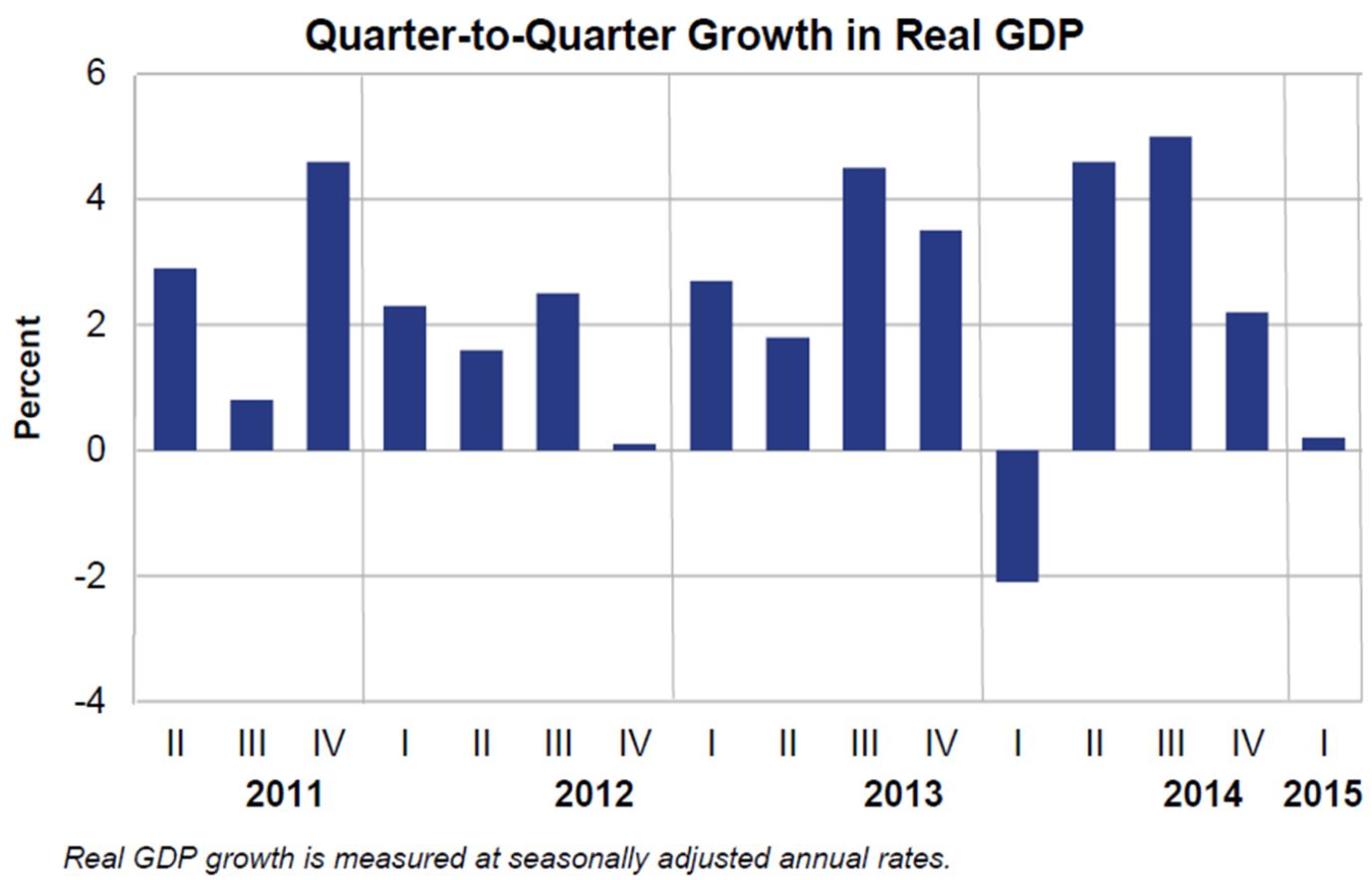

I began 2015 with expectations of a global economy that would accelerate as the year progressed. Growth would be fueled by new contributions from primarily Europe and Japan – the result of an unprecedented easing from the central banks of these two important areas. In retrospect, I (along with most everyone else) didn’t expect such a disappointing first quarter economic performance here in the United States. According to the “advance” estimate released on April 29th by the Bureau of Economic Analysis (BEA), first quarter real gross domestic product (GDP) increased only 0.2 percent, similar to last year’s first quarter, weather-related washout. And these numbers could be lowered further in the next revision expected on May 29.

