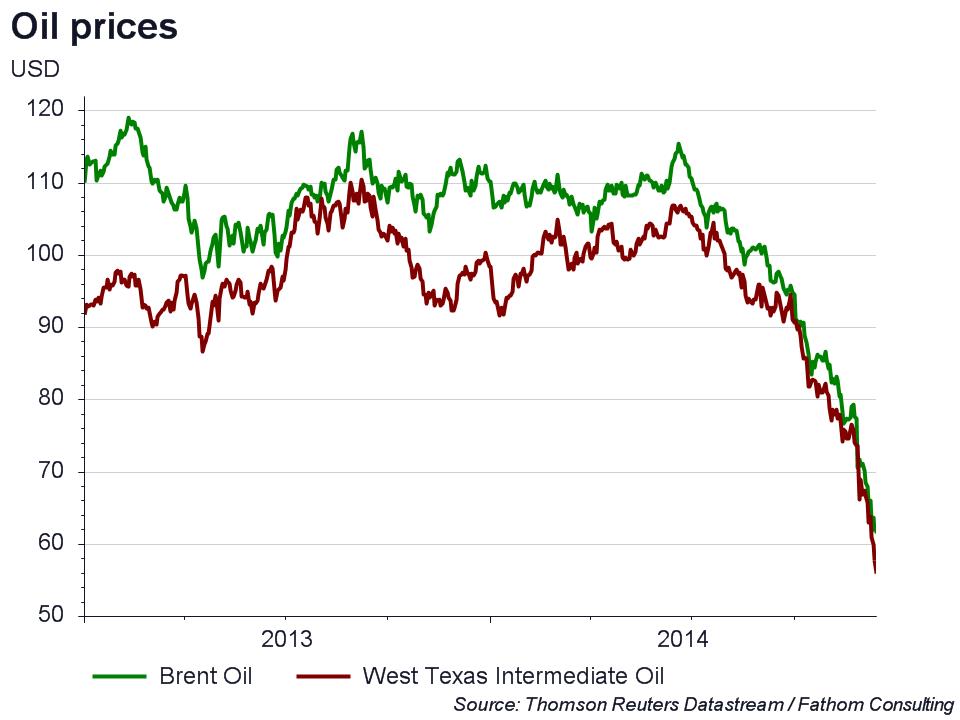

Rapidly falling oil prices have given the markets a case of the jitters. It’s a little like the nervousness we all felt as children entering a new school – a little uncertain about what the coming year will hold. Make no mistake, lower oil prices are beneficial for much of the world, like an instant tax cut for consumers. Doesn’t it feel good to go to the pump and spend less than you expected? It also opens all sorts of discretionary possibilities for what to do with the windfall. But like most good things, someone is paying the cost. In this case, it’s the oil producers who are taking it on the chin.

And producers are not just oil exploration and production companies. Some nations that are net exporters of oil rely on the revenues to run the country. Such nations—including Russia, Nigeria and Venezuela—are already feeling the pressure. The ruble has fallen over 55% this year, while the iShares MSCI Russia Capped ETF has declined over 50% (in US Dollar terms). To be sure, there have been other factors affecting Russia, such as sanctions over Crimea. But if oil prices stay low for an extended period, or fall further from here, the stress on Russia and other producing countries might develop broader ramifications. Before considering that further, let’s look at the positive side of cheap oil.

Not only are lower oil prices a boon to consumers around the world, they also reinforce a disinflationary environment. That creates flexibility for central bankers in providing policy accommodation going forward. This is especially salient for the euro-zone and Japan, both of which are struggling with sluggish growth and deflation concerns. It allows them to stimulate their economies even more. The benefits also accrue to oil importing countries that have been maintaining tight monetary policies to combat local inflation, but may now be able to ease policy toward growth instead.

