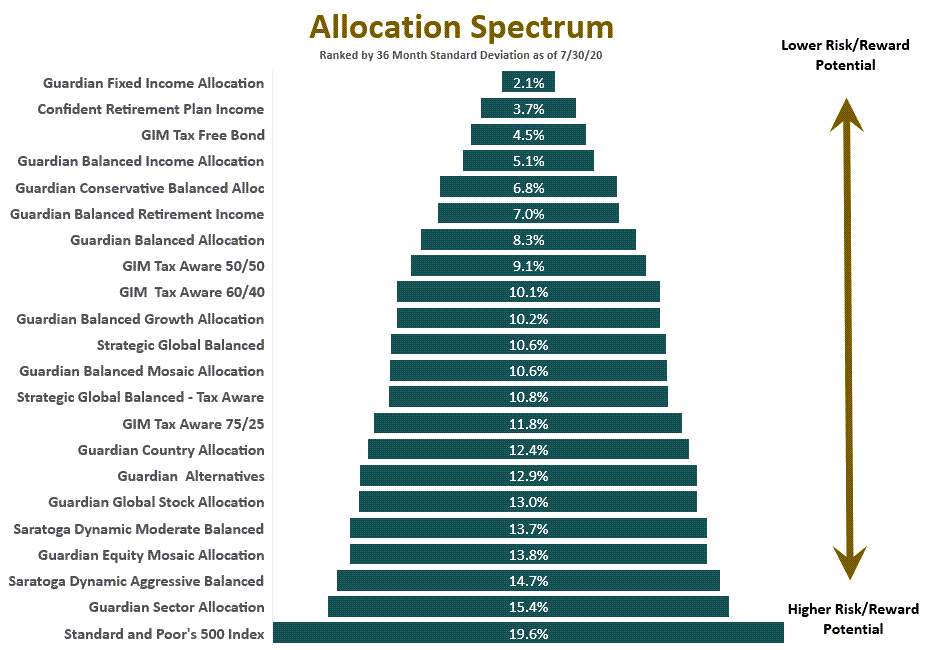

Each Guardian allocation utilizes the active/defensive style GIM has become known for. This diversified style attempts to minimize portfolio loss during difficult or “bear” markets and seeks to provide risk adjusted returns that meet or exceed the returns of similarly allocated passive managers.

The Guardian allocations range from the conservative Fixed Income to the more aggressive Stock, Sector and Country allocations. Guardian allocations are designed for investors who place more emphasis on their desire for principal preservation. Below is a list of our allocation offerings.

Guardian Fixed Income

This Model is diversified mostly among domestic bond funds with a small allocation to foreign bonds periodically. It is a flexible fixed-income strategy tactically allocated in bonds between one end of the yield curve and credit quality spectrum to the other, commensurate with the economy’s position in the interest rate cycle. We actively monitor and alter it in an attempt to maximize returns within moderate risk parameters. This allocation is designed for clients who seek relatively high current income while also seeking good risk-adjusted total returns. It may also be suitable for clients requiring higher income with safety and stability. This allocation often uses high yield bond funds. Such funds generally contain non-investment grade bonds (sometimes called “junk bonds”.) These usually offer better yields than higher rated bonds with similar maturities. But they are also considered speculative and can involve greater price volatility and risk of loss.

Guardian Tax-Free Allocation

This strategy seeks to provide current income exempt from federal income tax by investing in a diversified mix of domestic tax-free bond funds of varying maturities. This strategy may be suitable for investors that are in a high income tax bracket and are seeking tax-free income.

Guardian Balanced Income

This Model has a strategic target of 70% equities and 30% bonds and is designed to provide a moderate level of current income and moderate growth.

Guardian Conservative Balanced

This Model has a strategic target of 50% equities and 50% bonds and is designed to provide conservative long-term growth with some current income, though less than the Guardian Fixed Income and Guardian Balanced Income allocations.

Guardian Balanced

This Model has a strategic target of 60% equities and 40% bonds and is designed to provide long-term wealth accumulation with moderate risk and purchasing power protection.

GIM Tax Aware 50/50

The Tax Aware 50/50 (50% equity/50% fixed income) is for investors who want an allocation that is managed with an eye toward post-tax, rather than pre-tax, returns. Its fully tax aware strategy is about more than simply holding municipal bonds. For instance, turnover is an important consideration since short term gains are taxed more heavily than long term ones. Qualified dividends are taxed at a lower rate than income distributions, and equity funds may have both taxable and tax-deferred shareholders. The Tax Aware 50/50 is managed with these considerations in mind. It is designed for investors who seek long term growth in after-tax wealth. Since it generally maintains a significant exposure to equities, it is for the investor who can tolerate moderate risk in the pursuit of after-tax returns.