All this comes after a lukewarm increase of 2.2 percent in the fourth quarter of 2014 (see the Chart below from the BEA). Across the Atlantic, the United Kingdom’s first quarter economic output was similarly disappointing. It’s not surprising that this news has rattled markets a bit, especially since both the U.S. and the U.K. have spearheaded the global recovery in recent years. Their current lack of leadership stands out by way of contrast. But what does it say about the future of the economic expansion and the durability of the bull market from here?

While first quarter economic data was disappointing, warning sirens of impending doom are probably a little premature. There were a lot of dynamics taking place during the first quarter that affected the numbers. U.S. growth appears to have been worsened by a huge surge in imports as the result of a settlement of the labor dispute in West Coast ports, not to mention severe weather effects in several regions. A decline in business investment, notably in oil wells, also took a toll. But my expectation is for a snap-back in growth in the second quarter. This is more than a matter of intuition. Consider these factors:

- The weather effect on growth in the first quarter has been estimated by some sources to be as high 1.25%. There should be a natural rebound from some of those missed economic activities in the following quarter.

- In its May 1, 2015 publication, U.S. Economic Analyst, Goldman Sachs pointed out that the first quarter GDP weakness was at odds with other data measured by its Current Activity Indicator (CAI). This near real-time composite of economic activity showed 2.8% growth on a quarter-on-quarter annualized basis. The 2.6-point gap between the CAI and reported GDP was the largest in the history of the indicator (1997-2015). And Goldman noted that historically, gaps of 1.5 points or more have on average been unwound by a subsequent acceleration in GDP growth, rather than a slowdown in the CAI.

- Dave Altig, executive vice president and research director of the Atlanta Fed, observed in a recent publication entitled All Eyes on the consumer, that “the fundamentals suggest the four-month annualized growth of consumer spending should have been in excess of 4 percent, as opposed to the approximately 1.5 percent we actually saw. That is a story we don’t expect to persist, and our current view of the year is that first-quarter consumer spending results are not indicative of future performance.”

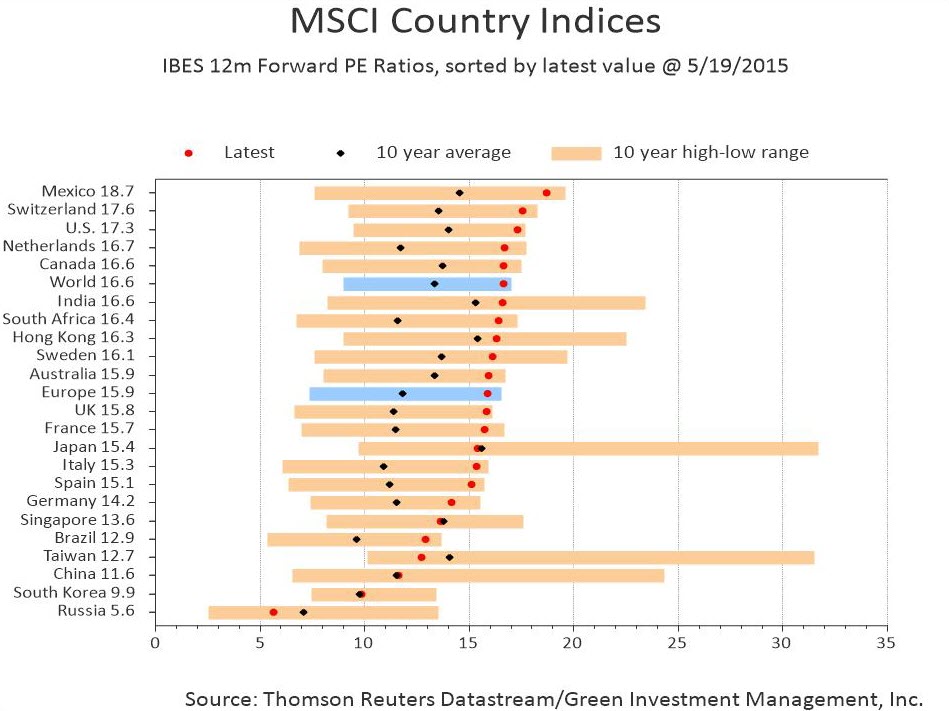

All told, while global growth momentum has slowed somewhat, I anticipate a rebound in the near-term, one that appears to be underappreciated by the markets at the moment. This is important because when fears of slow growth rise, valuations become more critical considerations for investors.