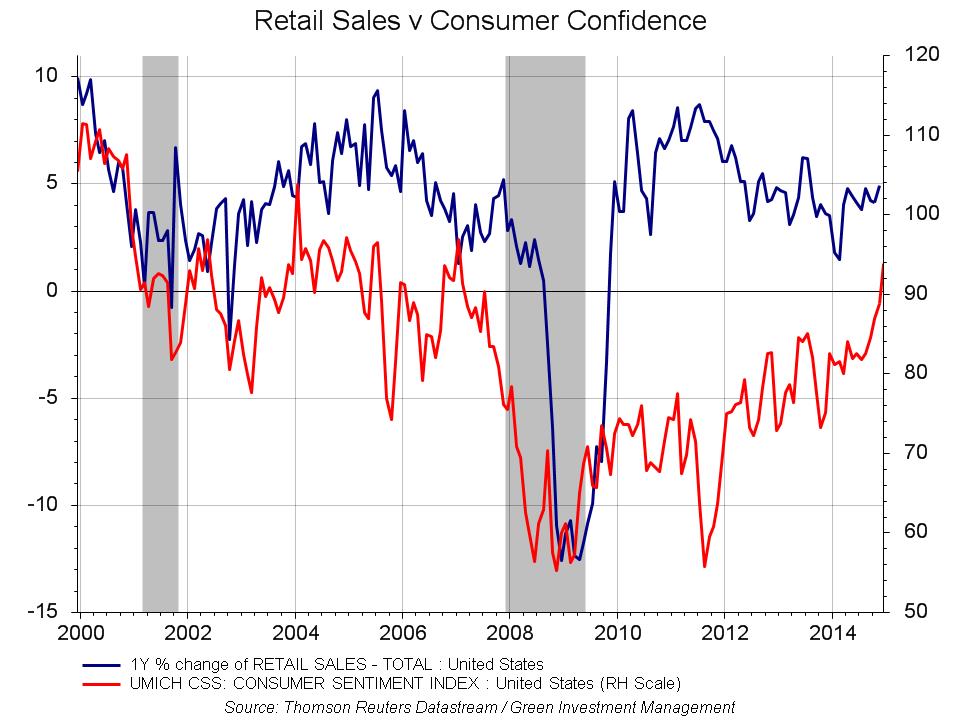

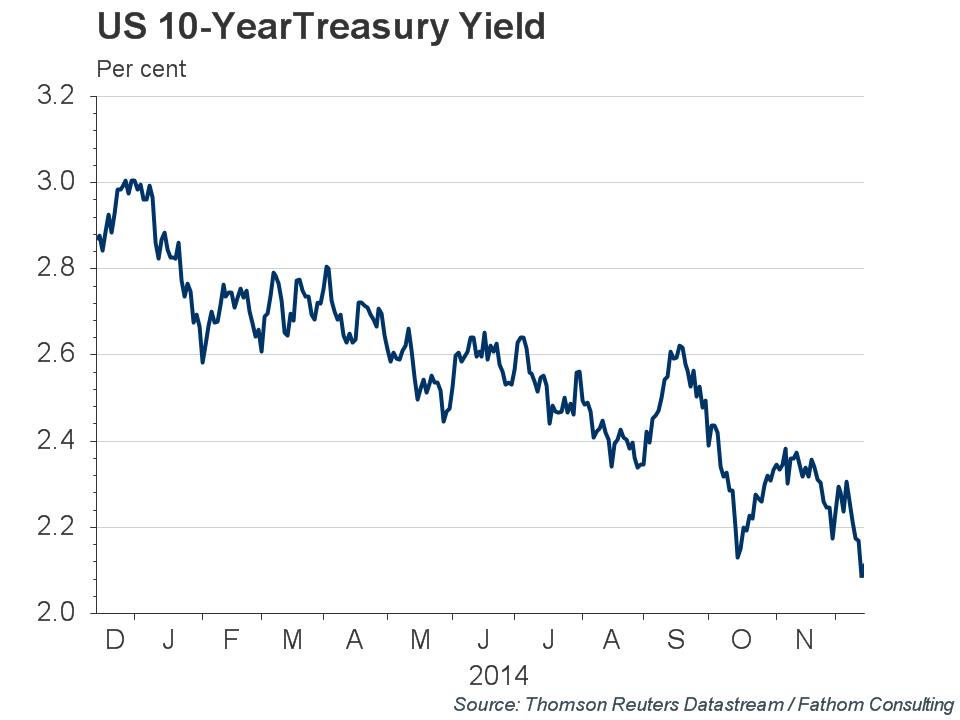

The U.S. economy continues to be one of the best stories around and the main driver of global growth. It looks poised to break out of the “timid 2s” (2%-type growth) that have persisted for some time. Earnings growth is encouraging companies to hire more workers and invest more in their businesses. With a little luck, we expect 3%-plus figures to be the norm in 2015. While the Fed may be approaching a rate tightening episode in the last half of 2015, falling oil prices (which have helped push consumer confidence to a seven-year high) and sinking bond yields should create momentum to carry the economy successfully through higher rates. And as the Fed moves towards the QE exit, the European Central Bank (ECB), the Bank of Japan (BOJ) and the People’s Bank of China (PBOC) will likely maintain a bias toward easing. This will help keep global rates anchored. So while we expect some short-term turbulence in response to Fed tightening, we do not expect it to derail good returns to equities.

Improving momentum in the U.S. (and rising discretionary income) should give a boost to imports. That should help global trade and most global equity markets. It should also support a stronger dollar, the negative effects of which could be largely offset by rising U.S. wages and income.

The euro area has struggled throughout the year. Low inflation and the risk of deflation are likely to keep monetary policy generally supportive. And we expect an announcement of sovereign quantitative easing (QE) from the ECB in early 2015. If this happens, it will keep downward pressure on the euro currency.

