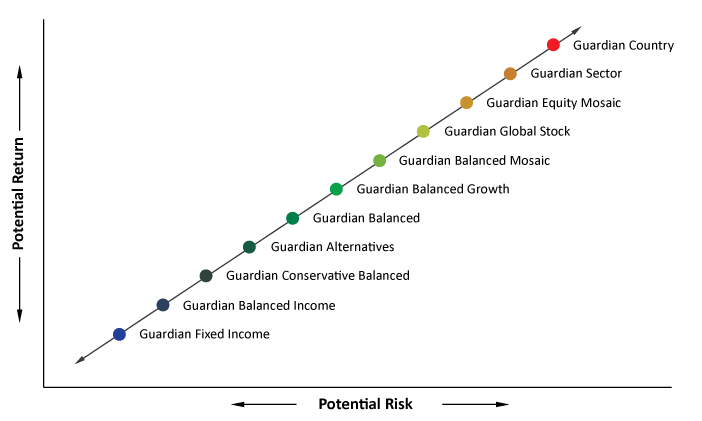

Guardian allocations utilize the active/defensive style GIM has become known for. This diversified style attempts to minimize portfolio loss during difficult or “bear” markets and seeks to provide risk adjusted returns that meet or exceed the returns of similarly allocated passive managers. The Guardian allocations range from the conservative Fixed Income to the more aggressive Stock, Sector and Country allocations. Guardian allocations are designed for investors who place more emphasis on their desire for principal preservation.

Guardian Alternatives

Guardian AlternativesThis actively managed portfolio is a disciplined investment strategy designed to provide a hedge against either inflation or deflation by investing in ETFs or ETNs that are either long or short in commodities, currencies, real estate and/or emerging market equities. Because these assets tend to move in a cyclical fashion, the opportunity for gains on both advancing and declining markets exists.

Guardian Balanced Mosaic

Guardian Balanced MosaicThis actively managed portfolio is a diversified mix of both domestic and international stock and bond funds, with a stronger emphasis on stock. This allocation employs an active/defensive style designed to provide long-term growth for clients that have a reasonable tolerance for variable returns.

Guardian Equity Mosaic

Guardian Equity MosaicThis actively managed portfolio is a diversified mix of domestic and foreign stock funds. As the name ‘Mosaic’ implies, multiple investment styles are employed within this portfolio. GIM’s sector allocation methodology has been added to GIM’s traditional balanced investing style to create this hybrid portfolio.

Guardian Country Allocation

Guardian Country AllocationThis actively managed portfolio makes concentrated investments into foreign country or region specific stock funds that are demonstrating positive relative strength and can shift and diversify among both emerging and developed markets. Because of its concentrated focus, this strategy may bear a greater degree of market risk than a more diversified investment portfolio. Clients with a high tolerance for variable returns seeking aggressive long-term growth may find this investment appealing.

Disclosure: Request GIM Form ADV Part 2 for a complete description of Green Investment Management, Inc.’s management services. Market and economic conditions can change rapidly producing materially different returns (or losses) over different periods. No inference should be drawn that managed accounts will achieve similar performance or will be profitable in the future. Investing involves risk and you may incur a profit or a loss. Past performance is no guarantee of future results.

Guardian Fixed Income

Guardian Fixed Income Guardian Balanced Income

Guardian Balanced Income Guardian Conservative Balanced

Guardian Conservative Balanced Guardian Balanced

Guardian Balanced Guardian Balanced Growth

Guardian Balanced Growth Guardian Global Stock

Guardian Global Stock Guardian Sector

Guardian Sector