GIM Tax Aware 60/40

Tax Aware 60/40 (60% stock/40% fixed income) is for investors who want a strategy that is managed with an eye toward post-tax, rather than pre-tax, returns. Its fully tax-aware strategy is about more than simply holding municipal bonds. For instance, turnover is an important consideration since short term gains are taxed more heavily than long term ones. Qualified dividends are taxed at a lower rate than income distributions, and stock funds may have both taxable and tax-deferred shareholders. The Tax Aware 60/40 is managed with these considerations in mind. We designed it for investors who seek long term growth in after-tax wealth. Since it generally maintains a majority exposure to stocks, it is for the investor who can tolerate some risk.

Guardian Balanced Growth

This Model has a strategic target of 75% equities and 25% bonds and is designed to provide long-term wealth accumulation and purchasing power protection.

Strategic Global Balanced

We designed this Model for investors seeking to benefit over the long term from a diverse combination of investment approaches, including passive holdings around an active core. As the name implies, the positions are global in nature and comprise a balance of stock and fixed income as well as a small cash component. We provide rebalancing services for the Model relative to its neutral position weightings. Because it usually remains fully invested through various market environments, it is best suited for investors who have moderate risk tolerance.

Guardian Balanced Mosaic

This Model has a strategic target of 75% equities and 25% bonds and in addition, 40% of this model is allocated to a domestic sector allocation strategy (described under the Guardian Sector Model below) to provide a ‘mosaic’ of investing styles. This Model is designed to provide long-term growth for clients who have some tolerance for variable returns.

Strategic Global Balanced Tax Aware

We designed this Model for investors seeking to benefit over the long term from a diverse combination of investment approaches including passive holdings around an active core. It is similar to the Strategic Global Balanced Model but managed for tax efficiency through the use of investments such as municipal securities. We will provide rebalancing services for the Model relative to its neutral position weightings. Because it will usually remain fully invested in various market environments, it is best suited for investors with moderate risk tolerance.

GIM Tax Aware 75/25

GIM Tax Aware (75% equity/25% fixed income) is for investors who want a strategy that is managed with an eye toward post-tax, rather than pre-tax, returns. Its fully tax-aware strategy is about more than simply holding municipal bonds. For instance, turnover is an important consideration since short term gains are taxed more heavily than long term ones. Qualified dividends are taxed at a lower rate than income distributions, and stock funds may have both taxable and tax-deferred shareholders. The Tax Aware 75/25 is managed with these considerations in mind. We designed it for investors who seek long term growth in after-tax wealth. Since it generally maintains a heavy exposure to equities, it is for the investor who can tolerate risk.

This Model follows an aggressive strategy that involves foreign country or region specific exchange-traded funds that we believe are demonstrating risk-adjusted relative strength or represent unusual value. The allocation generally invests in equities from 4 to 8 different foreign countries. The objective is to provide foreign equity diversification with enhanced risk-adjusted returns compared to broad foreign equity indexes.

Guardian Alternatives

This actively managed portfolio is a disciplined investment strategy designed to provide a hedge against either inflation or deflation by investing in ETFs or ETNs that are either long or short in commodities, currencies, real estate and/or emerging market equities. Because these assets tend to move in a cyclical fashion, the opportunity for gains on both advancing and declining markets exists.

Guardian Global Stock

This Model is a tactical strategy offering diversified exposure to stock markets around the globe, including the United States, developed foreign markets, and emerging markets by investing in a diversified mix of domestic and foreign stock funds. In addition to stock market risk, the fund is also subject to currency risk and country risk. Long-term investors seeking global equity exposure who are comfortable with the volatility inherent in stock market investing may wish to consider this model.

Saratoga Dynamic Moderate Balanced

This Model is a diversified mix of stock, bond and money market mutual funds. It is for the moderately conservative investor.

Guardian Equity Mosaic

This Model is a tactical strategy offering diversified exposure to stock markets around the globe, including the United States, developed foreign markets, and emerging markets by investing in a diversified mix of domestic and foreign stock funds. In addition, 40% of this model is allocated to a domestic sector allocation strategy (described under the Guardian Sector Model below) to provide a ‘mosaic’ of investing styles. This allocation is designed to provide moderately aggressive long-term growth for clients who have a reasonable tolerance for variable returns.

Saratoga Dynamic Aggressive Balanced

This Model is a diversified mix of stock, stock sector, bond and money market mutual funds for more aggressive investors who seek higher returns than the Dynamic Moderate Balanced Model.

Guardian Sector

This Model invests in equity funds. In it we make concentrated investments into equity sectors of the market that are demonstrating relative strength or represent unusual value in our opinion. We actively monitor and alter it to maximize returns within reasonable risk parameters. This allocation is most suitable for clients with a high tolerance for variable returns who seek aggressive long-term growth.

Disclosure: Request GIM Form ADV Part 2 for a complete description of Green Investment Management, Inc.’s management services. Market and economic conditions can change rapidly producing materially different returns (or losses) over different periods. No inference should be drawn that managed accounts will achieve similar performance or will be profitable in the future. Investing involves risk and you may incur a profit or a loss. Past performance is no guarantee of future results.