As you can see from the chart above, global valuations in terms of 12-month-forward price-to-earnings (P/E) ratios are well above average and near the top of their ten-year ranges. Keep in mind that this is against a backdrop of global deleveraging and rising savings rates, both of which help mute global growth. This is what has led to the current environment of unprecedented worldwide monetary policy accommodation. Both Europe and Japan have taken a page from the U.S. monetary playbook. The European Central Bank (ECB) has committed to keeping its massive easing program in place until at least September of 2016. All told, about 20 central banks across the globe have cut their rates in recent months. This should help keep rates low for much longer than we have normally experienced in previous expansions-and this should serve to extend the length of the expansion. So yes, equities are no longer compelling from many different valuation perspectives. But these valuations have to be compared against other competing assets and the unusual environment that we are in. You can’t point to bonds and say they are more compelling than equities or that cash-earning almost 0 percent-is a good investment. As long as we live in a world where economic growth is muted and more than half of all sovereign bonds yield less than 1%, then high equity valuations can be supported. At some point in the future this expansion will come to an end, as will the current bull market. But I don’t believe we are there yet-there is still more gas in the tank.

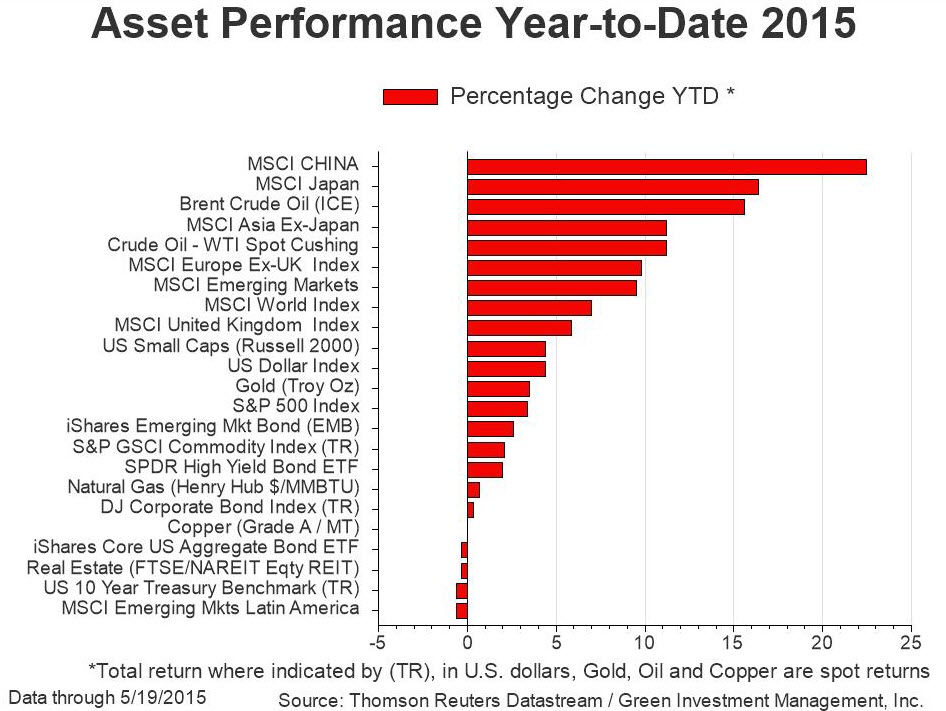

Reflecting uncertainty, U.S. large cap equities have been trading in a narrow range of under 4% since the first of the year. As I have been expecting for some time, the U.S. finally appears to be passing the stock market performance baton off to China, Europe and Japan (see graph below).