The European Union (EU) has drawn up a wish list of almost 2,000 projects worth 1.3 trillion euros ($1.59 trillion) for possible inclusion in an investment plan meant to revive growth and jobs. Investment has been a casualty of the financial crisis in Europe, and these projects are meant to alleviate the situation and create real growth. Leaders of the 28-nation EU must approve the plan at a summit in Brussels on December 18-19. The plan is expected to be operational by mid-2015 and doled out over three years. We think this, as well as easier financial conditions, less fiscal drag and lower oil prices will help growth accelerate in the EU in 2015.

In Japan, Prime Minister Abe’s party handily won an election he called as a referendum on his economic plan. The island nation has been stuck with low-to-negative GDP growth recently. We think continuing monetary stimulus (read, a weaker yen), corporate tax cuts and a delay of the VAT hike should pull growth back into positive territory in 2015.

Emerging market economies are somewhat mixed, with continued gradual deceleration in China. Meanwhile, improvement is generally expected in Latin America, India and parts of Asia. Rising demand from the U.S. should help spur growth in these places.

Overall, our asset allocation is biased toward growth. A broadening global recovery with easy monetary policy and low inflation should support outperformance by equities relative to bonds, commodities and cash.

With that said, U.S. stock market leadership may fade in the coming year as global growth strengthens. Internationally, we are focusing on competitive economies that are positioned to benefit from an improvement in the global trade cycle. These include countries such as Germany, Japan, Sweden and much of emerging Asia. We expect P/E expansion in these countries as earnings growth and valuations rise, in some cases, from depressed levels. And compared to developed markets, emerging equity valuations and yields are the most attractive they have been in some time. Weak commodity prices could give a boost to many of these countries with oil-importing consumer sectors, including India and China.

As we previously mentioned, not everyone benefits from cheaper oil. In places where oil exports are a crucial source of revenue, such as Russia, the result could include a weaker currency, a decline in investment and even recession. This could then bleed over to exporters in Europe, creating another headwind for the struggling economies there.

This risk, while real, appears manageable at present. Remember, we have seen this movie before. In the last four decades we have experienced four separate boom-and-bust cycles in oil. Generally speaking, the up-cycles lead to recession and down-cycles to booms. We think the current oil price decline is predominantly driven by supply-side concerns and not by fresh realizations of worse than expected global growth. Most negative effects of this drop will likely be short-lived and the substantial stimulus that follows to more than offset these problems.

The decline in oil prices has left some casualties in the bond space recently, too. The benchmark Bank of America Merrill Lynch High Yield Total Return Index has declined 4.5% since its high on July 1, 2014, most of that loss coming in recent days. Roughly 13.6% of the index is exposed to energy names that have been hit hard by the price collapse. In these situations, investors tend to sell first and ask questions later. Once oil prices hit a stable point in the coming months, potentially attractive buying opportunities should appear. Such environments are where our tactical style of fixed income investing reaps benefits for investors.

Assuming global growth picks up as we expect, investors may become less attracted to “safe haven” assets. There is a good chance those investors will migrate up the risk curve in a search for return. In the bond space, this could lead them to higher yielding corporates, convertibles and emerging market debt. Periodic jitters, such as the markets are experiencing now with oil in retreat, will highlight the danger of being over-invested in these riskier areas. So while we do not generally see great return potential to Treasuries in the coming year, they remain important as a diversifier that has little correlation with stocks or other risk assets. Overall, we remain moderately underweight bonds in our balanced portfolios, with a bias toward equities.

As always, there are risks to our outlook. Geopolitical tensions are always a danger to intensify and negatively impact either global demand or oil prices. And the global macro environment, awash with liquidity, is primed to create asset bubbles. This will require great care to avoid overpriced holdings. Within sectors, we like technology, industrials and financials at the moment.

Those are the most prominent and pressing issues on our radar right now. Going forward, we can always be certain of uncertainty, so we will be monitoring the situation closely and getting back to you as the situation warrants. We send thanks to those of you who are our clients. We value the trust you have placed in our firm and we sincerely appreciate your business. Please do not hesitate to call or email us if you have any questions or concerns.

Disclosures: The views expressed are those of Byron Green as of December 16, 2014 and are subject to change. The information contained herein does not constitute investment advice or take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Additionally, this publication is not intended as an endorsement of any specific investment. Investing involves risk and you may incur a profit or a loss. Information contained herein is derived from proprietary and non-proprietary sources. We encourage you to consult with your tax or financial advisor. Click here to read the GIM Form ADV Part 2 for a complete list of Green Investment Management’s services.

![]() Click here to download printable PDF of GIM Market Commentary 12-16-2014

Click here to download printable PDF of GIM Market Commentary 12-16-2014