point of significantly affecting the global economic outlook.

- According to President Obama, we are building a coalition of allies and partners to support the defeat of ISIL. While ISIL’s actions are extremely violent and disturbing and occupy a great deal of news-space, it’s important to remember that Iraq’s economy only accounts for 0.3% of world GDP. So as with Ukraine, the conflict isn’t likely to overturn global growth. With that said, Iraq is one of the world’s major oil producers. A complete loss of output would have a considerable impact on prices. But out of the 3.3 million barrels a day that Iraq produces, 2.8 million comes from the Shiite-dominated south, outside of ISIL’s current zone of influence. And production in the northern part of Iraq is used mostly for internal consumption. Furthermore, we expect the current plans to form a coalition against ISIL will be sufficient to prevent the conflict from growing into something that could significantly damage our outlook.

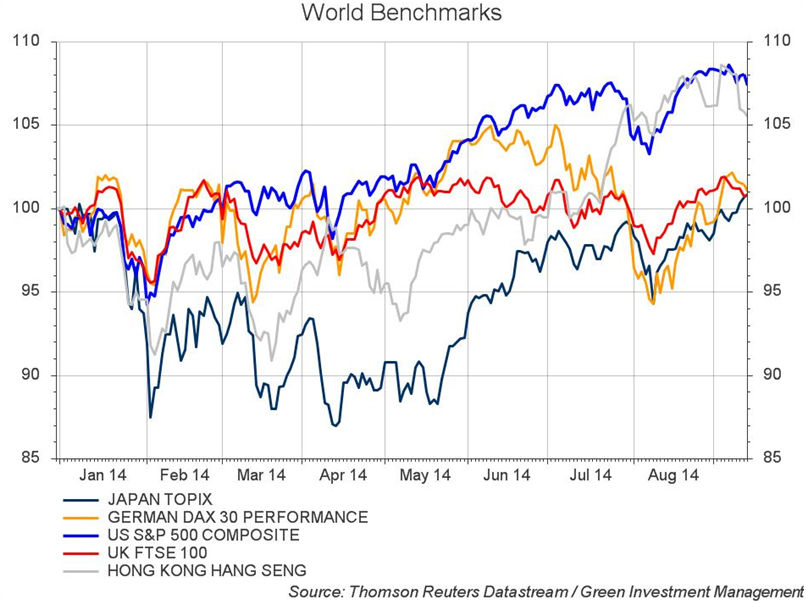

Our general expectation is for an improving U.S. and global economy that supports equity gains in most of the major regions. The European Central Bank’s (ECB) recent policy actions reflect the weaker growth and inflation experienced in the Euro-zone of late. This has limited European equity performance. But we think the ECB’s monetary action will eventually prove positive for equities. Volatility may remain elevated for the remainder of the year, but we still prefer equities over other asset classes, and will likely maintain this outlook as long as monetary policy remains supportive, the global economy continues to improve and valuations do not stretch. We like the valuations available in Europe as well as Japan now. But because of the diverging monetary policy between these countries and the U.S., we also expect strength in the U.S. dollar. Consequently, we favor investment vehicles that can hedge the currency risk out of these developed markets.

The recent trend of sporadically rising bond yields in the U.S. will likely persist in the months ahead. From an equity strategy perspective, anticipation of the first rate hike typically increases market volatility, but rarely marks the end of a bull market in stocks. If this holds true, it will be supportive of our continued overweight in equities, one we have maintained relative to bonds for months now.

We believe that US treasuries are broadly overvalued, but we are still constructive on corporate bonds – especially high yield bonds. Yield differentials over treasuries remain sufficient to cushion the negative impact of rising rates. This will likely continue to be true as long as monetary policy does not tighten sharply, growth and profits continue at favorable rates and geopolitical risks don’t escalate. However, preparation for what may happen at the Fed in the coming months has us taking a more cautious stance regarding interest rate risk. We have shortened the duration of our portfolios materially and are monitoring economic and geopolitical developments carefully.

A hawkish surprise at the upcoming Fed meeting would push interest rate expectations higher in the U.S. and would likely weigh on emerging markets (and especially their currencies). Absent such a surprise, emerging market equities have been garnering more favorable flows in recent months – encouraged by more constructive data from China and a reinvigorated India under Prime Minister Modi.

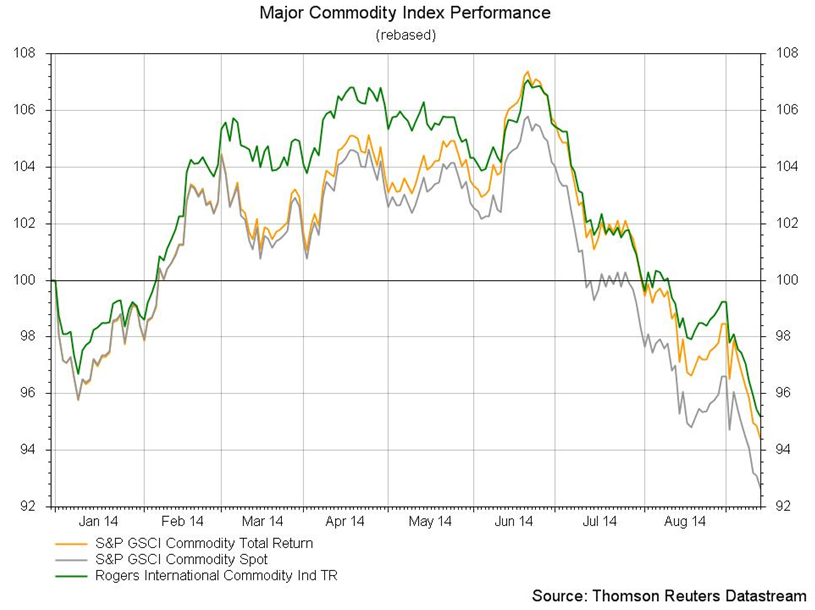

Within the commodity markets, gold has been one of the biggest casualties of the improving U.S. economy, hitting an 8-month low recently. Oil prices have also weakened as US crude production has rebounded 65% from its trough in 2008. A surge in U.S. oil shale production, softer demand from Europe and a stronger dollar have all contributed. In the months ahead, we expect that oil demand will increase as the global economy picks up steam. In the meantime, recent reductions in crude output by Saudi Arabia to the tune of 400,000 barrels per day should lessen the imbalance that is driving prices down. Overall we are relatively neutral on commodities, but expect a continued divergence of returns within the investable commodity complex in the months ahead.

Those are the most prominent and pressing issues on our radar right now. Going forward, we can always be certain of uncertainty, so we will be monitoring the situation closely and getting back to you as the situation warrants. We send thanks to those of you who are our clients. We value the trust you have placed in our firm and we sincerely appreciate your business. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of September 16, 2014 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 09-16-2014

Click here to download printable PDF of GIM Market Commentary 09-16-2014