In light of all these circumstances, I believe the case is compelling for stocks to continue outperforming bonds and for corporate bond returns to exceed treasuries. In a global environment where growth and income are scarce, investors will be willing to pay for both. And for the first time in some time, the U.S. equity market is not the only place to be among a myriad of global opportunities.

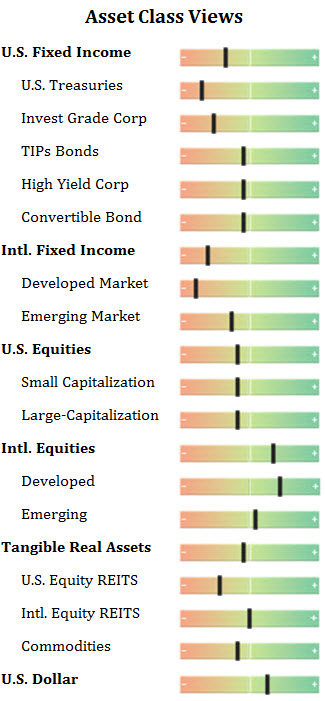

Here is a summation of my current views on some of the primary asset classes:

Equities: As said, I remain constructive on equities. Valuations have advanced, but the environment is still generally favorable. Within developed markets I would modestly underweight U.S. equities, and overweight Europe and Japan. The Eurozone economy grew by 0.4% in the first quarter, the fastest pace of growth in about two years. The ECB’s quantitative easing program, a weak Euro and lower oil prices all contributed to the better-than-expected results. If Europe can find a way to negotiate a non-disruptive deal with Greece regarding its debts, this would be a very favorable green light to the markets.

In emerging markets, country and region selection remain critical. I generally like the current dynamics in India, China, Korea, Taiwan and Mexico, to name a few. Policy reform and monetary stimulus are common to many of the more attractive country-specific opportunities. As I mentioned earlier, U.S. and global growth should improve in the coming months and bring tailwinds for the equity market that may strengthen as the year progresses.

Fixed Income: Credit has outperformed other fixed-income categories year-to-date, with high-yield bonds outpacing their investment-grade counterparts. Going forward, I expect the advance in global bond yields to persist as the expansion continues to gain traction. A gradual reappraisal of the outlook for inflation should continue to drive nominal yields higher across the major markets. For this reason I continue to recommend exposure to Treasury Inflation-Protected Securities (TIPS) in many of our strategies, and an underweight to longer maturity Treasuries. I continue to recommend a modestly underweight position to bonds in our balanced allocations, while recognizing that bonds play a critical diversification role versus stocks in a multi-asset portfolio. At this time, a Fed funds rate hike in September appears to be the most likely scenario.

Commodities: After bottoming in mid-January at around $45 a barrel (Brent Crude), the oil market has rebounded to around $66 today. In fact, it rebounded so briskly that the rebound itself may derail the market’s natural rebalancing of supply versus demand that caused producers to cut capital expenditures for drilling. Therefore, I expect that oil prices may stabilize at current levels or move a bit lower in the months ahead. For the overall commodity complex, almost every commodity is trading significantly below its five-year average as the market continues to adjust to overcapacity. At the same time, global growth should offer what I expect to be at least some favorable early entry points to better returns going forward. Currencies: Divergence in global growth and in central bank policy should continue to fuel the relative strength of the U.S. dollar versus global currencies, especially the euro. The recent growth scare in the U.S. upset this dynamic temporarily, but dollar strength should resume assuming the U.S. economy snaps back from the weak first quarter.

Conclusion: The stock market and risk assets in general tend to perform best during periods of recovery and expansion, and poorly during contraction. It appears to me that the U.S. economy is still in expansion mode, while Europe, Japan and many emerging market economies are showing signs of improvement. In other words, the bull still appears to be alive and well at the moment. Being negative in such a setting will not likely be a rewarding exercise. I will keep abreast of economic and other relevant changes as they happen and report these back to you through this newsletter. Thank you for reading, and especially thank you for your business, if you are a client!

Disclosures: The views expressed are those of Byron Green as of May 20, 2015 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 05-20-2015

Click here to download printable PDF of GIM Market Commentary 05-20-2015